GST return preparation

GST returns are an essential part of any accounting tool because businesses need to pay or receive GST payments / refunds every one, two or six months. Afirmo however has several additional features to add more value to our customers.

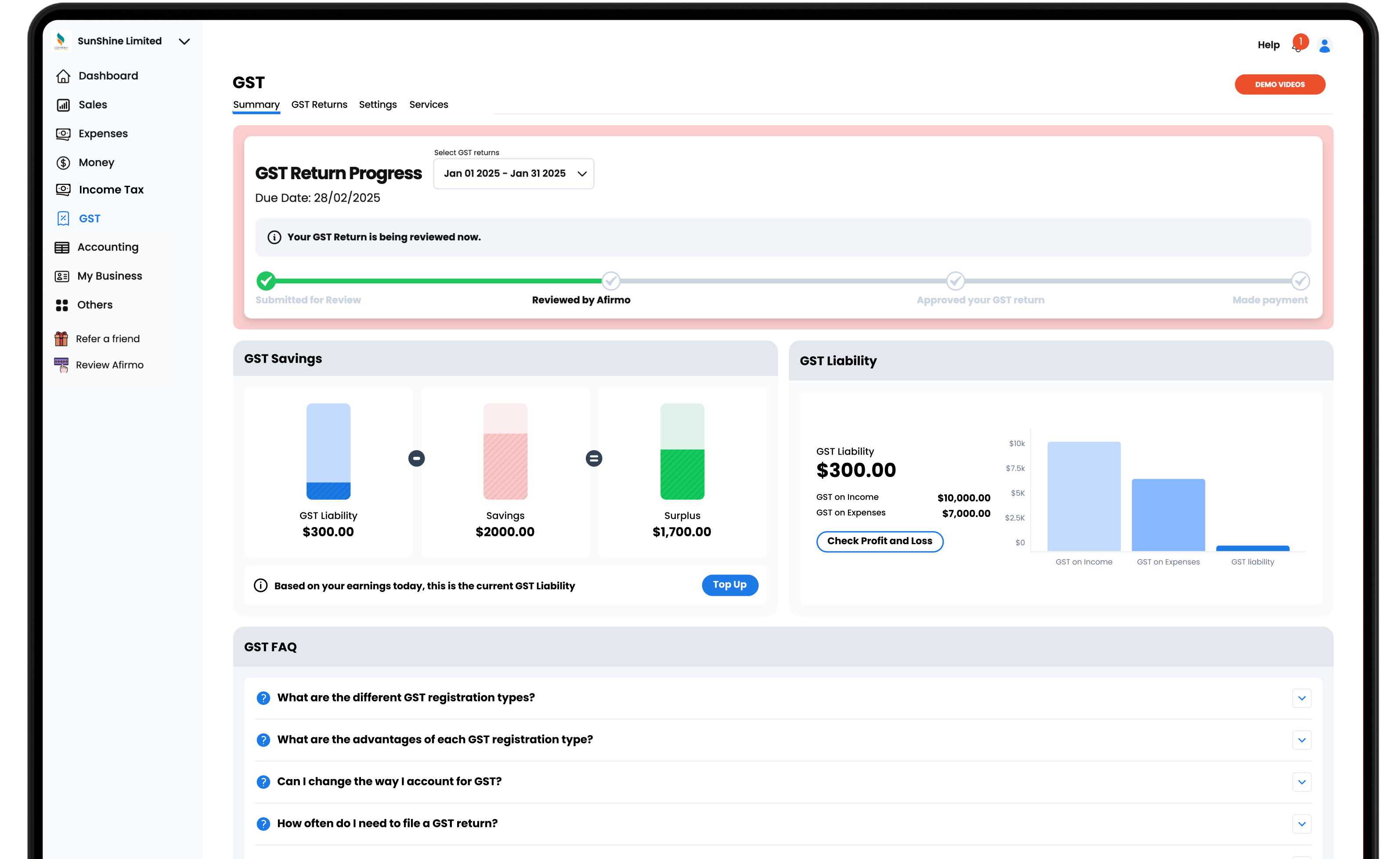

Live GST returns available 24/7:

Each time you add more information to your Afirmo software, the GST return will update to claim GST on the new transaction. The GST return is available to always view so you can keep track of your financial position.

Ready to file format if you want to file them yourself:

Afirmo’s GST returns match IRD requirements – so you can file them yourself, but with our experts reviewing them, why bother?

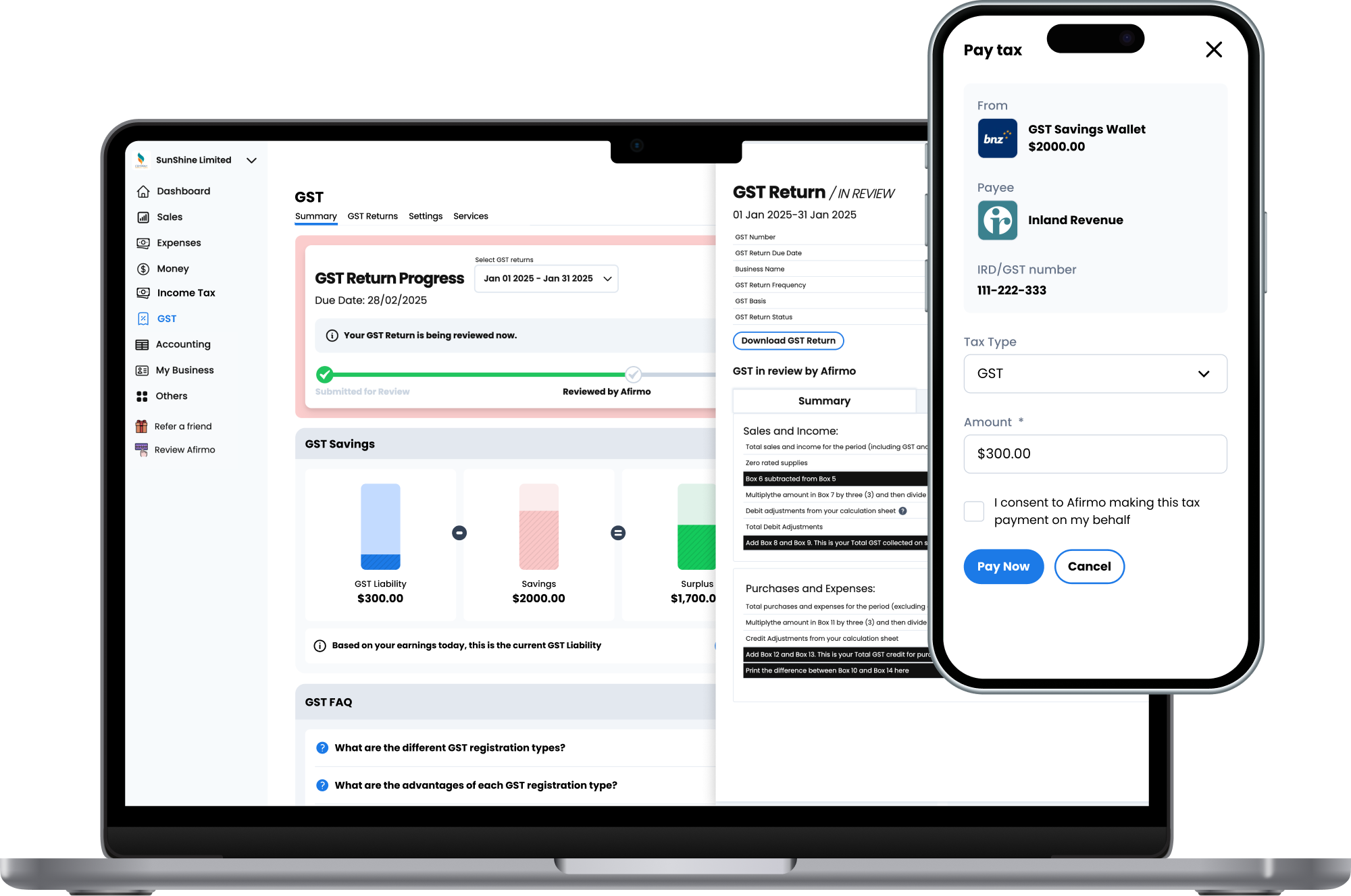

Afirmo tax experts review each GST return:

Afirmo likes to do things better than others, so we don’t just prepare your GST return, we will review it for you before it is submitted to the IRD. We will contact you and start a dialogue if we think you need to make changes.

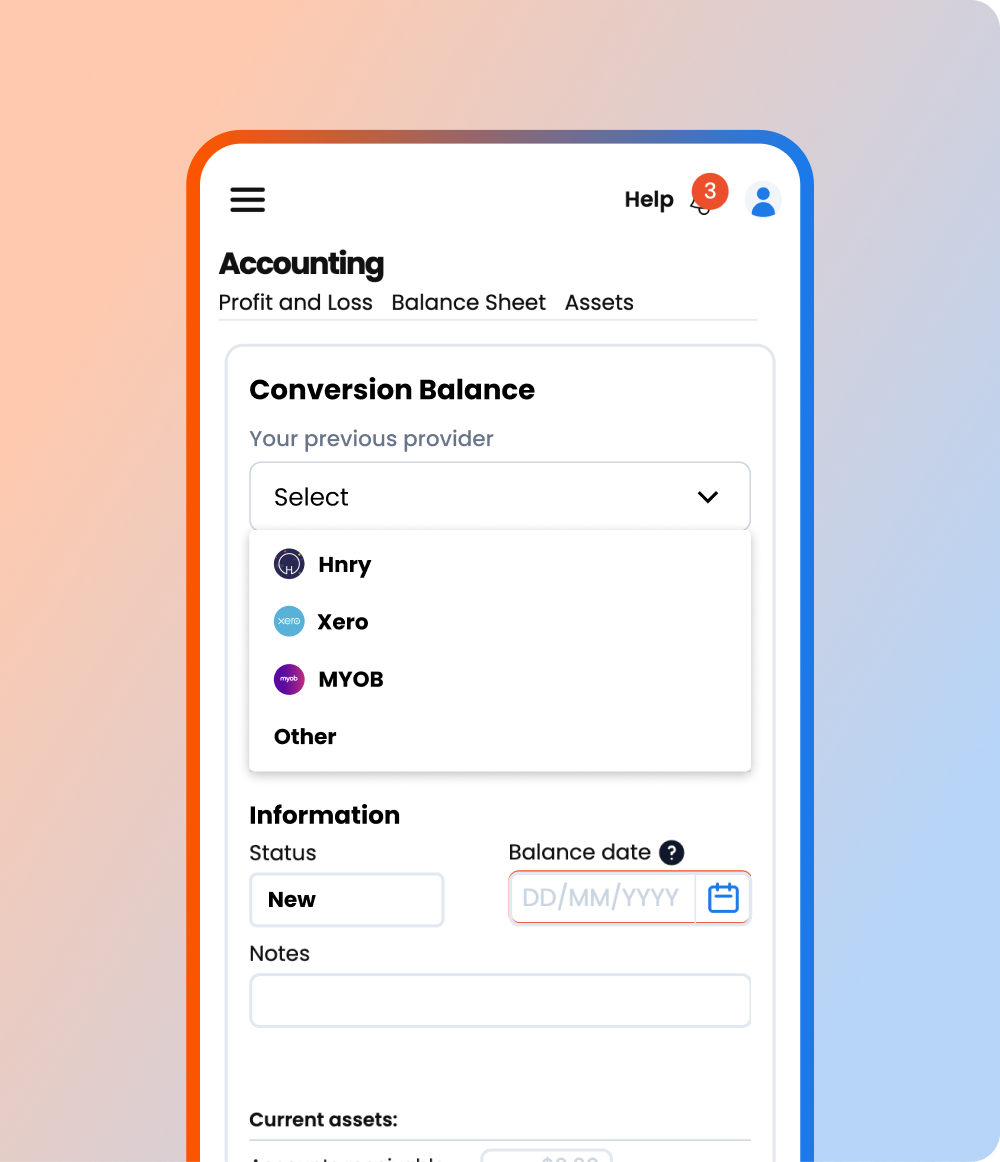

Flexible GST return settings

Change GST filing frequency when you want:

Within certain revenue limits, you can register for GST return filing frequencies other than the default two-monthly returns. This may be attractive if you are expecting large refunds and want the cash sooner.

Switch GST accounting basis when you want:

GST can be accounted for on a cash basis and on an invoice basis. Sometimes it makes sense to switch the way you account for GST if your circumstances change. Afirmo software is built with this flexibility in mind.

Open and close GST returns:

You can save your GST returns and reopen them before they are submitted to the IRD. Afirmo deals with these seamlessly.

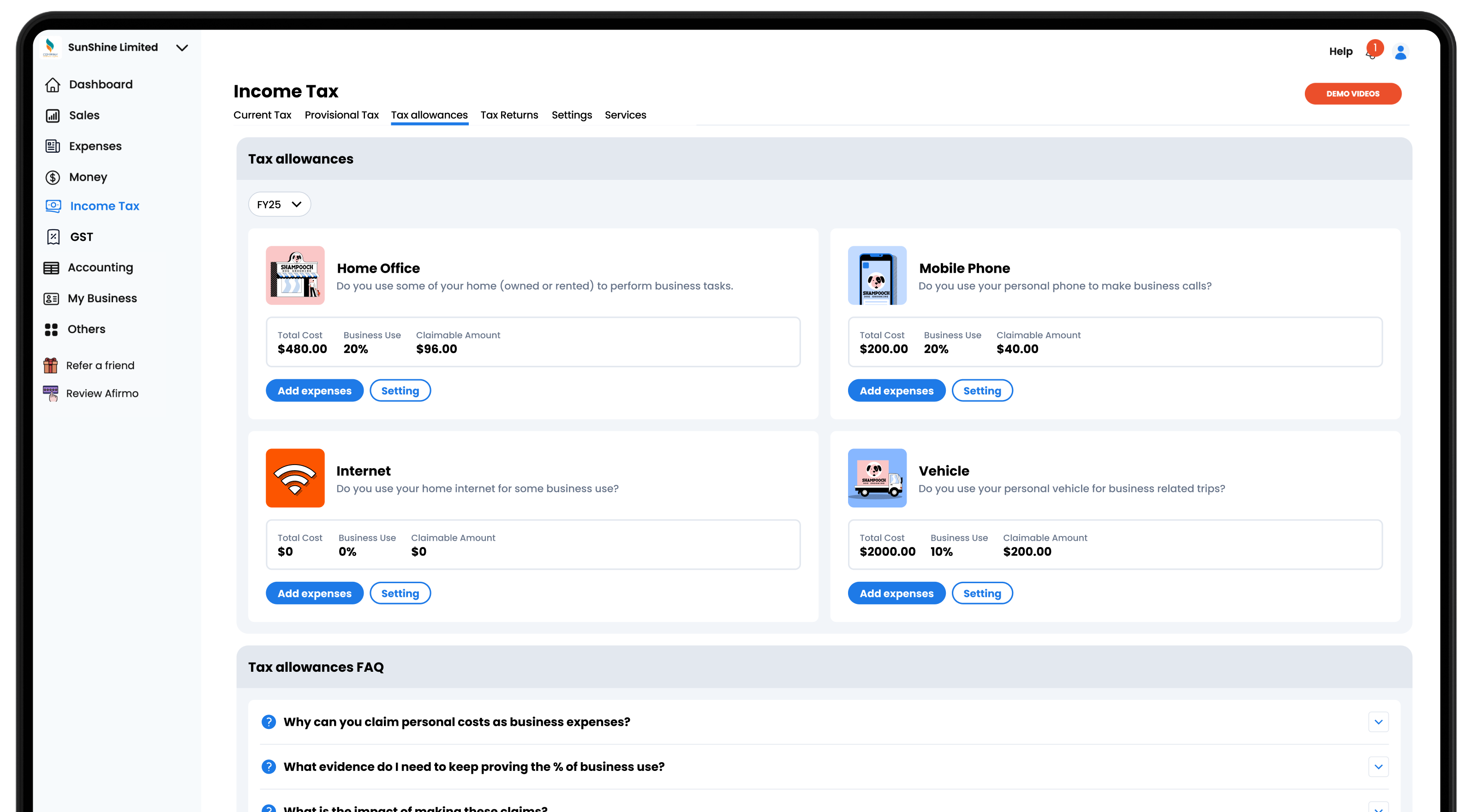

Private use adjustments automated

You can only claim for business use elements of expenses and for GST claims.

Maintain private use settings in the Afirmo tax module:

The tax module lets you select the business use percentage for all expense allowances such as mobile phones, home office expenses, mortgage interest, motor vehicles etc.

Add private use settings for assets:

if you use business assets for personal use, then you can edit these settings to avoid any fringe benefit tax problems.

Automatic GST claims:

Afirmo software calculates the correct amount of GST based on your personal use settings.

Frequently Asked Questions

A word from real customers

See who’s using Afirmo

⭐⭐⭐⭐⭐

Trusted by 7,500+ Users

Supercharge

$95/Month

$88 on Annual Plan

Supercharge

$1,140 $1,045/Year

Save $95

Best for Small Companies that:

- Need Afirmo to prepare and file up to six GST returns per year

- Need a year-end Business Income Tax return

- Need tax and accounts support

- Need year-end accounts prepared.

Supercharge PRO

$150/Month

$138 on Annual Plan

Supercharge PRO

$1,800 $1,650/Year

Save $150

Best for Growing Companies that:

- Need Afirmo to prepare and file up to 12 GST returns per year

- Need a priority year-end Business Income Tax return

- Need a director or shareholder personal tax return included

- Need one hour per month of bookkeeping support

- Fees-Free IRD tax payment date deferment

- Need year-end accounts prepared