All Features

Discover What Afirmo Can Do:

Open Your Account in 3 minutes

Open Your Account in 3 minutes

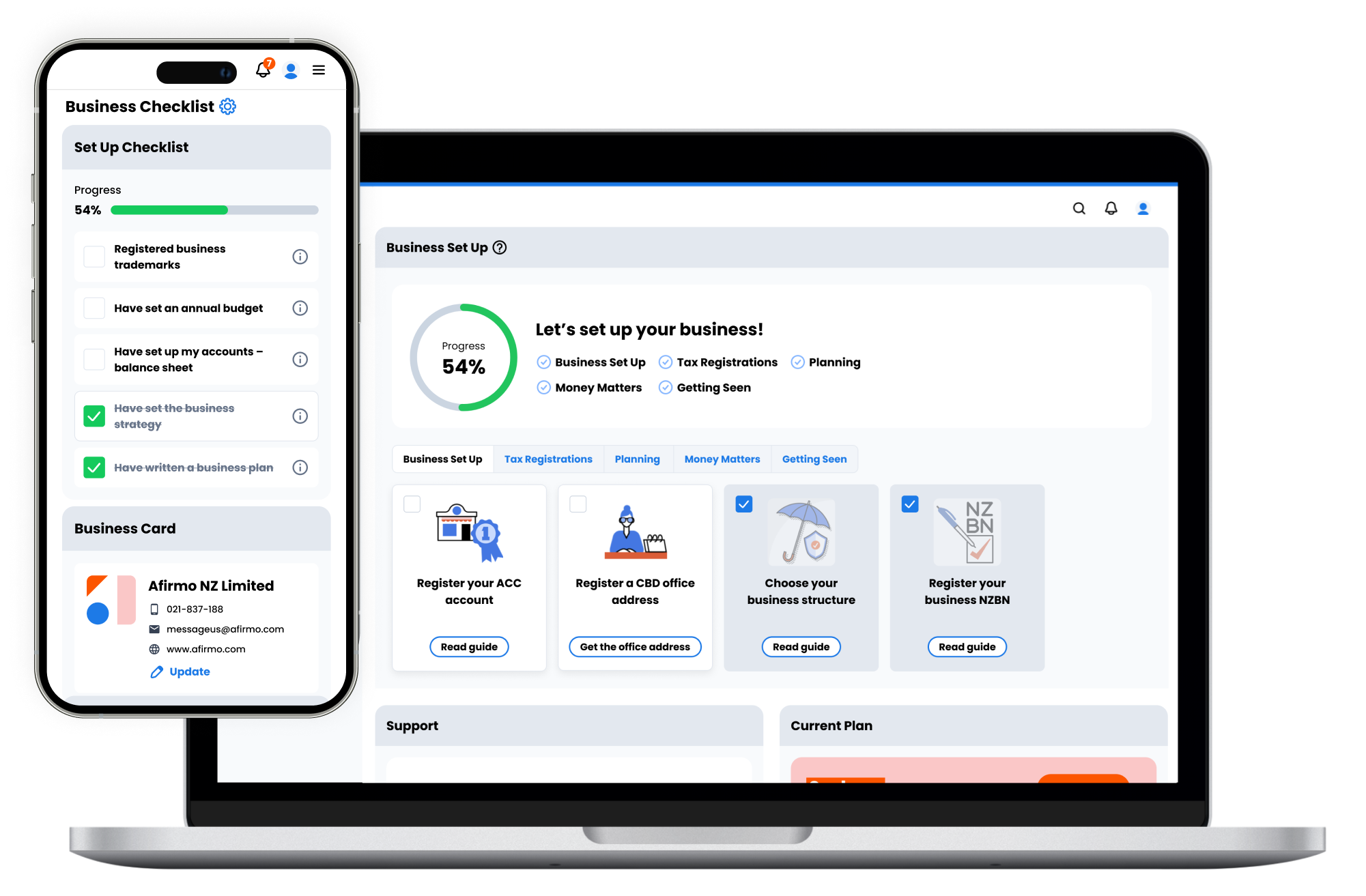

100% Online, Hassle-Free Setup:

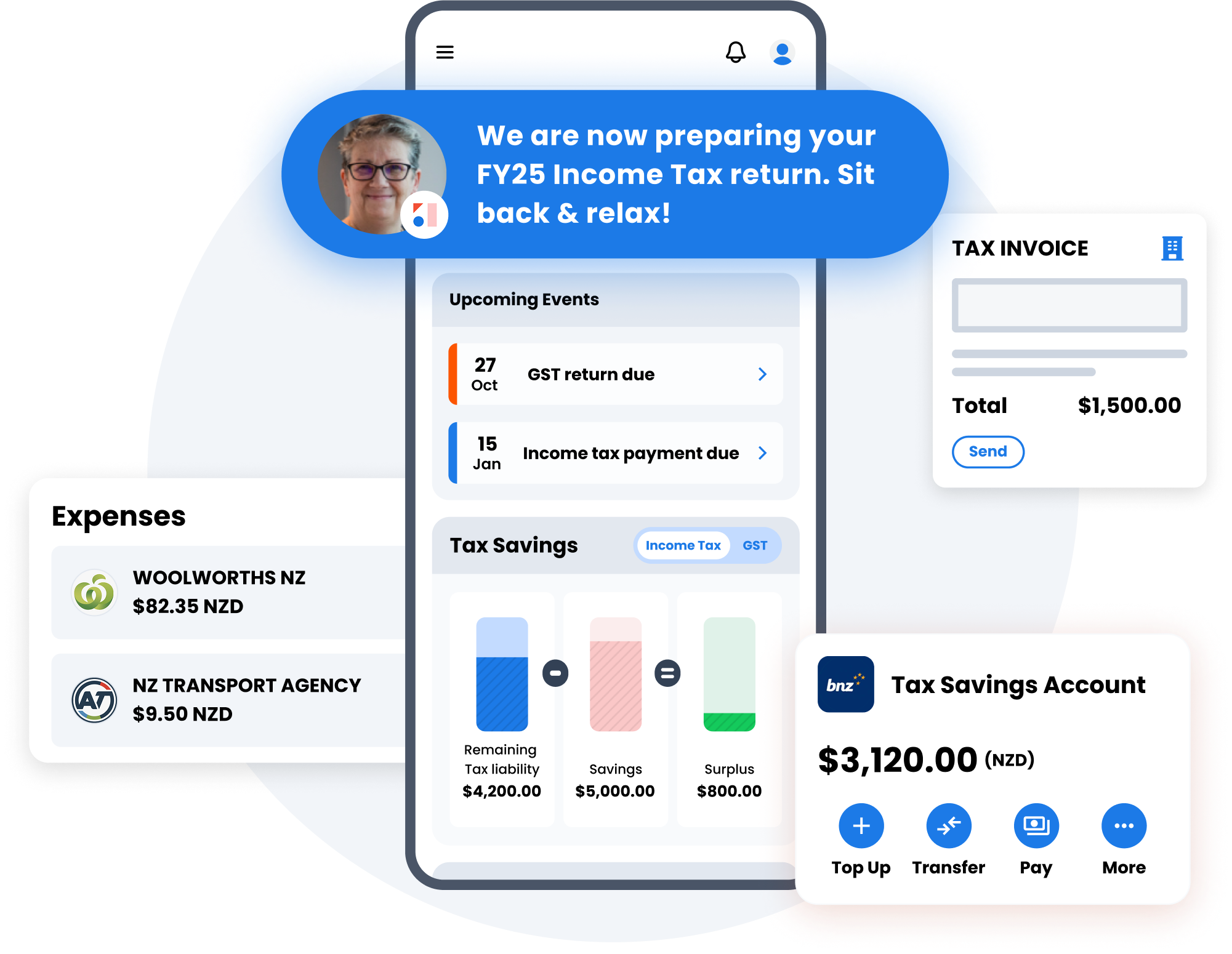

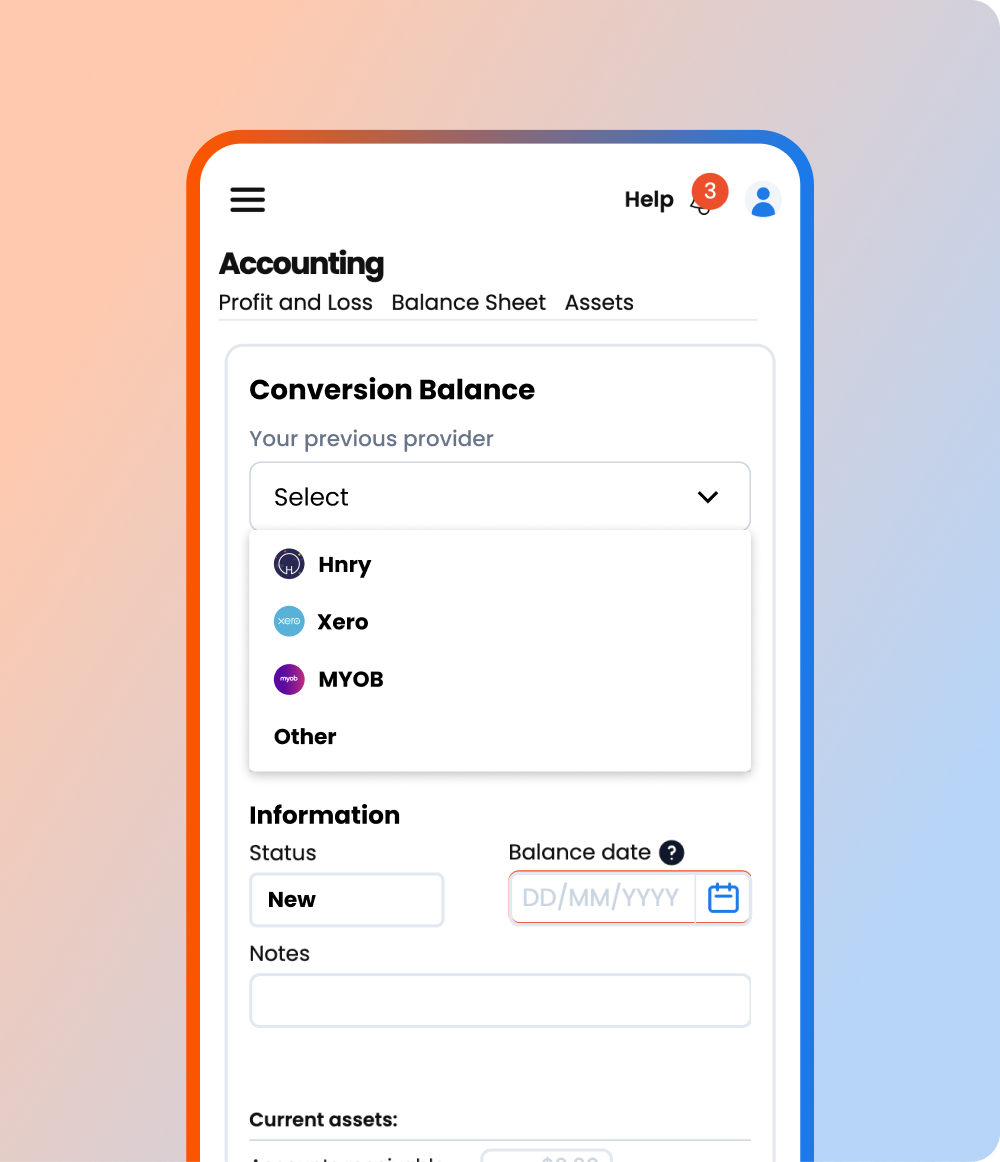

Why wait? Open your new account in less than three minutes! Simply sync your details directly from NZBN or the Companies Office with Afirmo, and you’re good to go.

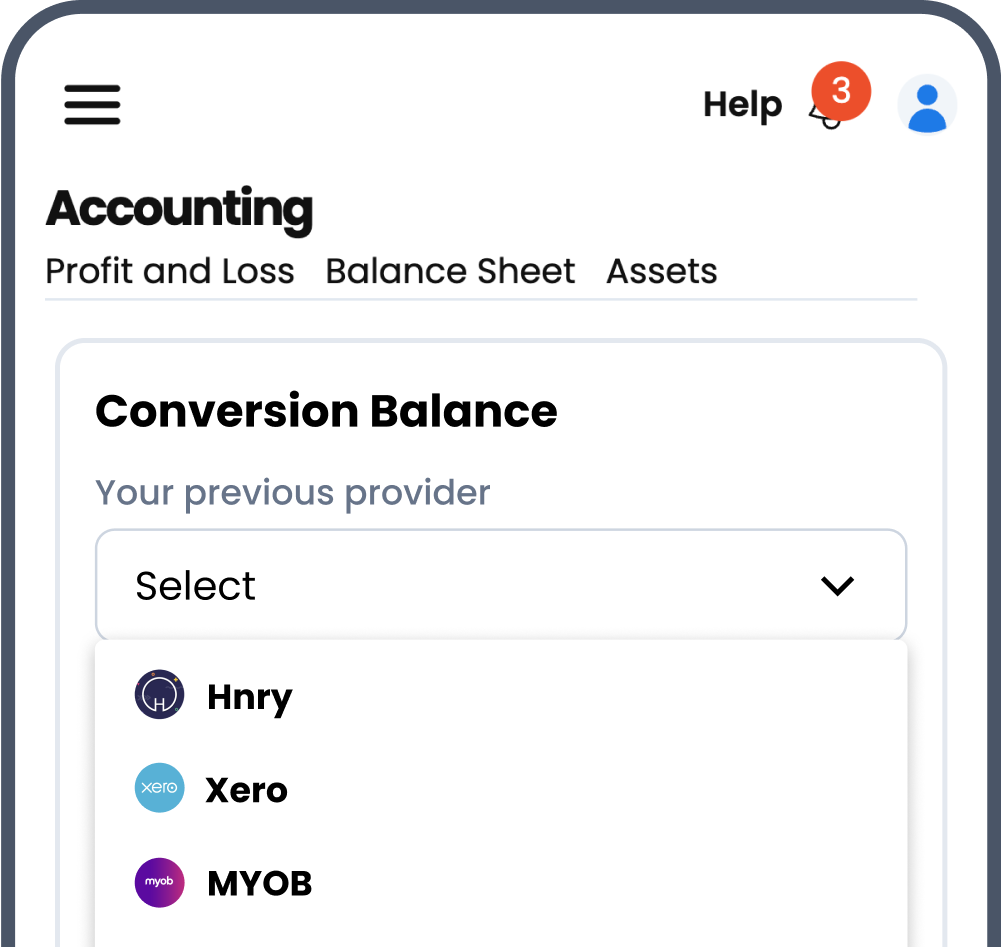

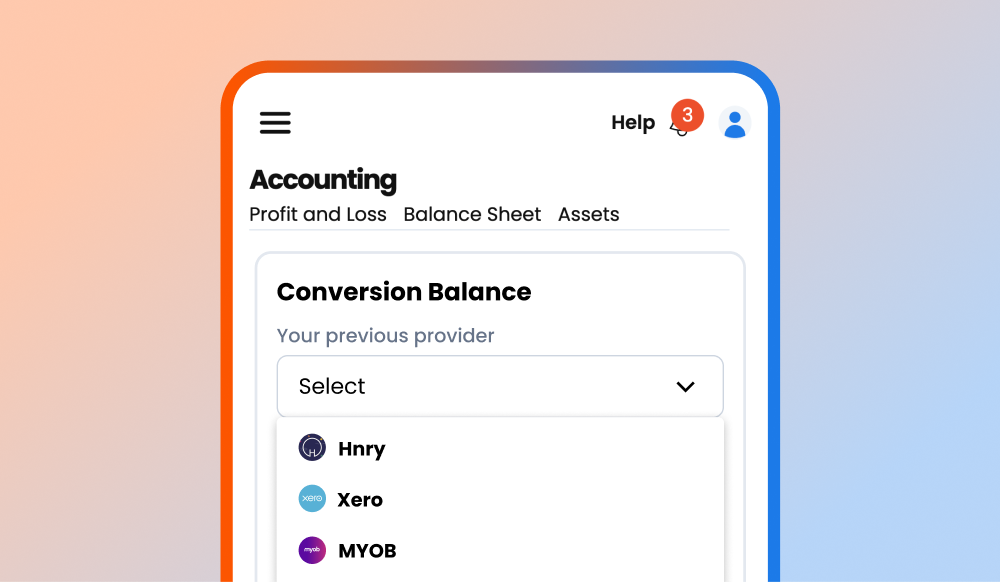

Easily Migrate Your Data:Switching providers has never been easier. Import your data automatically from Hnry, Xero, or MYOB with just a few clicks. Need help? Our friendly support team is always here to guide you through.

Get started today and see how simple managing your business can be!

Frequently Asked Questions

A word from real customers

See who’s using Afirmo

⭐⭐⭐⭐⭐

Trusted by 7,500+ Users

Supercharge

$95/Month

$80 on Annual Plan

Supercharge

$1,140 $950/Year

Save $190

Best for Small Companies that:

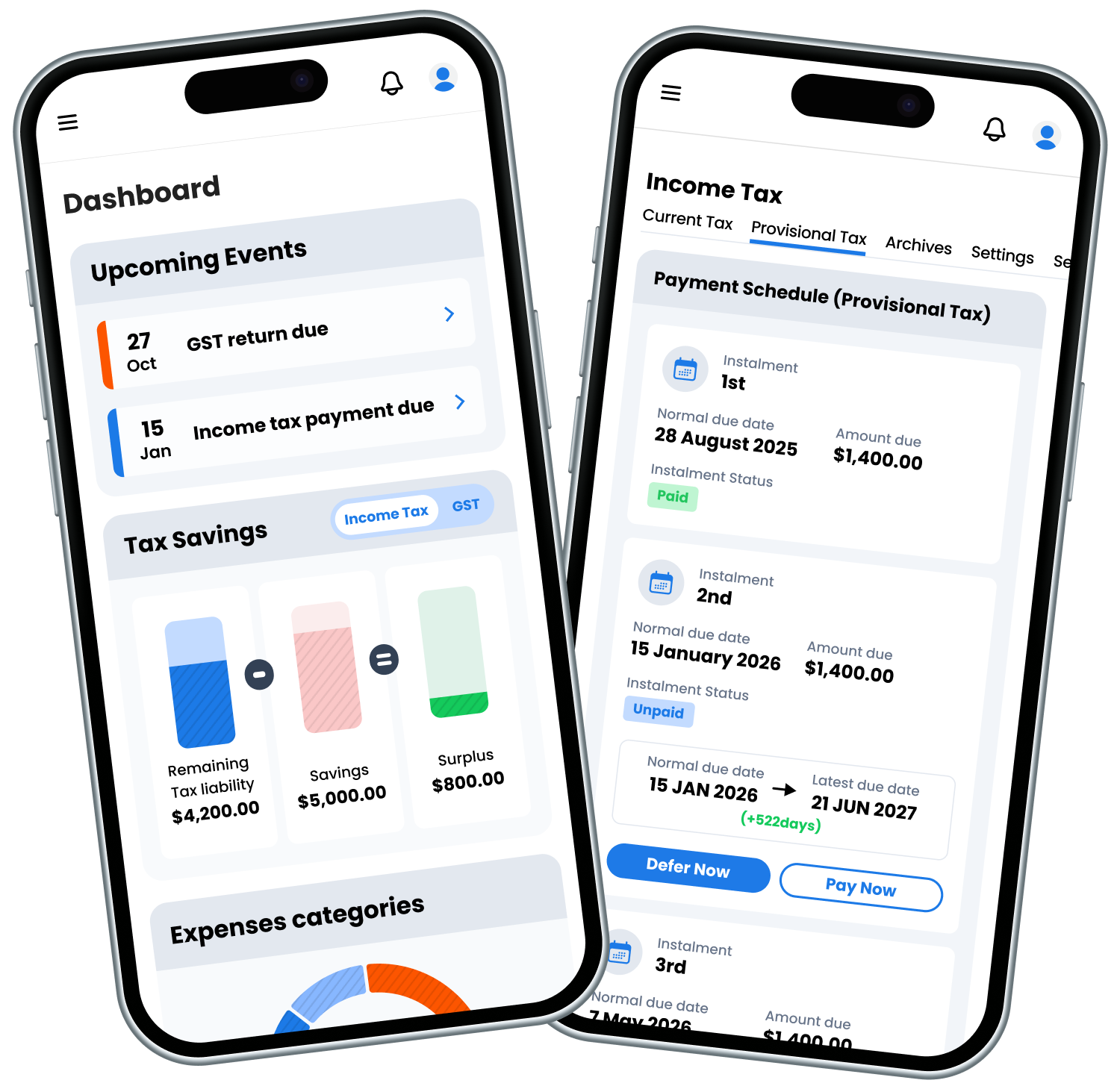

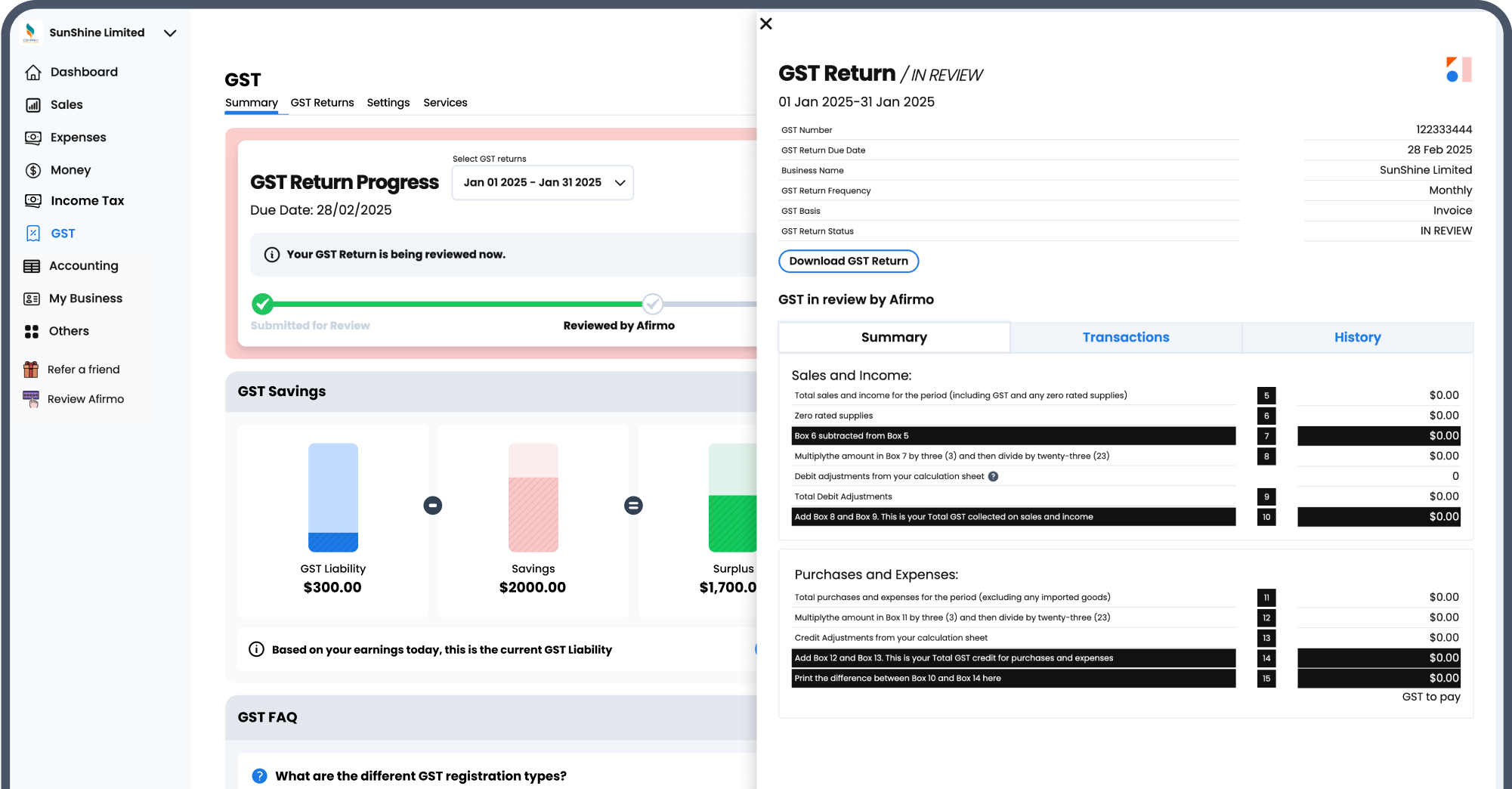

- Need Afirmo to prepare and file up to six GST returns per year

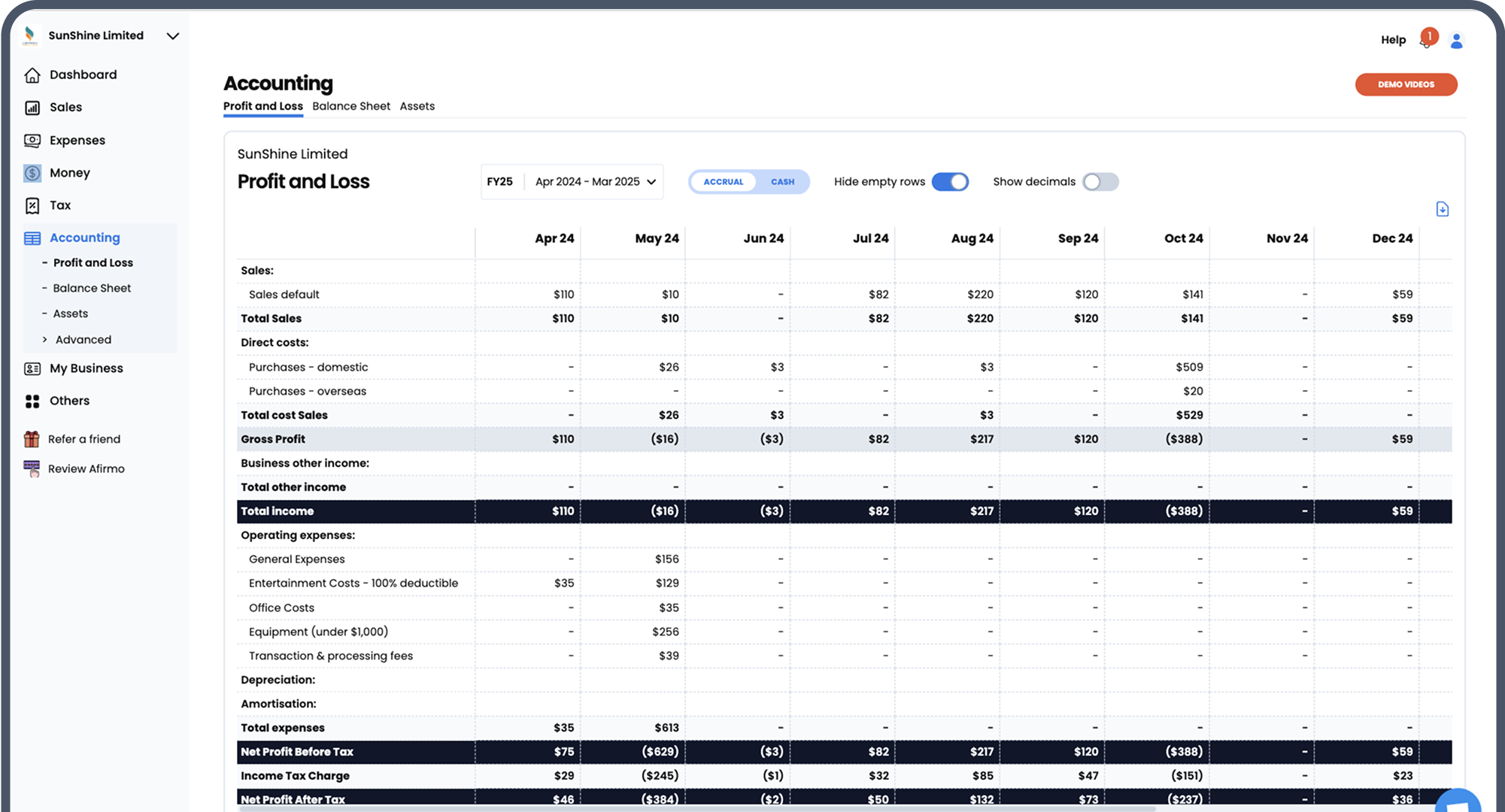

- Need a year-end Business Income Tax return

- Need tax and accounts support

- Need year-end accounts prepared.

Supercharge PRO

$150/Month

$125 on Annual Plan

Supercharge PRO

$1,800 $1,500/Year

Save $300

Best for Growing Companies that:

- Need Afirmo to prepare and file up to 12 GST returns per year

- Need a priority year-end Business Income Tax return

- Need a director or shareholder personal tax return included

- Need one hour per month of bookkeeping support

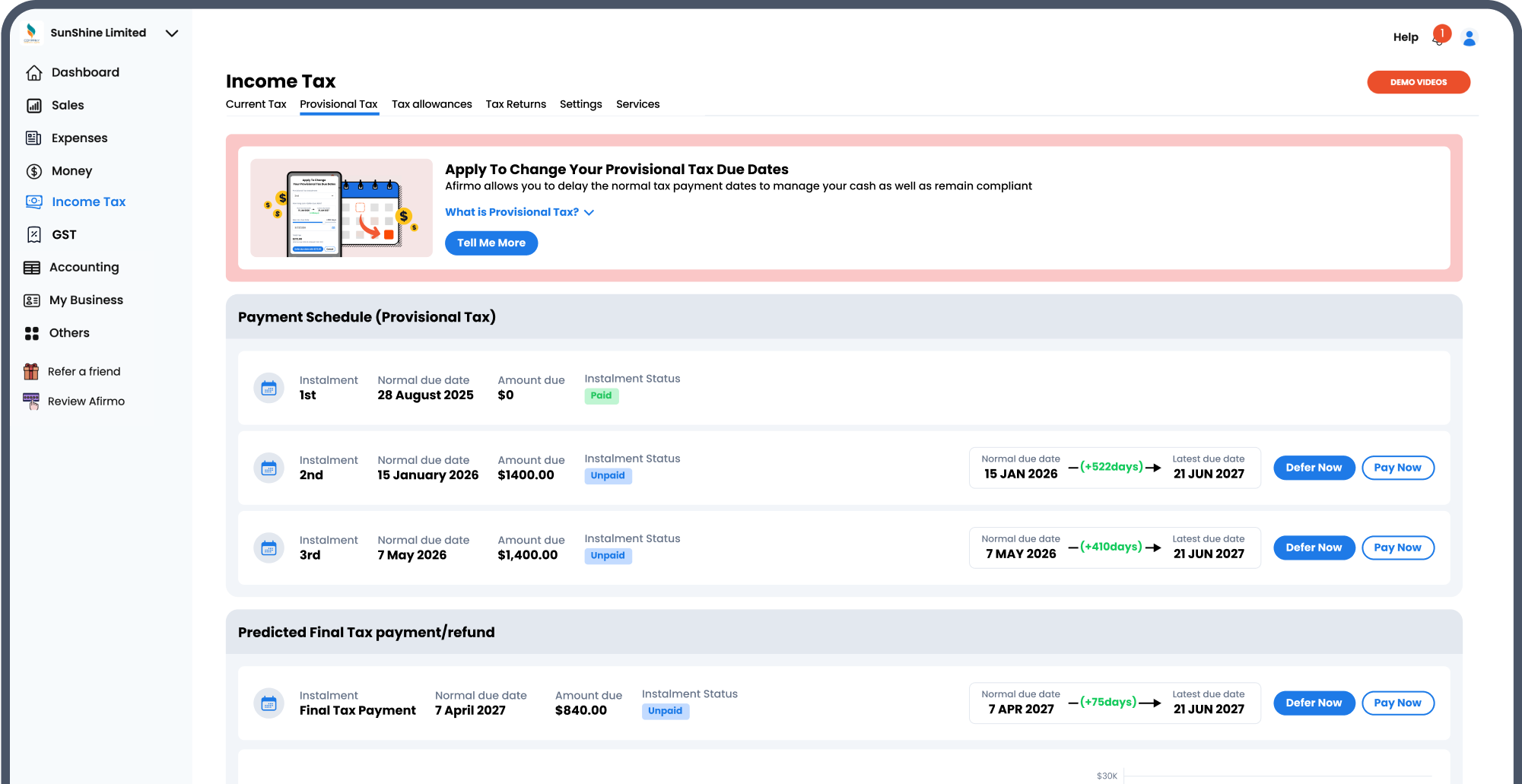

- Fees-Free IRD tax payment date deferment

- Need year-end accounts prepared