Defer your provisional tax due dates

100% acceptance guaranteed. Decide which of your IRD tax instalments to defer (one, two, three or all) and lock in the new due dates with the IRD.

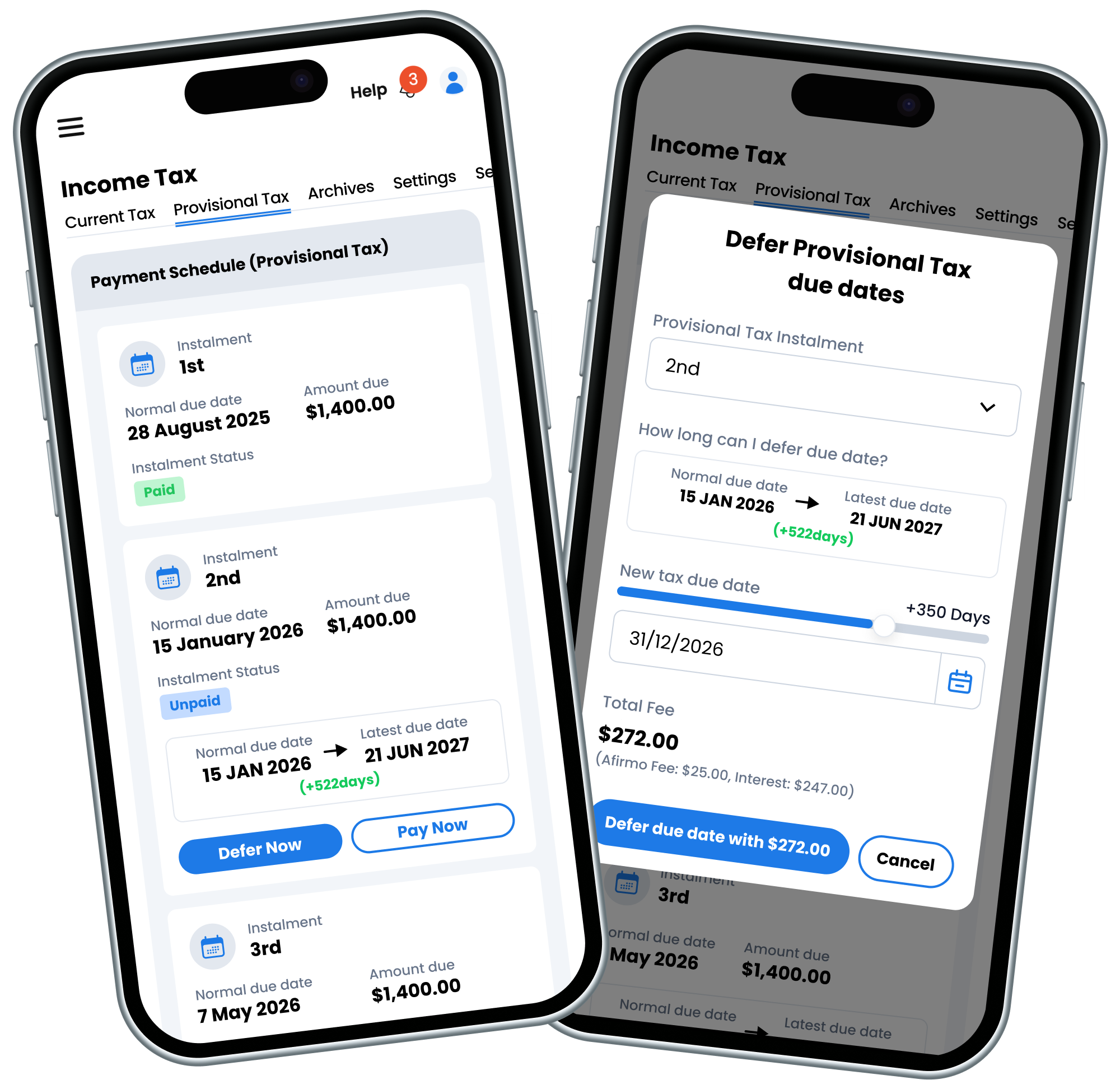

Choose a new due date that suits you:

Sometimes tax due dates come at an inconvenient time, even with a bit of planning! Choose a new due date and get Afirmo to lock it in with the IRD.

Retain the cash in your business:

Defer the tax instalment and lock in a new due date. Use the saved funds to grow your business.

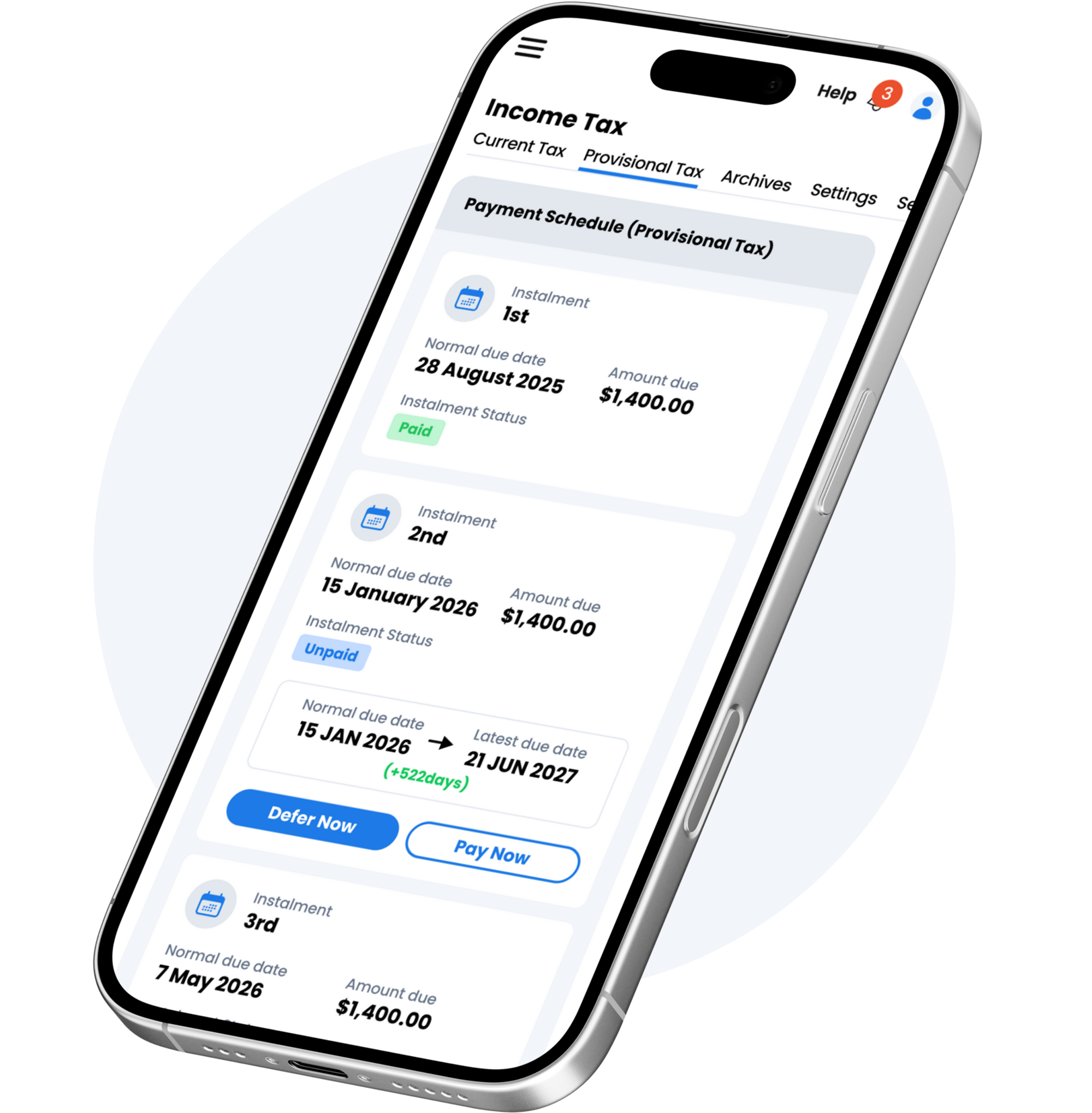

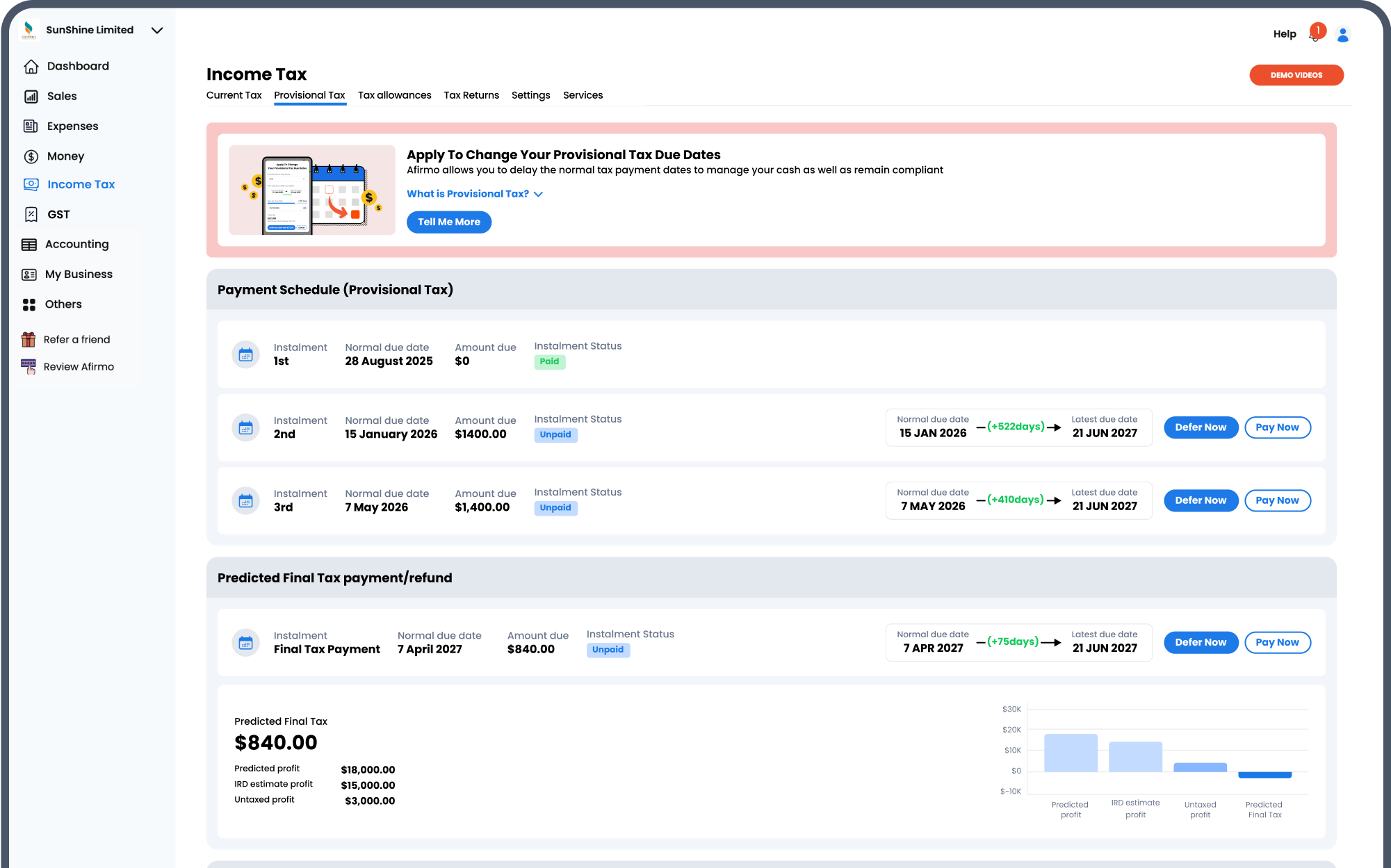

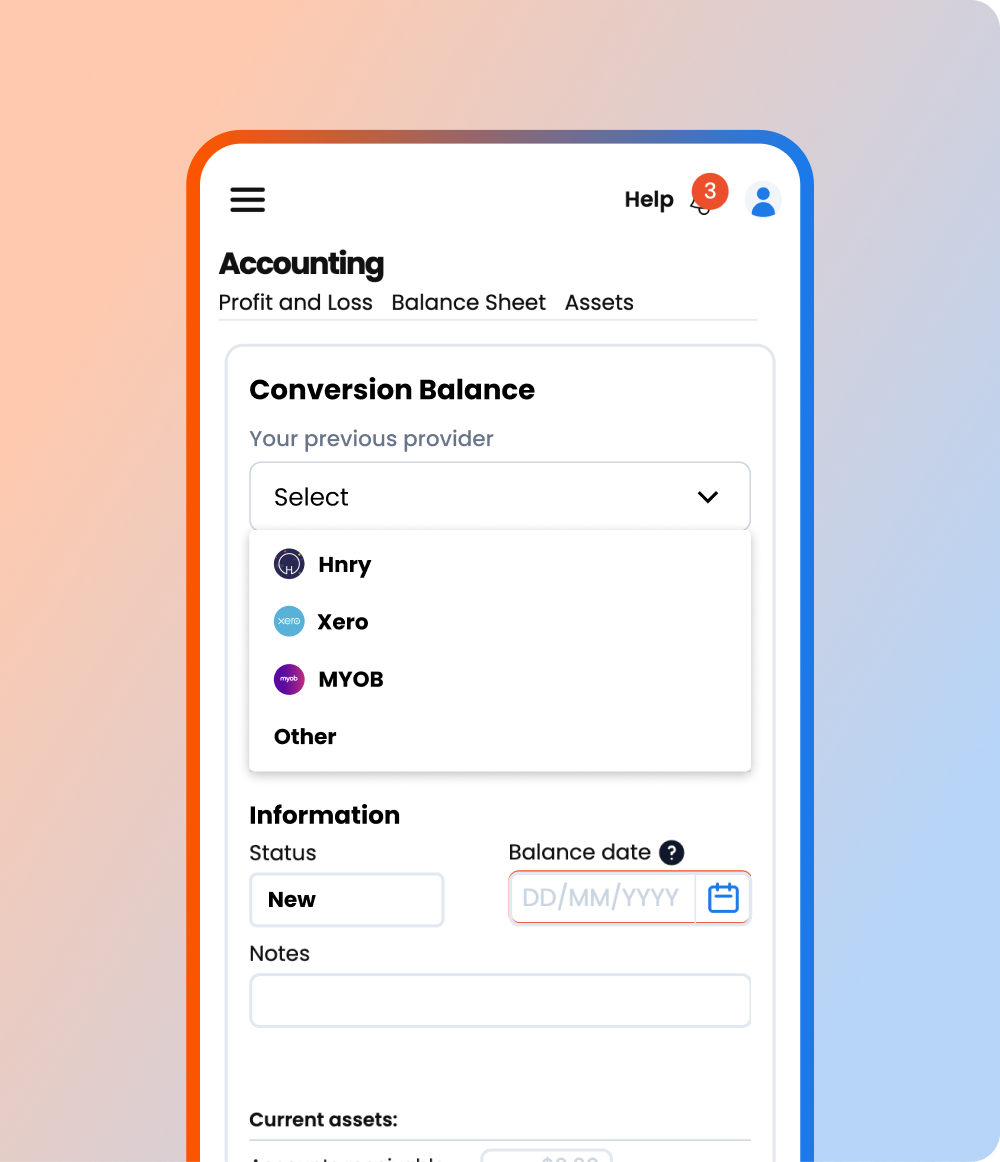

Choose your new due dates in the app

Use the Afirmo provisional tax due date feature to select a new due date and get Afirmo to lock it in with the IRD to ensure you retain your A1 compliance history.

Defer your tax due dates up to 1.5 years:

The IRD allows a maximum delay period, and Afirmo adheres to that. This is up to nearly 1.5 years for the first tax instalment.

Get reminders about the new due date:

Let Afirmo remind you when the new due date is coming up.

See the new due dates:

Keep track of the new agreed due dates in the app.

Get payment reminders:

Get payment reminders to make sure you never miss a payment.

Pay the IRD directly from the app:

Pay from the app or set up a payment authority for a future date to stay ahead.

Frequently Asked Questions

A word from real customers

See who’s using Afirmo

⭐⭐⭐⭐⭐

Trusted by 7,500+ Users

Supercharge

$95/Month

$88 on Annual Plan

Supercharge

$1,140 $1,045/Year

Save $95

Best for Small Companies that:

- Need Afirmo to prepare and file up to six GST returns per year

- Need a year-end Business Income Tax return

- Need tax and accounts support

- Need year-end accounts prepared.

Supercharge PRO

$150/Month

$138 on Annual Plan

Supercharge PRO

$1,800 $1,650/Year

Save $150

Best for Growing Companies that:

- Need Afirmo to prepare and file up to 12 GST returns per year

- Need a priority year-end Business Income Tax return

- Need a director or shareholder personal tax return included

- Need one hour per month of bookkeeping support

- Fees-Free IRD tax payment date deferment

- Need year-end accounts prepared