What’s the difference?

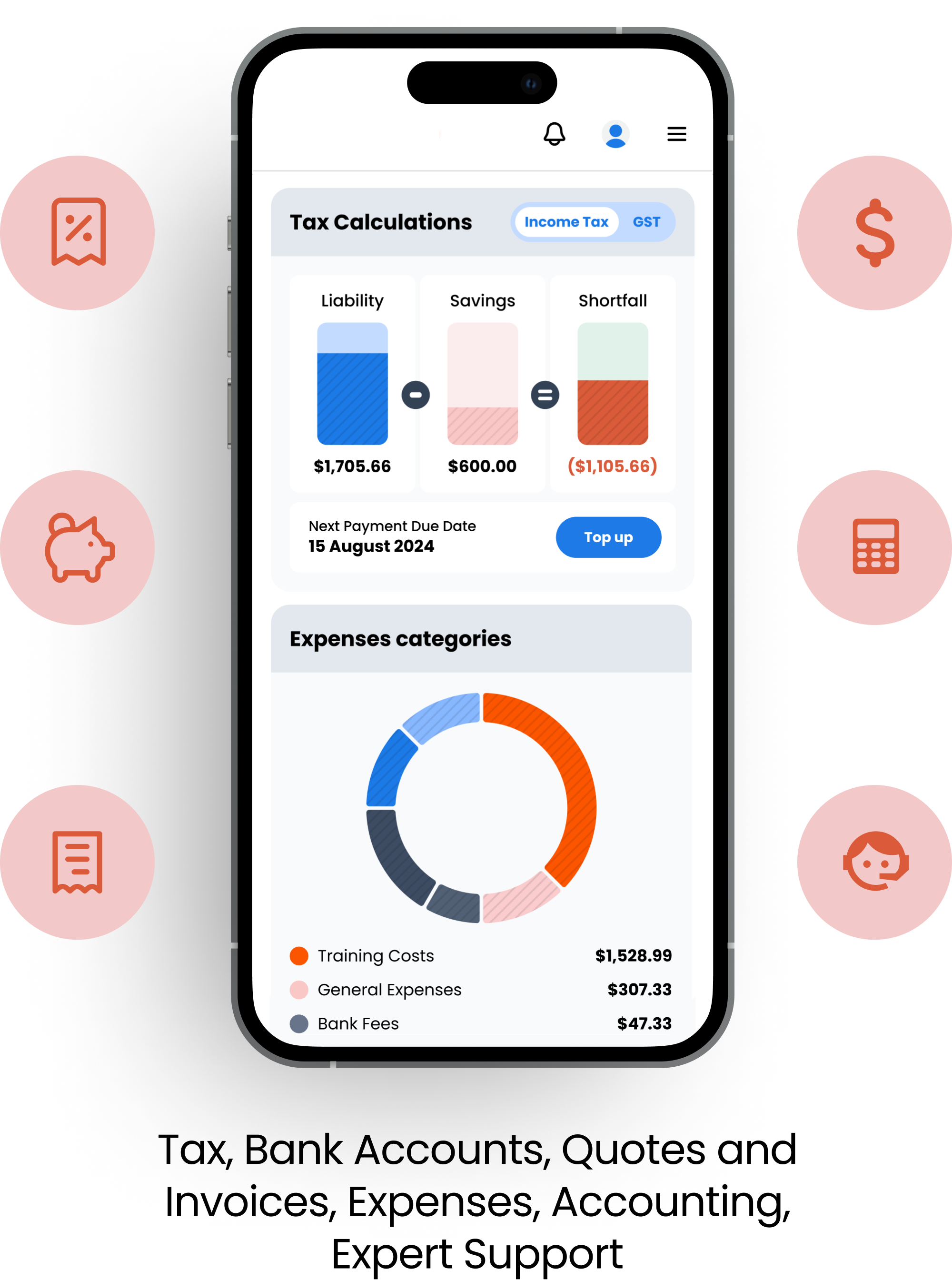

Afirmo’s tax and accounting software is simple to understand, and use, and is designed for the owners of small businesses.

MYOB has built an accounting system aimed at bookkeepers and business owners with extensive accounting know-how. The MYOB software manages accounting and GST, but not income tax – unlike Afirmo which manages everything.

Choosing between Afirmo and MYOB comes down to four key questions:

- Where are you at in your business journey?

- What type of business do you own?

- How much functionality and which functionality do you need?

- Do you want to use an accountant in addition to your subscription?

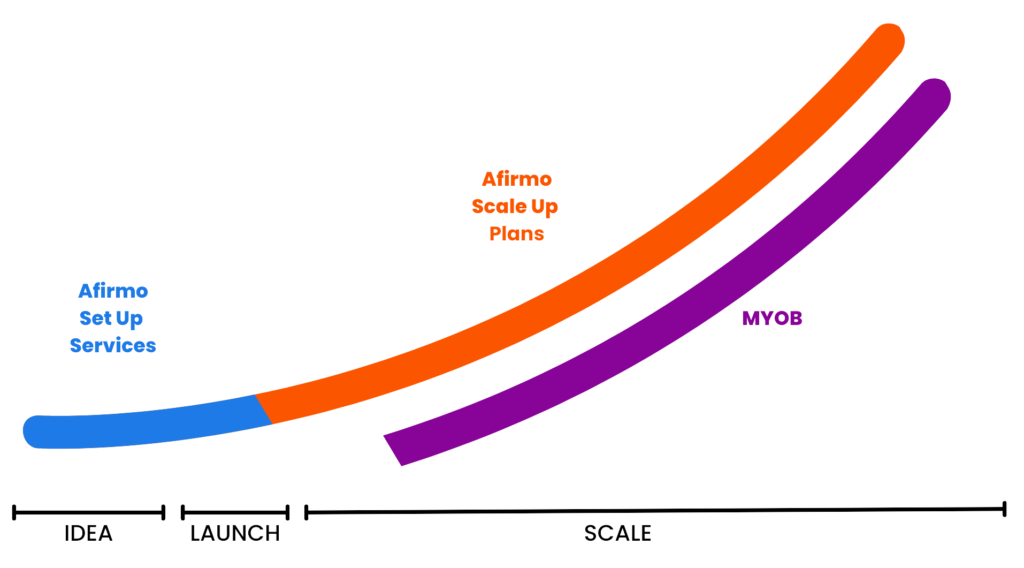

Where are you in your business journey?

Unlike MYOB, with Afirmo, starting your business is easy. Afirmo provides all the essential tools you need so you can get your great business idea up and running smoothly, including choosing your business structure, business basics, and marketing.

Once your business is trading, Afirmo ensures your business bookkeeping is straightforward and user-friendly. And Afirmo’s subscription plans are designed to include everything you need, without having to purchase any add-ons.

Cost Savings Calculator

How much will I save?

What type of business do you own?

Afirmo is here to support all types of business owners – from side hustlers to companies and partnerships. MYOB can in theory handle all of these, but freelancers and sole trader are not MYOB’s primary domain.

Unlike with Afirmo, with MYOB you face higher fees, you will have to complete your own Income Tax returns, (Afirmo does these for you depending on the plan you select), and with MYOB you will potentially still need to engage an accountant.

What features do you need?

| Features | Afirmo | MYOB |

|---|---|---|

| Business Set Up tools | ✅ | ❌ |

| Link existing bank account(s) | ✅ | ✅ |

| Create bank wallets | ✅ | ❌ |

| Unlimited sales quotes and invoices | ✅ | ✅ |

| Bank reconciliation | ✅ | ✅ |

| Tax agent support | ✅ | ❌ |

| Accountant Support | ✅ | ❌ |

| Cloud File Storage | ✅ | ❌ |

| Insurance Cover | ✅ | ❌ |

*Afirmo issued bank accounts are in the form of BNZ Wallets. You can control the funds within. You can set up as many wallets as you like and withdraw funds at any time. Details based on non-promotion-based public information from www.myob.com as of November 2024.

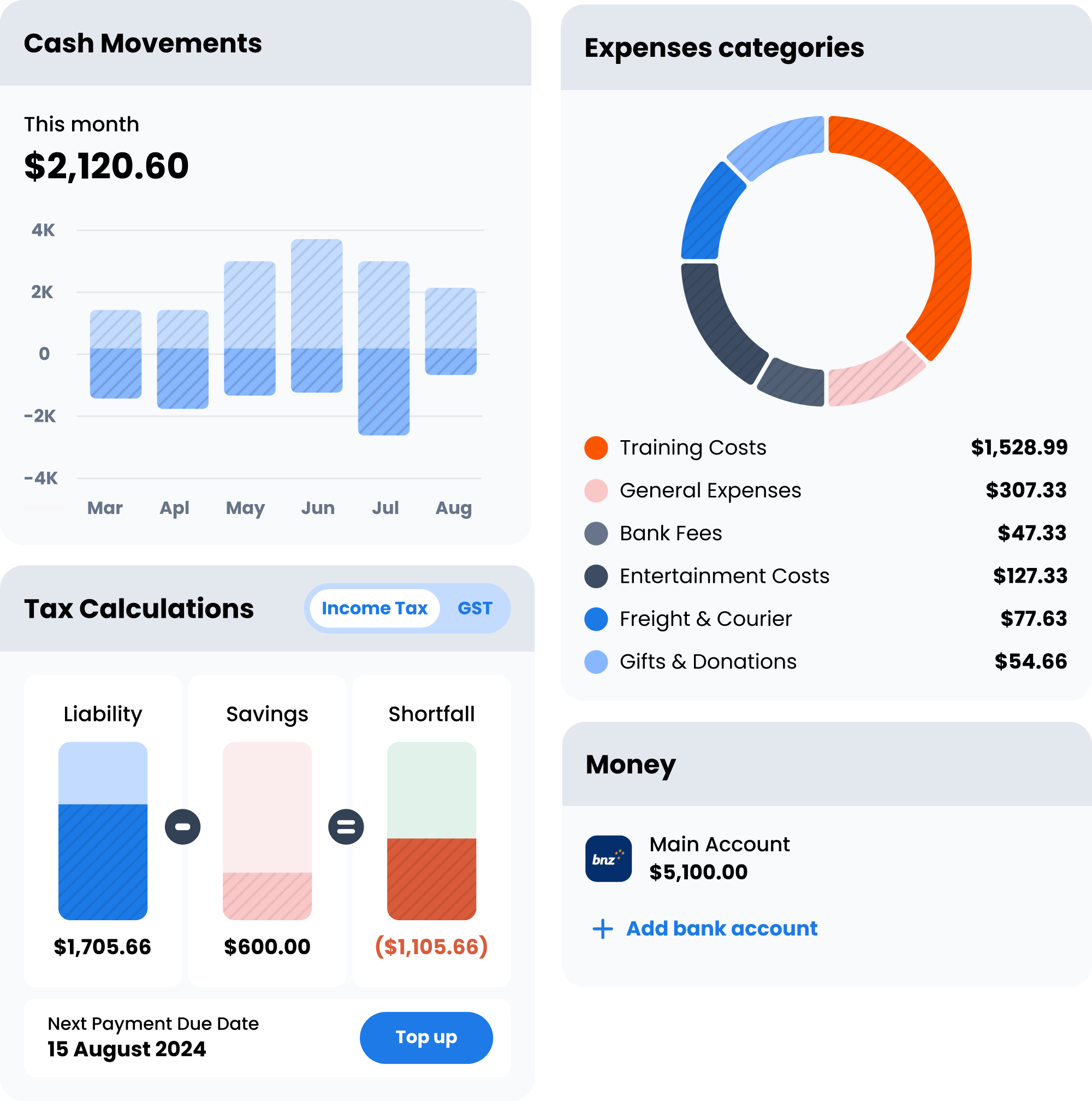

Consider the critical functions you need from your accounting software, to run your business. Afirmo offers the following:

Afirmo’s Plans include Income Tax return preparation and filing and expert tax agent support

Afirmo knows that keeping on top of your tax obligations can be a struggle. So Afirmo subscription plans include full tax agency support, preparing and filing your GST and Income Tax returns. MYOB does not offer you this service – for tax agency support you still need to enlist an accountant in addition to the cost of MYOB software.

Afirmo doesn’t do add-ons

MYOB does offer some functionality (at a price) that Afirmo doesn’t. While MYOB includes features like payment integrations, inventory management, and project tracking, Afirmo takes a streamlined approach. We focus on essential financial tools without add-ons that may not be necessary for all businesses. This simplicity makes Afirmo user-friendly and affordable compared to MYOB. So, for businesses seeking straightforward and budget-friendly solutions, Afirmo stands out.

Afirmo offers business set up services

Afirmo also specialises in setting up your business for you, in addition to managing your taxes and bookkeeping. MYOB doesn’t offer business set up services.

If you’re just starting your business, Afirmo is the right choice for you. Our business set up services include business registrations, tax registrations, insurance, marketing tools (domain names, logo, website, email plans). A complete one-stop-business-support-shop.

Accounting and Accountant fees

When comparing annual prices between Afirmo and MYOB, it’s important to factor in accountant fees if you use MYOB.

A key difference between MYOB and Afirmo is the need for an accountant in addition to the software costs. With MYOB, you need to have an accountant to prepare and file your Income Tax returns – or you have to prepare and file them yourself.

Per year, traditional accountants cost approximately $2000 to $4000 ($167-$333/month) which is a large cost to factor in, on top of your monthly MYOB subscription fee. With Afirmo the tax agency and accountant costs are included in our subscription plan pricing.

Afirmo’s subscription plans are designed to suit a range of businesses with different requirements. You can select an Afirmo plan that doesn’t include tax support, or your business does need tax support, you can select an Afirmo plan, that enables Afirmo tax experts to manage all your tax for you.