Save time and money with Afirmo’s powerful AI automation software

Automated Tax &

Accounting Solution

Accounting Solution

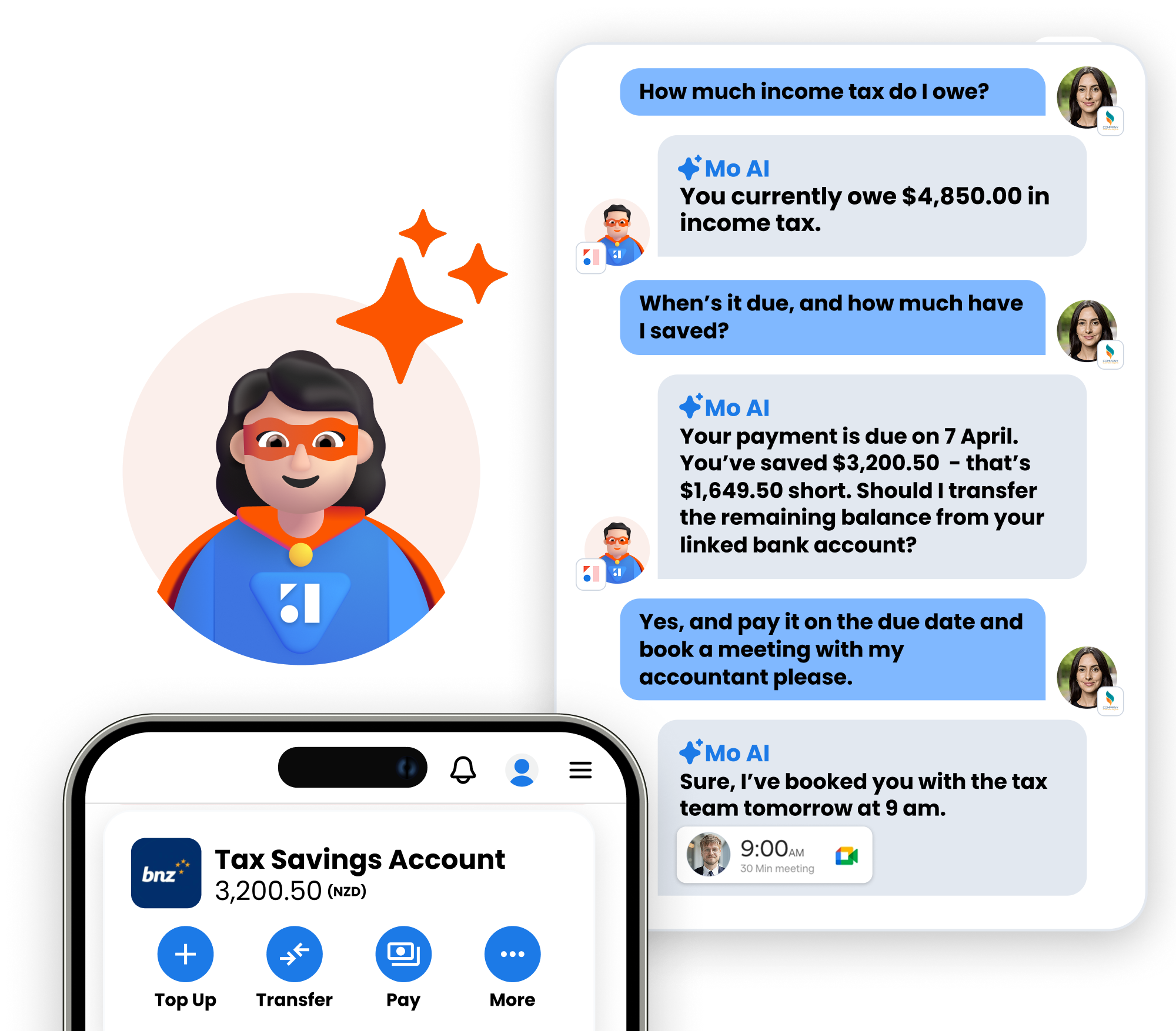

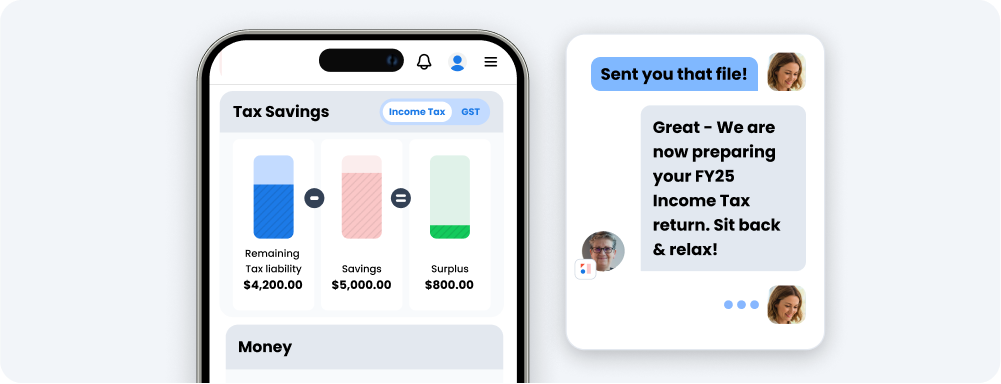

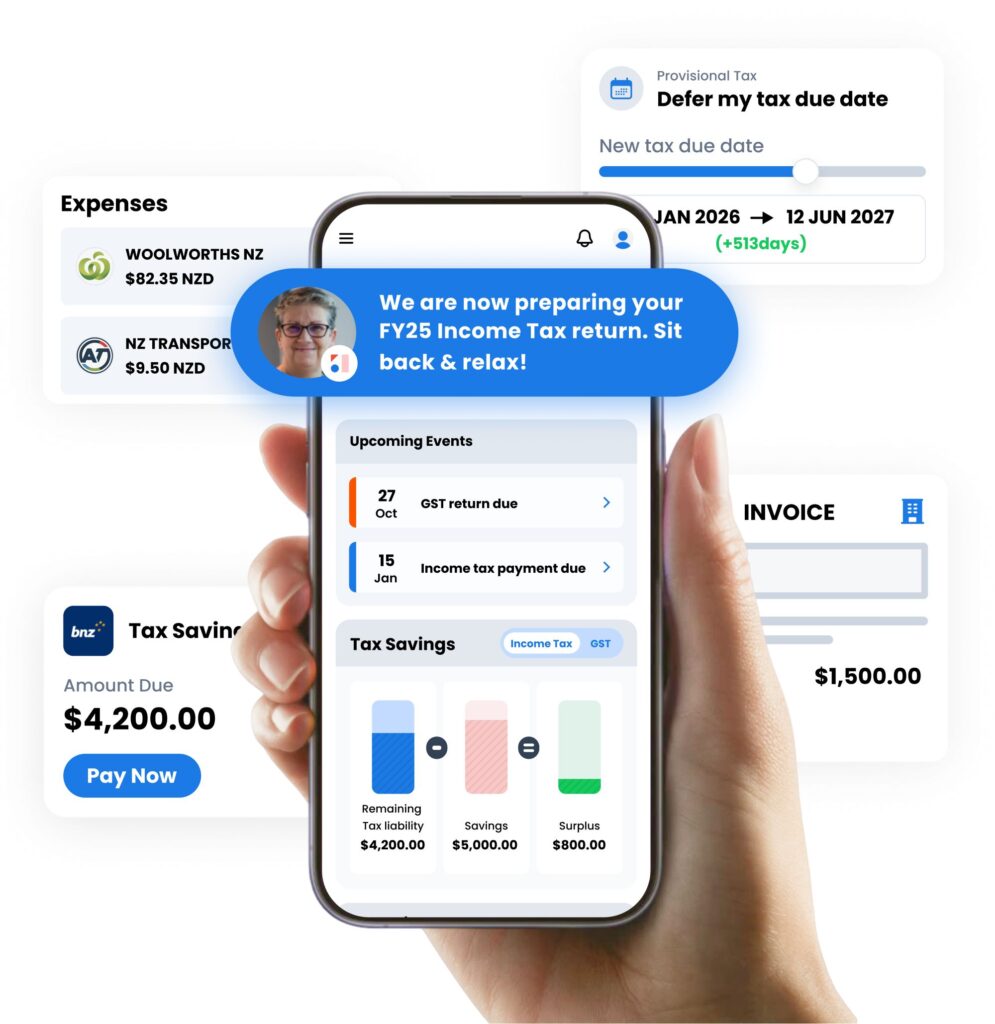

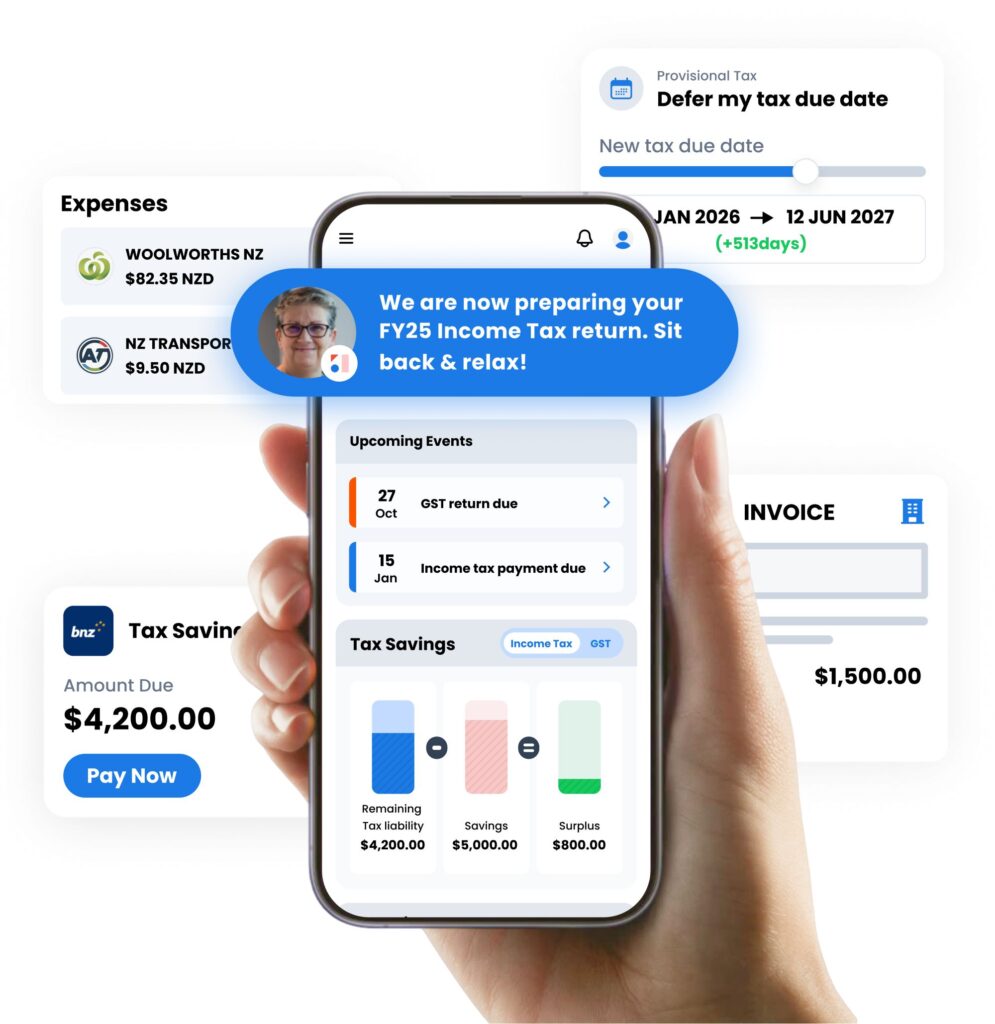

See business tax in real time

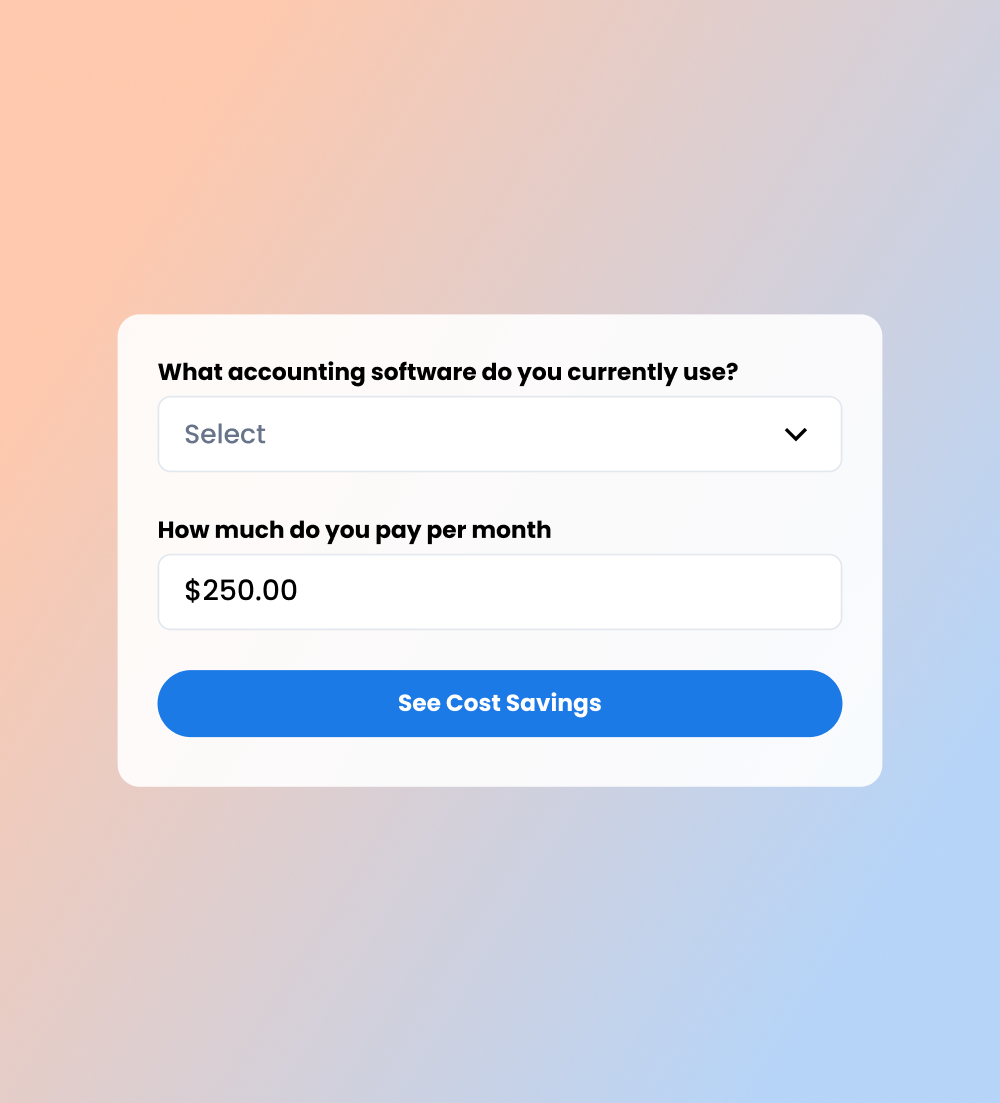

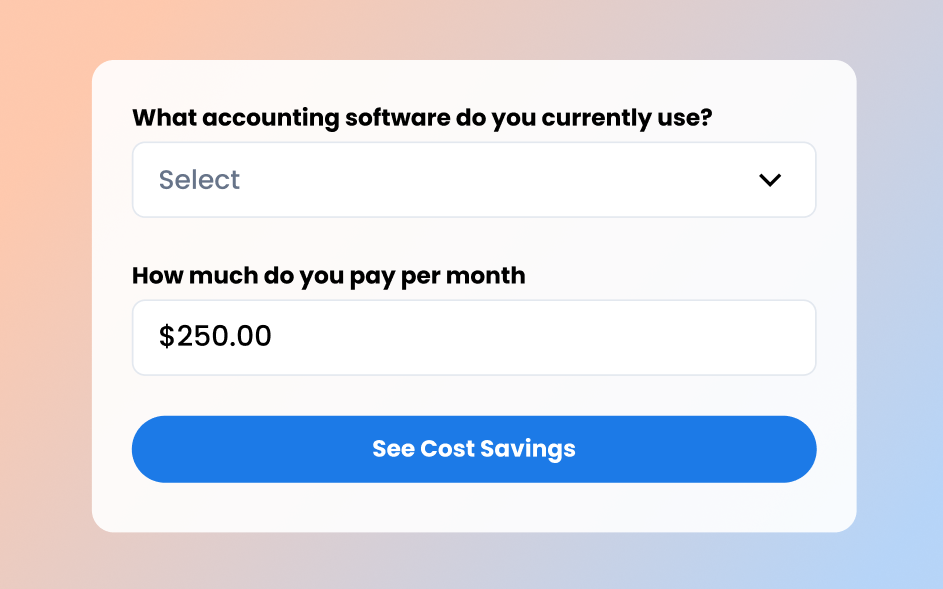

Ditch expensive software

Accountants file your Income Tax and GST

Ditch your expensive accounting software

Ditch your expensive accounting software

See your business tax in real time

See your business tax in real time

Afirmo accountants file your Income Tax and GST

Afirmo accountants file your Income Tax and GST

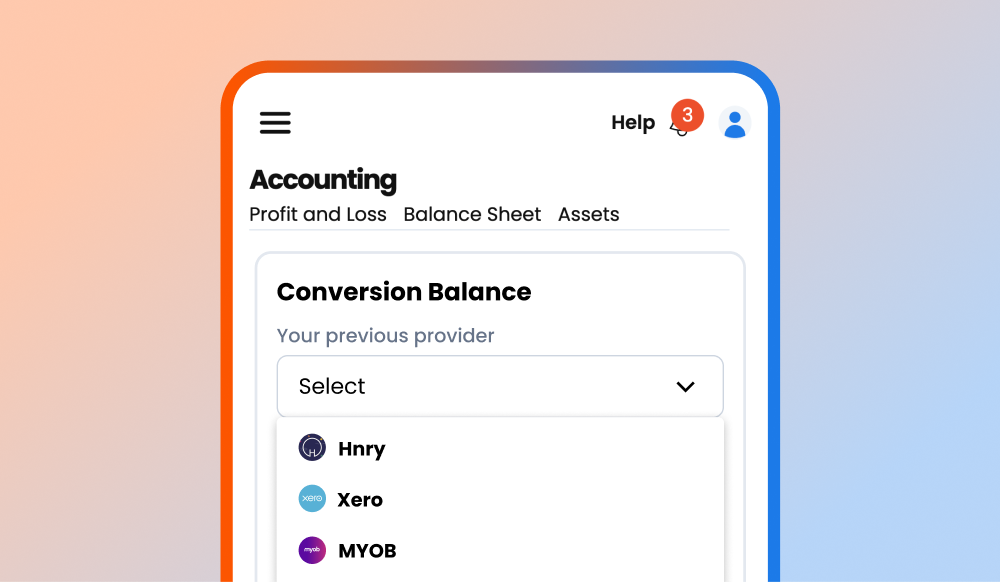

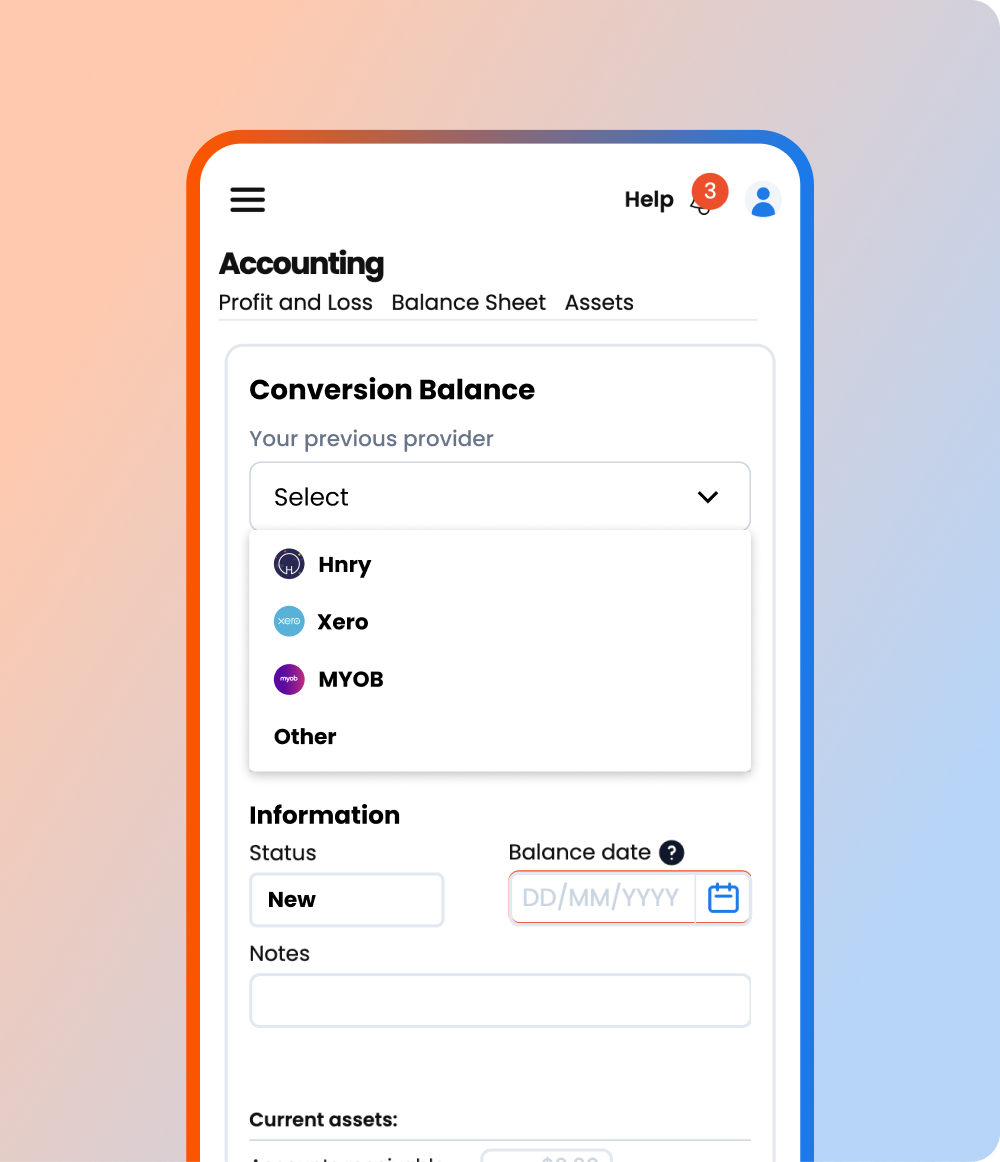

Let us migrate your old data (anytime of the year)

Why struggle with tax deadlines

and complicated accounting?

Transform your tax:

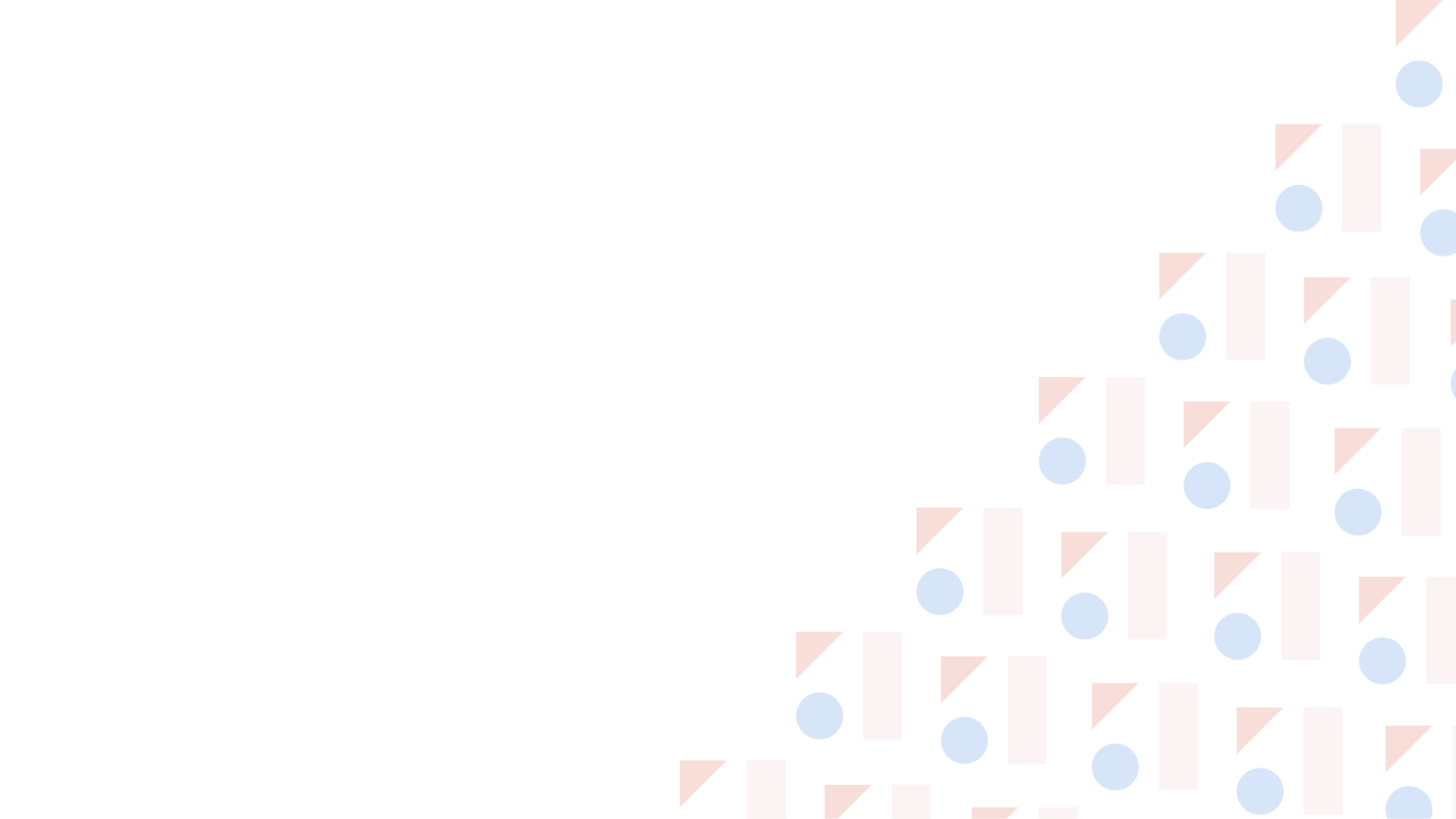

See your business tax in real time

See your business tax in real time

Pay tax only when it suits you (Extensions up to 1.5 years)

Pay tax only when it suits you (Extensions up to 1.5 years)

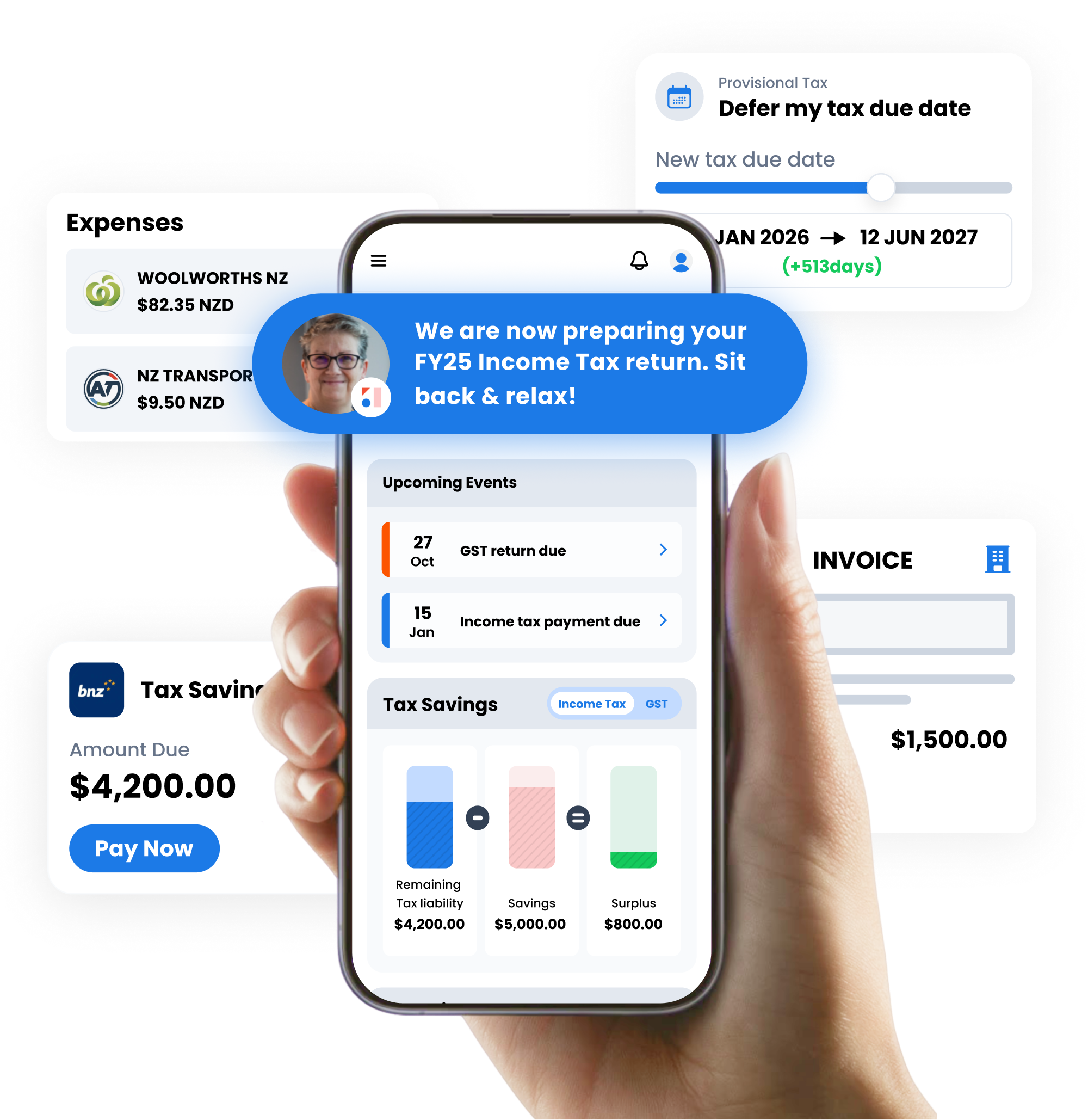

World-first AI automation technology

World-first AI automation technology

Backed by expert NZ accountants

Backed by expert NZ accountants

Free migration from old provider

Free migration from old provider

We file your GST & Income Tax returns for you

We file your GST & Income Tax returns for you

A word from real customers

How it works

AI-powered

Money, Tax & Accounting

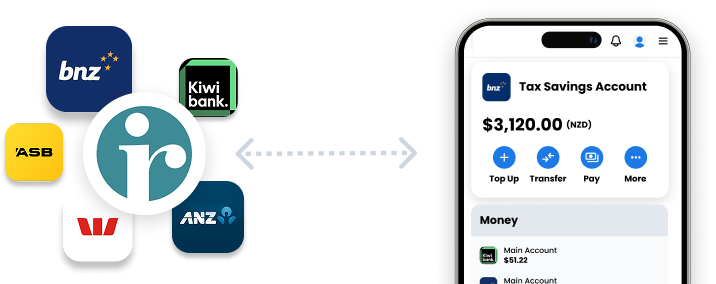

Link your Bank Accounts & IRD Account

Link your Bank Accounts & IRD Account

Link your business bank accounts or open an Afirmo Business Wallet to power our easy-to-use integrated accounting and tax tool.

Import your IRD data into the Afirmo app to optimise our real-time tax calculations and reduce data entry. Always stay in control of your money.

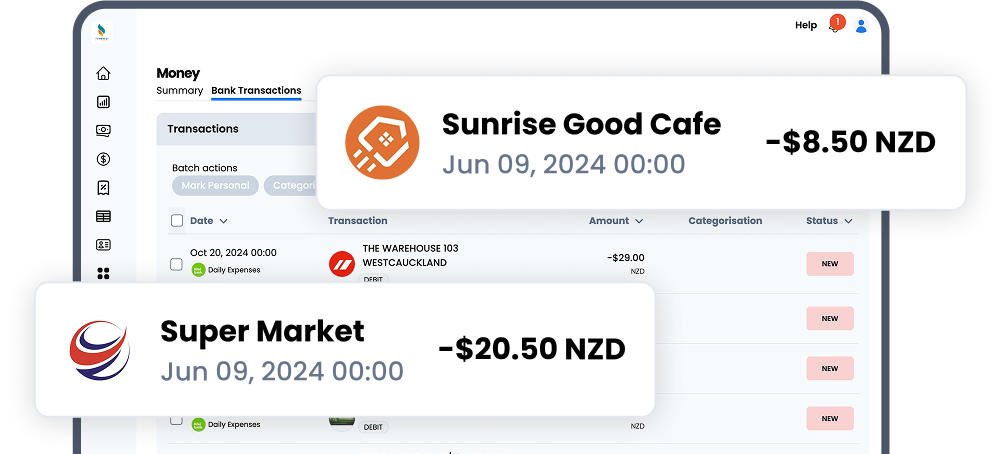

AI Powered Expense Tracking

AI Powered Expense Tracking

Monitor outgoings, automatically categorise expenses, track payables, and manage assets. Let the Afirmo app guide you to reduce your tax bill.

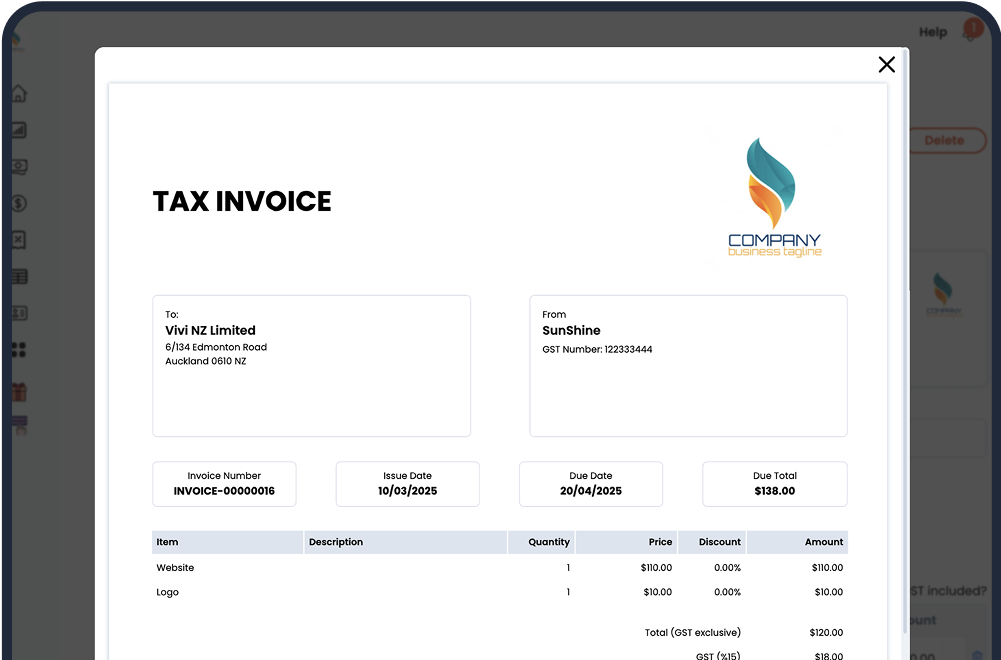

Use Afirmo Invoicing or Your Own

Use Afirmo Invoicing or Your Own

Create and track unlimited quotes and invoices with complete flexibility – use Afirmo’s sales invoices or your own software.

Customise them with your logo and products, and easily manage receipts and outstanding payments.

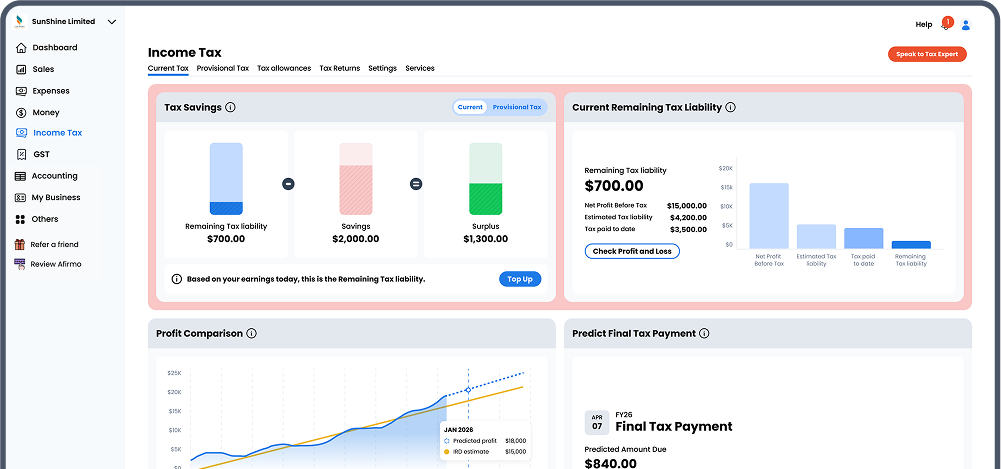

See your Income Tax & GST liabilities in real time

See your Income Tax & GST liabilities in real time

See your Income Tax and GST liabilities calculated 24/7 & set your tax deduction allowances. Always know what tax you need to set aside.

Save funds in your linked bank accounts to always stay ahead & use the Afirmo tax allowance calculator to maximise your tax deductions and reduce your tax bill.

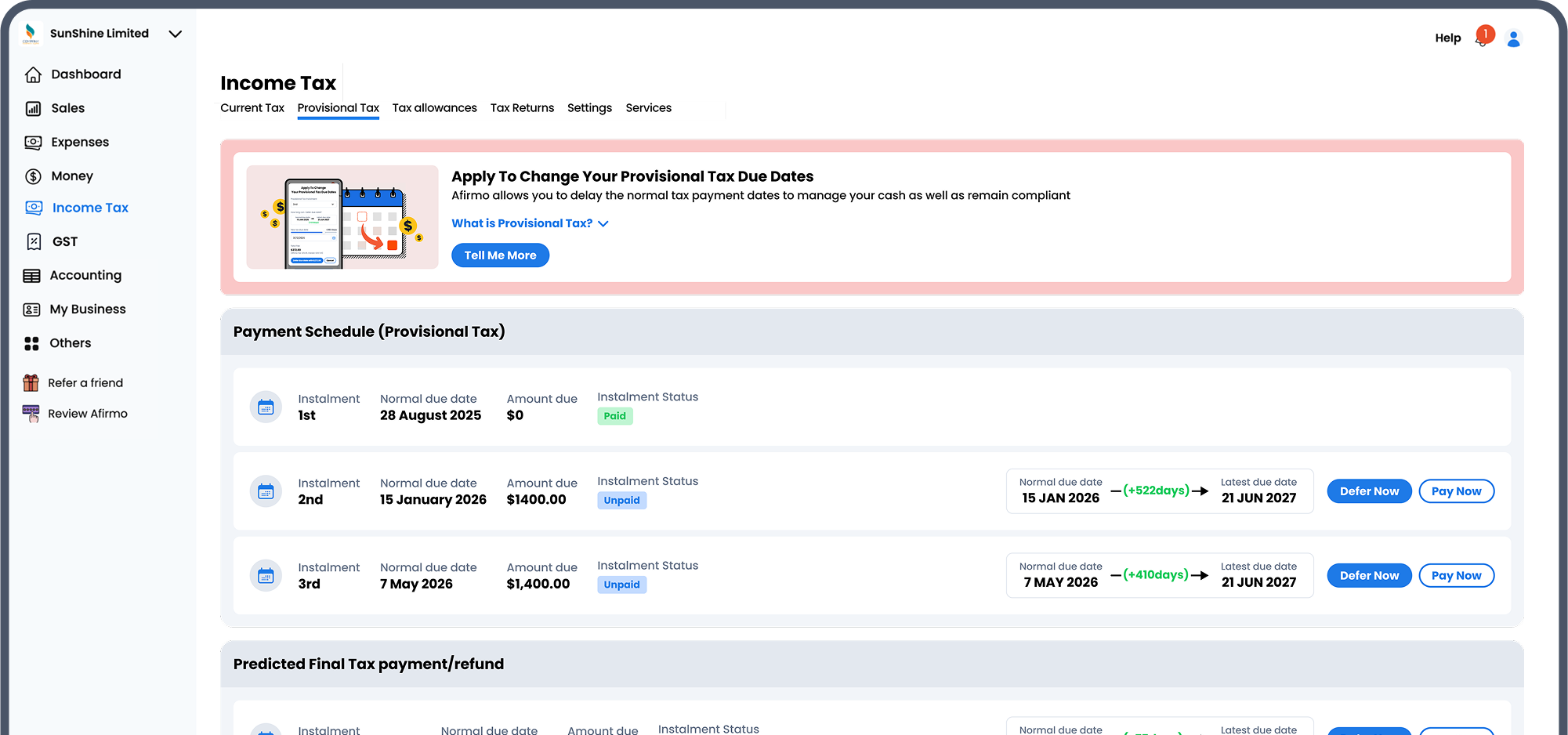

Easy Tax Deferment

Easy Tax Deferment

Choose when you pay tax by using the unique Afirmo tax deferring service to formally delay when you need to pay your income tax bills.

We will manage it with Inland Revenue so you retain a first-class compliance history.

Fully-managed Tax Returns

Fully-managed Tax Returns

Afirmo accountants review and submit your GST and Income Tax returns for you!