What’s the difference?

Xero is a well-known online accounting software provider. There is no question that they have a great product, the question is are they right for you and your business? They cater well to large and complex organisations with their robust platform and integrations. Until now, there haven’t been many alternatives for smaller businesses, or people who don’t need all the bells and whistles – but all that changed with Afirmo.

Afirmo makes starting your business easy. We provide all the essential services you need, so you can get up and running smoothly including choosing your business structure, business basics, and marketing.

Choosing between Afirmo and Xero comes down to four key questions:

- What features do you need? 🛠️

- Where are you at in your business journey? 🗺️

- What type of business do you own? 🏢

- How much accounting AND accountant fees do you want to pay? 💸

What features do you need?

| Features | Afirmo | Xero |

|---|---|---|

| Business Set Up tools | ✅ | ❌ |

| Link existing bank account(s) | ✅ | ✅ |

| Create bank wallets | ✅ | ❌ |

| Unlimited sales quotes and invoices | ✅ (All Plans) | 🔵 ($75+ NZD monthly plans only) |

| Insurance Cover | ✅ | ❌ |

| Accounts preparation | ✅ | ❌ |

| Tax agent support | ✅ | ❌ |

| Reporting | ✅ (All Plans) | 🔵 (Available as Add-on) |

| Claim unlimited expenses | ✅ (All Plans) | 🔵 ($75+ NZD monthly plans only) |

*Details based on publicly available non-promotion-based pricing from xero.com and currency exchange rates as of November 2024. All prices shown in NZD.

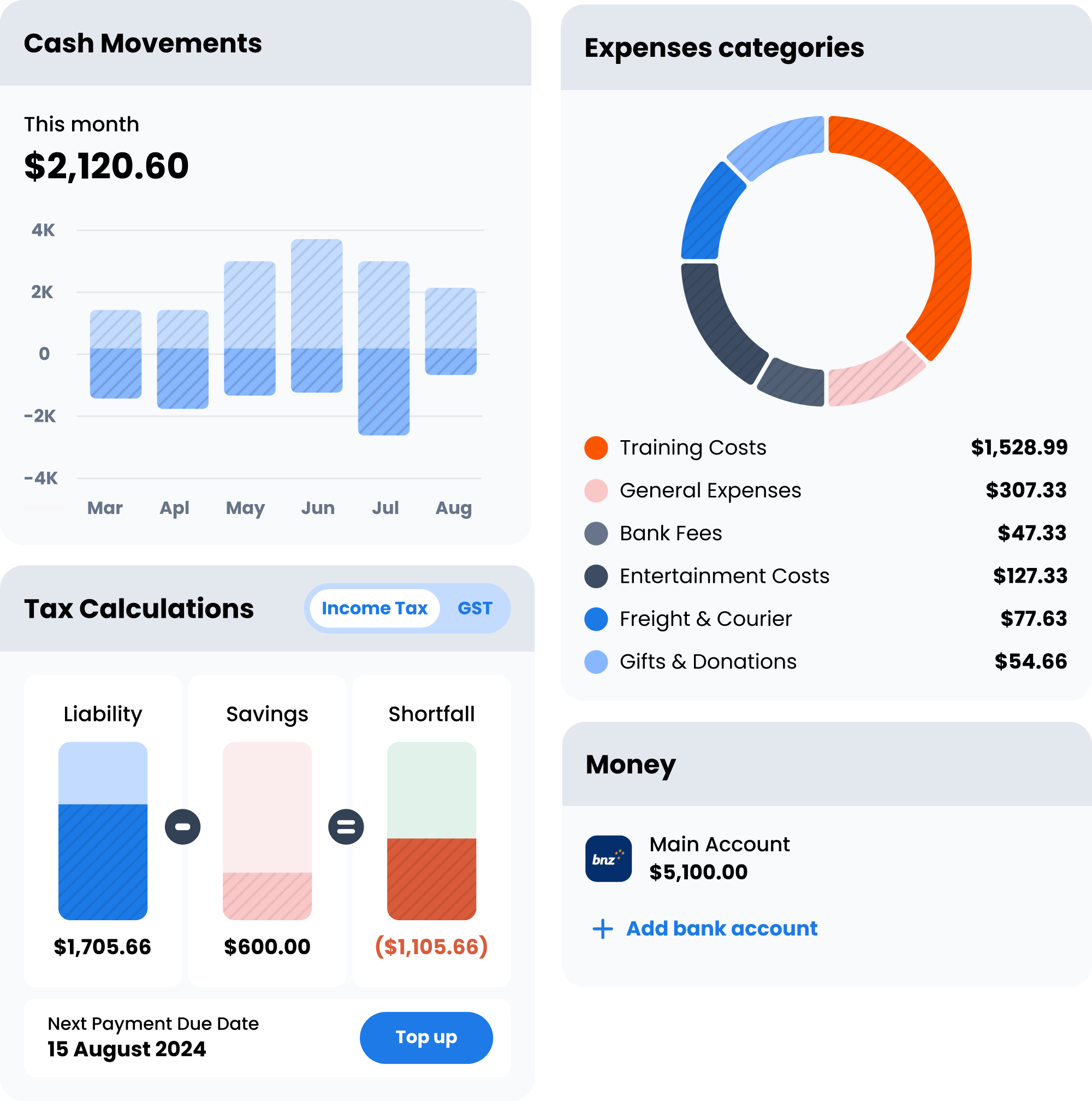

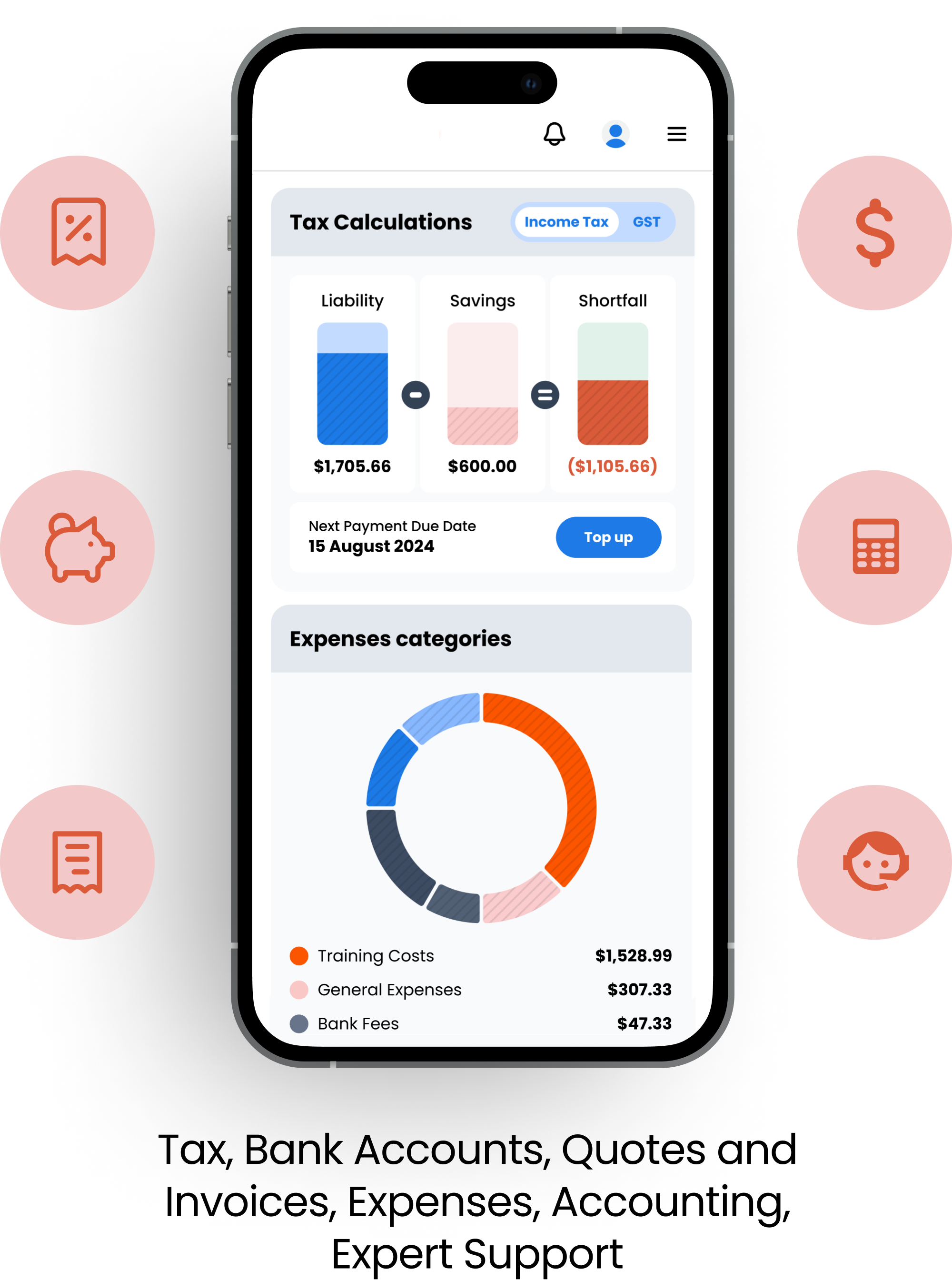

Consider the critical functions you need from your accounting software, to run your business. Afirmo excels at the following:

🚀 Unlimited bookkeeping basics on all plans.

One thing to note is that all Afirmo plans include unlimited sales quotes, invoices, transactions, and reconciliations. Whereas Xero limits access to these features depending on your plan.

🚀 Tax returns and accountant support are included in Afirmo pricing

We recognise keeping on top of your tax obligations is one of the biggest struggles of business ownership. This is why Afirmo offers you plans that include full tax agency support, preparing and filing your GST and Income Tax returns. Xero does not offer you this service – for tax agency support you still need to enlist an accountant in addition to Xero software.

🚀 Afirmo doesn’t do add-ons

Xero does offer some functionality (at a price) that we do not. While Xero includes features like payment integrations, inventory management, and project tracking, Afirmo takes a more streamlined approach. We focus on essential financial tools without add-ons that may not be necessary for all businesses. This simplicity makes Afirmo user-friendly and significantly more affordable than Xero. So, for businesses seeking straightforward and budget-friendly solutions, Afirmo stands out as the best choice.

Cost Savings Calculator

How much will I save?

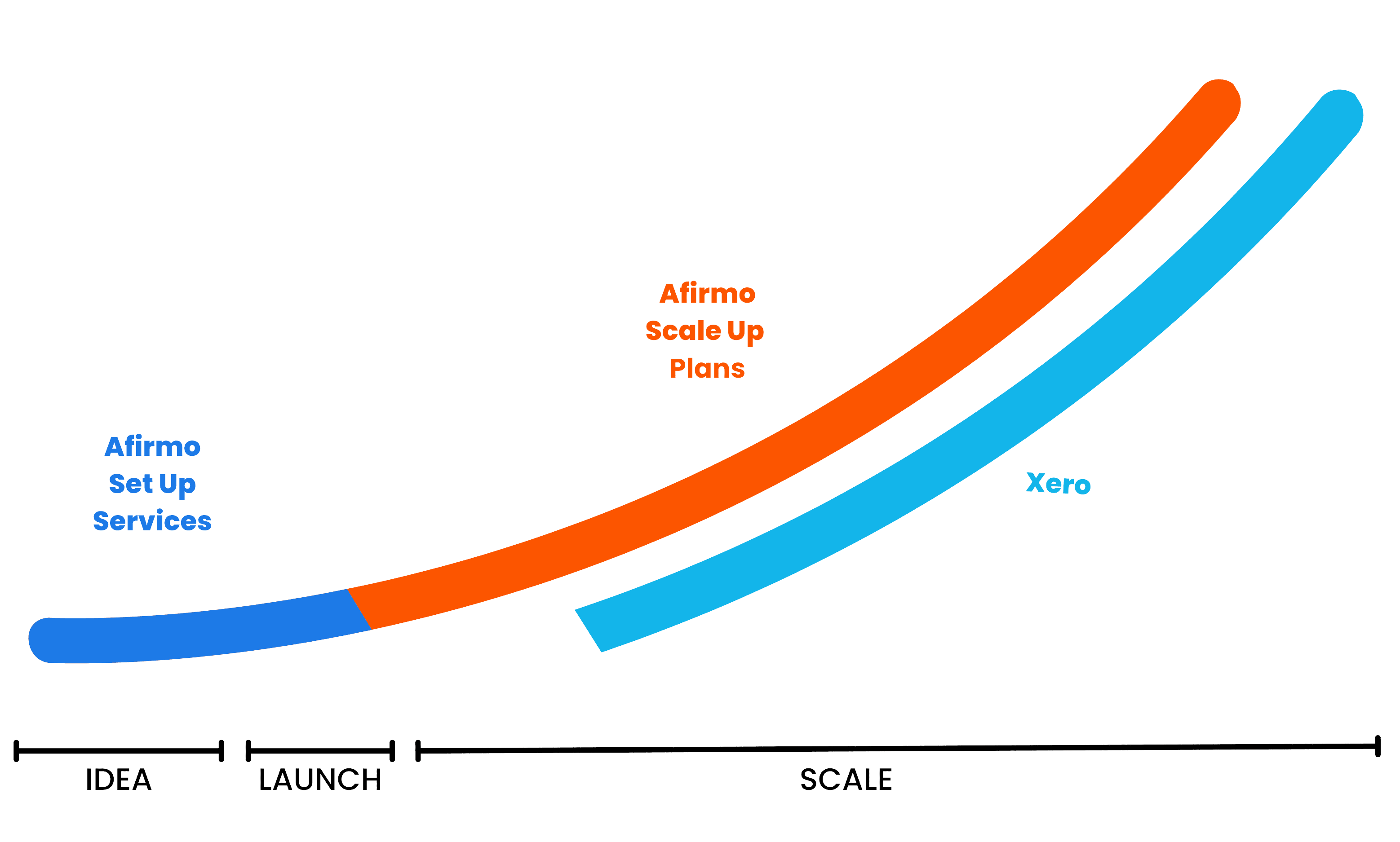

Where are you in your business journey?

Afirmo makes starting your business easy. We provide all the essential services you need, so you can get up and running smoothly including choosing your business structure, business basics, and marketing.

Once your business is trading Afirmo makes bookkeeping as straightforward as possible. Our plans are designed to include everything you need, without having to purchase any add-ons. Xero might be better suited to very large, complex organisations, as they offer a large number of add-ons and integrations. This functionality does come with a degree of added complexity that you might not need or be able to use without an accountant to help.

If you’re in the early stages of starting a business Afirmo may be a better option for you as we offer specialised guidance to help you launch and grow your business. Alternatively – you might own an established business that simply doesn’t need all the bells and whistles that come with Xero. Afirmo was built to be easily used by a range of business owners, regardless of financial literacy.

What type of business do you own?

Afirmo suits all shapes and sizes – from side hustlers to companies and partnerships. Xero can in theory handle all of these, but if you own an early-stage business or if your business is your second job, then Xero’s monthly fees could come with a sting.

Accounting and Accountant fees

When comparing Afirmo and Xero annual subscription plan pricing, remember to factor in accountant fees.

A key difference between Afirmo and Xero is that Afirmo pricing includes an accountant, and Xero pricing does not. So when comparing Afirmo and Xero plans, remember to add on the annual cost of an accountant of between $1000-5300 on top of the Xero annual subscription fee.

Afirmo’s subscription plans have been designed to suit a range of businesses with different requirements. You can select an Afirmo plan that does not include tax support, or you can select one of our plans whereby Afirmo’s tax experts manage your tax for you.