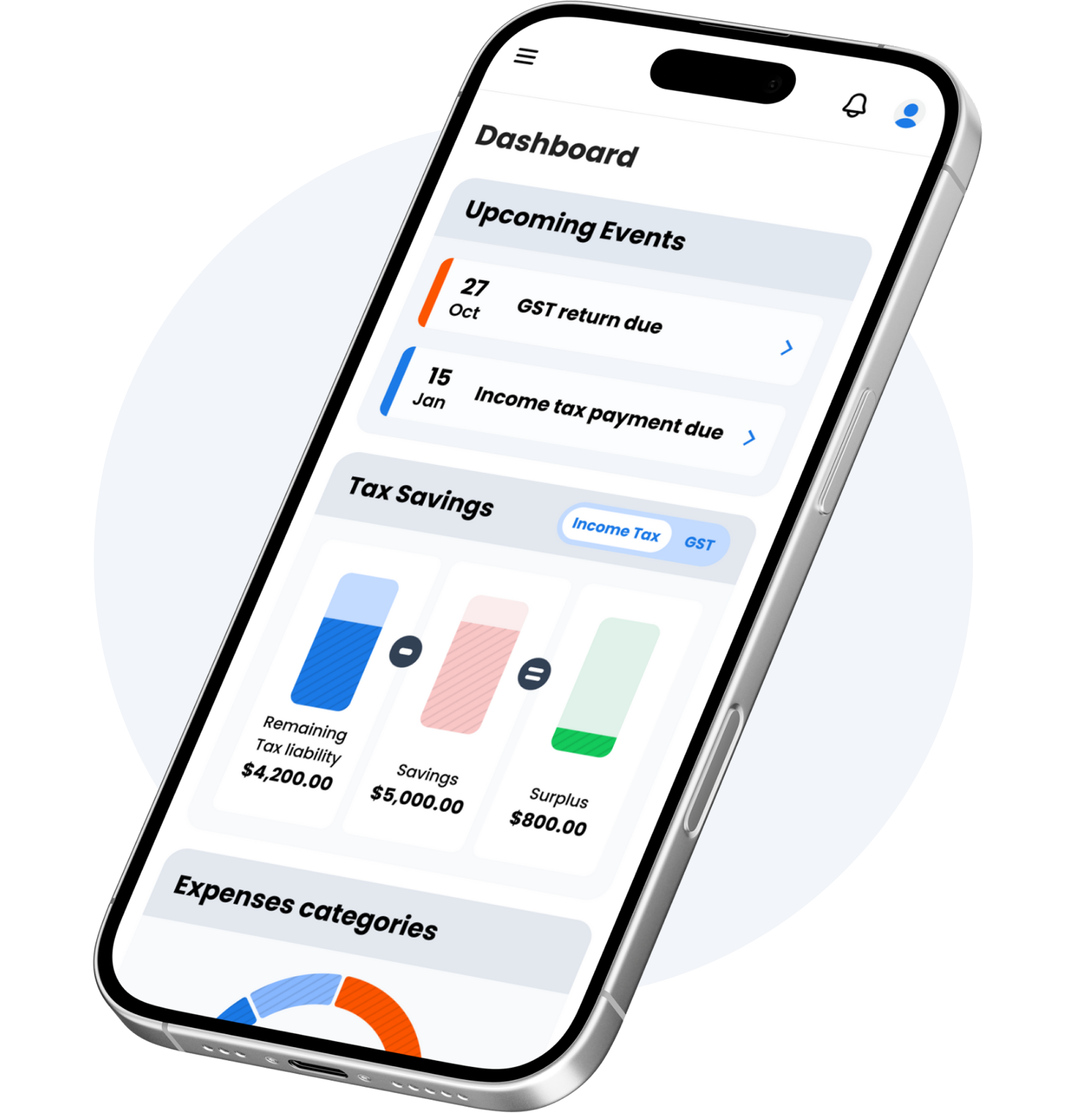

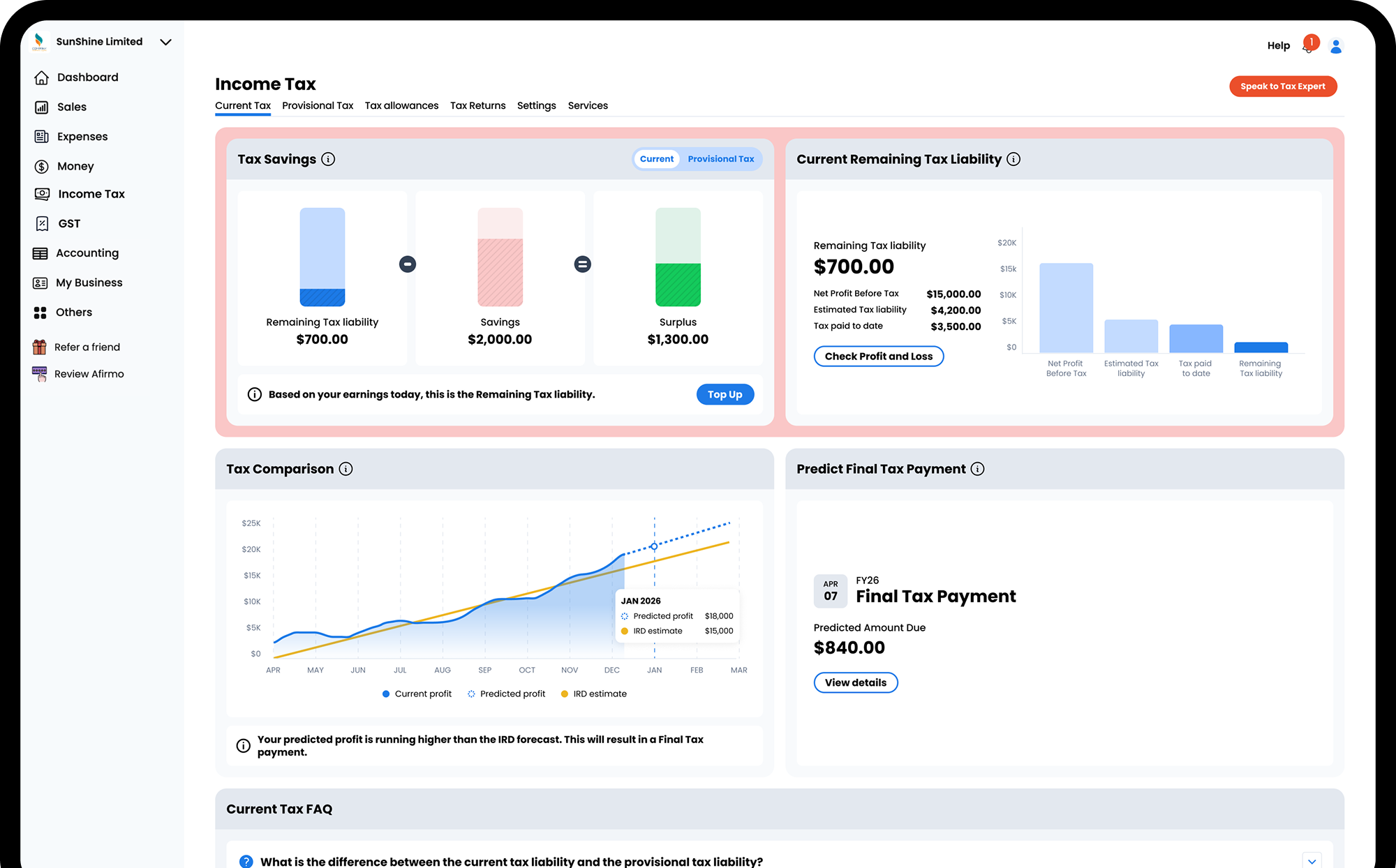

Income Tax calculator updated in real time

A New Zealand first! A 24 x 7 view of your business’s Income Tax liability.

Accurate Income Tax calculations:

The Income Tax calculation is based on multiple data sources ensuring accuracy.

Updates each time more information is added:

Sales invoices, expense claims, bank transactions, tax allowances, and other income sources all update the calculations.

Tax optimisation:

Keep the tax allowances tab updated to maximise your tax allowances (private expenses used in the business such as mobile phone, private car, mortgage interest etc).

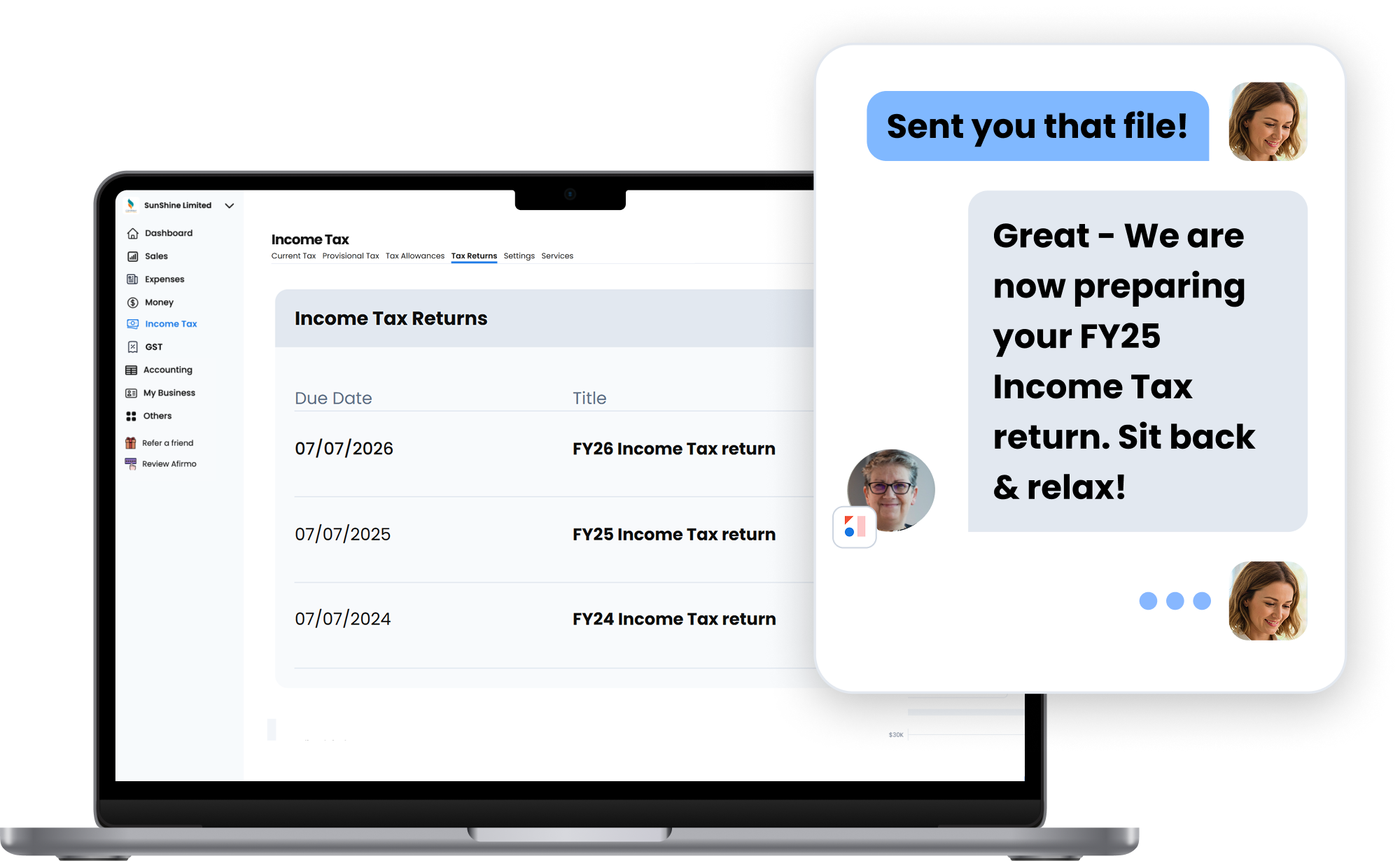

Income Tax return preparation

Afirmo prepares an Income Tax return for your business in real time ready for filing at tax year end. Your tax return also includes all the disclosures that are needed to remain compliant.

See your tax return in real time:

Afirmo automatically prepares your tax return for you (IR3, IR3b, IR4, IR10).

Ready for year-end filing:

Come tax year end our tax experts will review the returns and interact with you on any questions to minimise your tax liability.

Maximise deductions:

If the tax team find you have underclaimed tax deductions we will tell you to see if we can get that bill lowered.

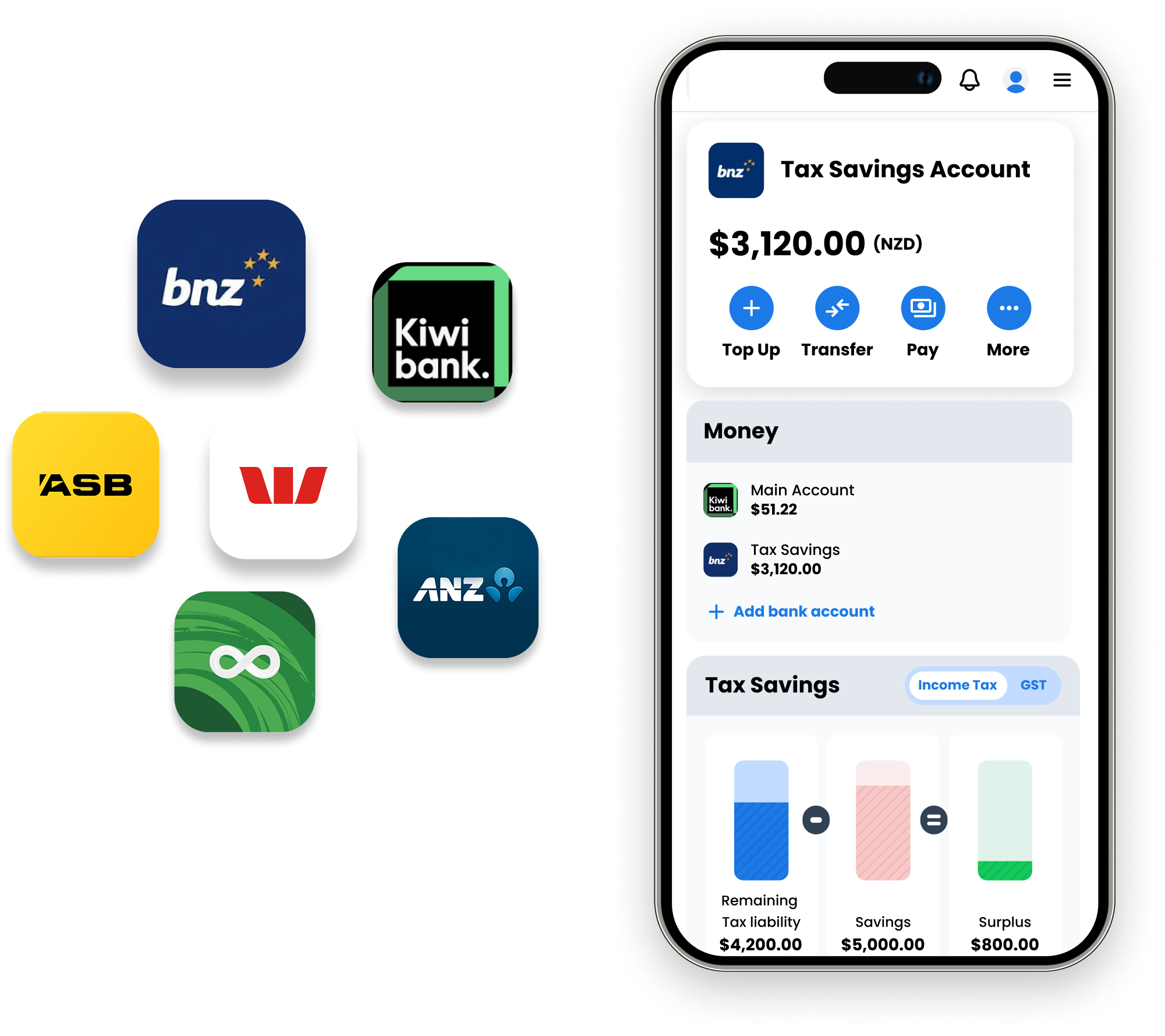

Income Tax savings

Link your existing bank accounts, or set up a BNZ wallet, and save against your Income Tax liability calculation.

Link your bank account:

Keep your tax money in your own bank account and still track your savings against your tax bill. Great for offset mortgage customers.

Set up a BNZ wallet:

If you want to save for your Income Tax bills and keep the cash out of your main bank account then you can apply for a BNZ wallet, which you can manage within the app.

Track your surplus or shortfall position:

Let the app show you your surplus or shortfall positions. Use the app to top up or withdraw funds as needed.

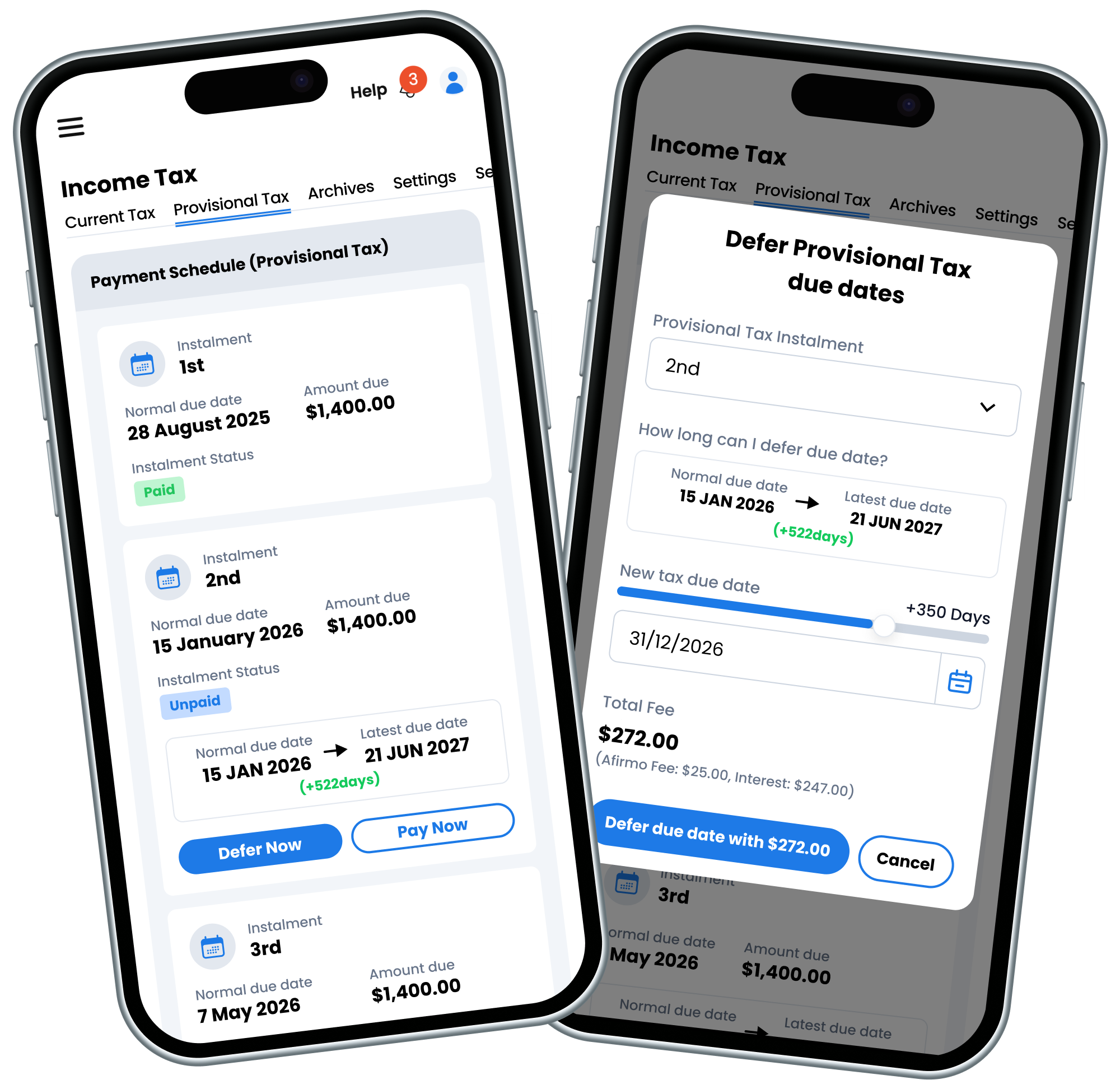

Income Tax payments

Pay your tax to the IRD – or defer payment – through the app on either the original or deferred due date.

Defer your tax due dates:

Afirmo partners with PWC so you can legitimately defer your provisional tax payments for up to nearly 1.5 years! Great for keeping cash in your business.

Pay the IRD:

You can pay the IRD with Afirmo or consent for Afirmo to make the payments for you on your due dates.

Set regular bank payments to stay ahead:

Use Afirmo’s money tool allocations feature to set rules to pay ACC, KiwiSaver and IRD.

Frequently Asked Questions

A word from real customers

See who’s using Afirmo

⭐⭐⭐⭐⭐

Trusted by 7,500+ Users

Supercharge

$95/Month

$88 on Annual Plan

Supercharge

$1,140 $1,045/Year

Save $95

Best for Small Companies that:

- Need Afirmo to prepare and file up to six GST returns per year

- Need a year-end Business Income Tax return

- Need tax and accounts support

- Need year-end accounts prepared.

Supercharge PRO

$150/Month

$138 on Annual Plan

Supercharge PRO

$1,800 $1,650/Year

Save $150

Best for Growing Companies that:

- Need Afirmo to prepare and file up to 12 GST returns per year

- Need a priority year-end Business Income Tax return

- Need a director or shareholder personal tax return included

- Need one hour per month of bookkeeping support

- Fees-Free IRD tax payment date deferment

- Need year-end accounts prepared