Sign up now on a Rocket, Supercharge or Supercharge Pro annual plan to get:

✅ 30-Day FREE Trial – Try Afirmo risk-free before claiming your FREE tax return

✅ FREE 2025 Business Income Tax Return (Valued at: $480 NZD)

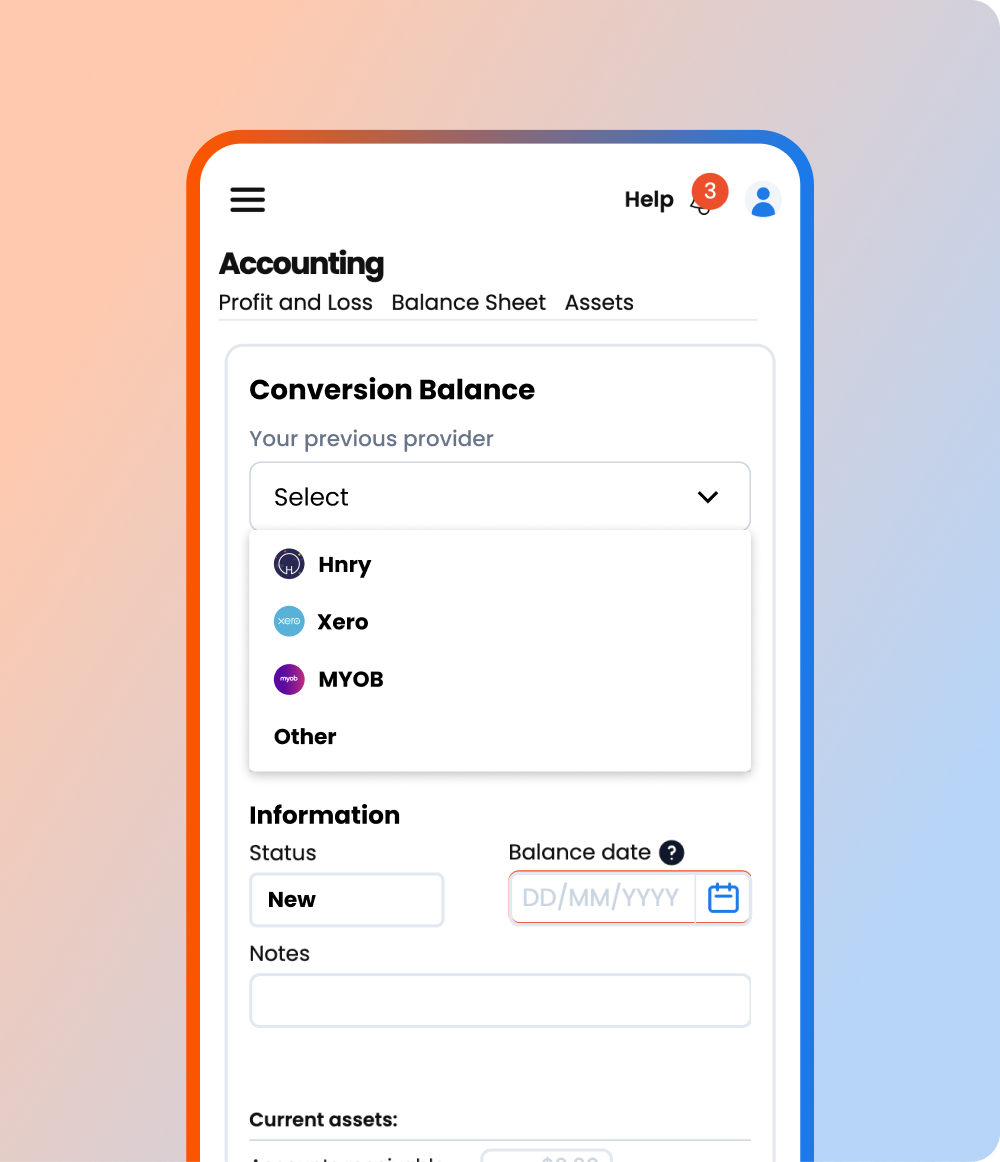

✅ FREE Migration & Account Check (We’ll handle the setup for you!)

*Available on select annual plans. Terms apply.

How it works

We Become Your Accountant

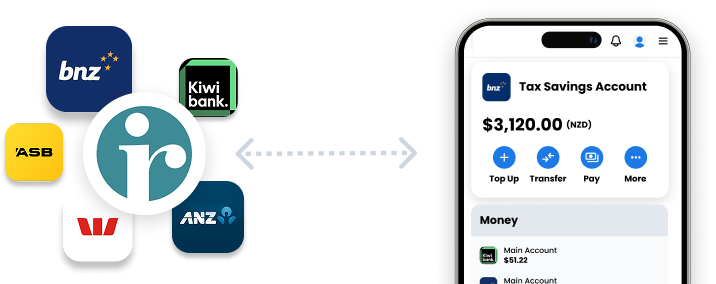

Link your Bank Accounts & IRD Account

Link your Bank Accounts & IRD Account

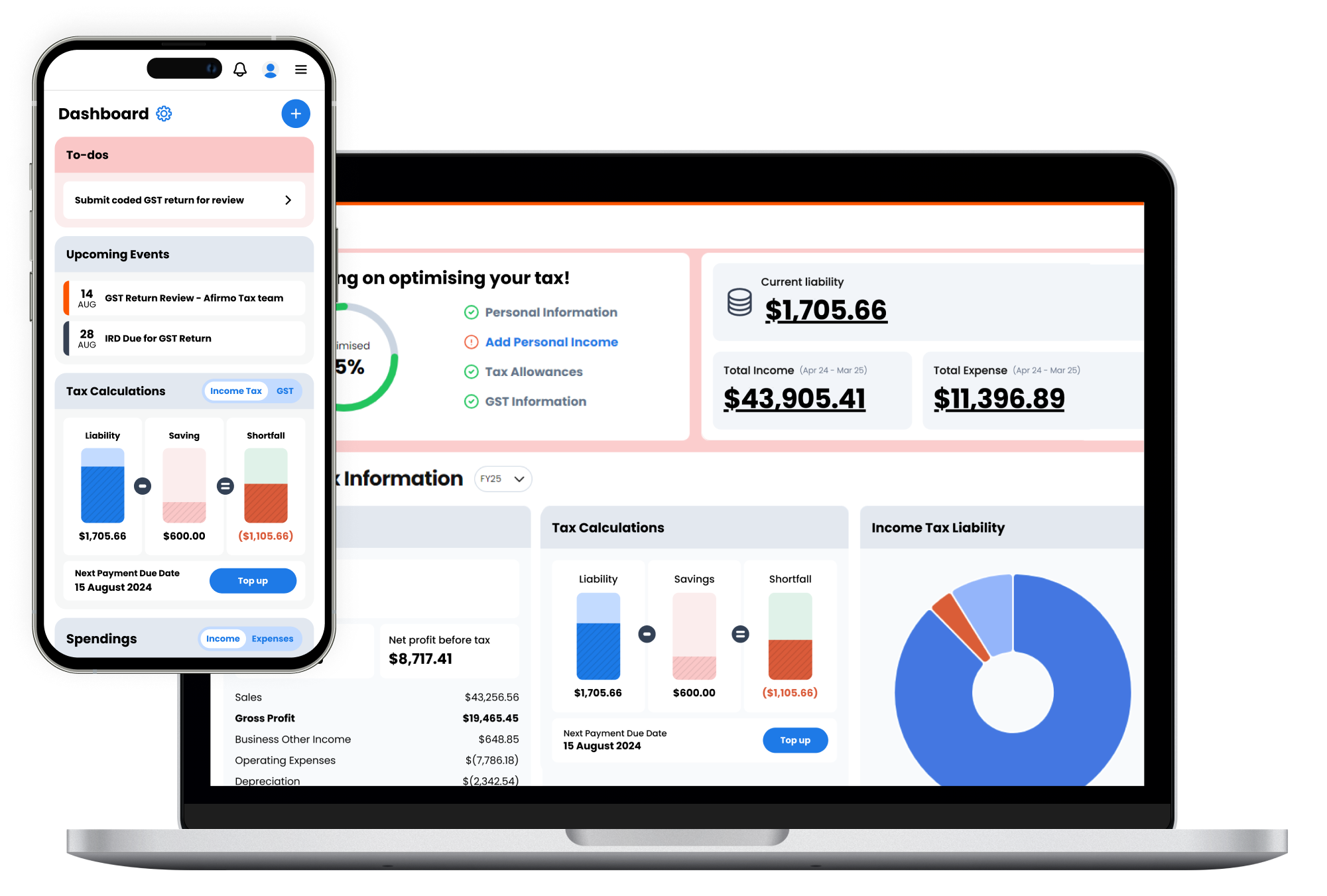

Link your business bank accounts or open an Afirmo Business Wallet to power our easy-to-use integrated accounting and tax tool.

Import your IRD data into the Afirmo app to optimise our real-time tax calculations and reduce data entry. Always stay in control of your money.

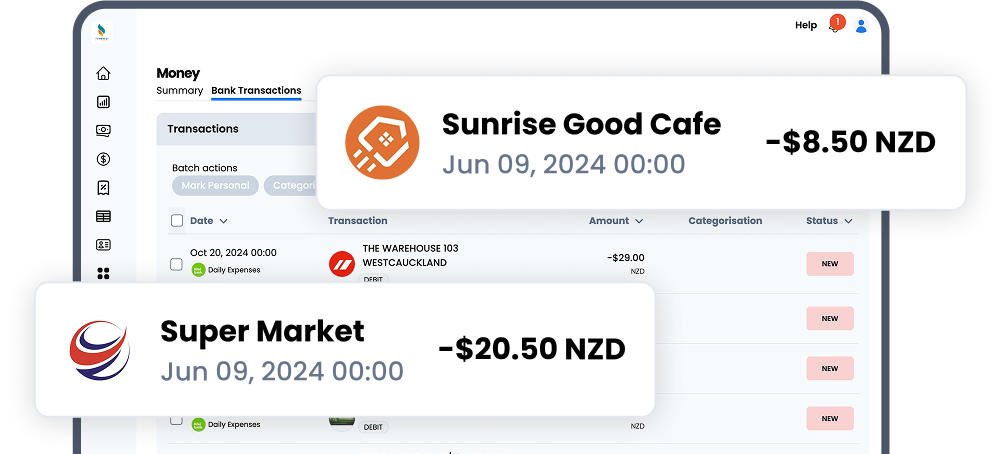

AI Powered Expense Tracking

AI Powered Expense Tracking

Monitor outgoings, automatically categorise expenses, track payables, and manage assets. Let the Afirmo app guide you to reduce your tax bill.

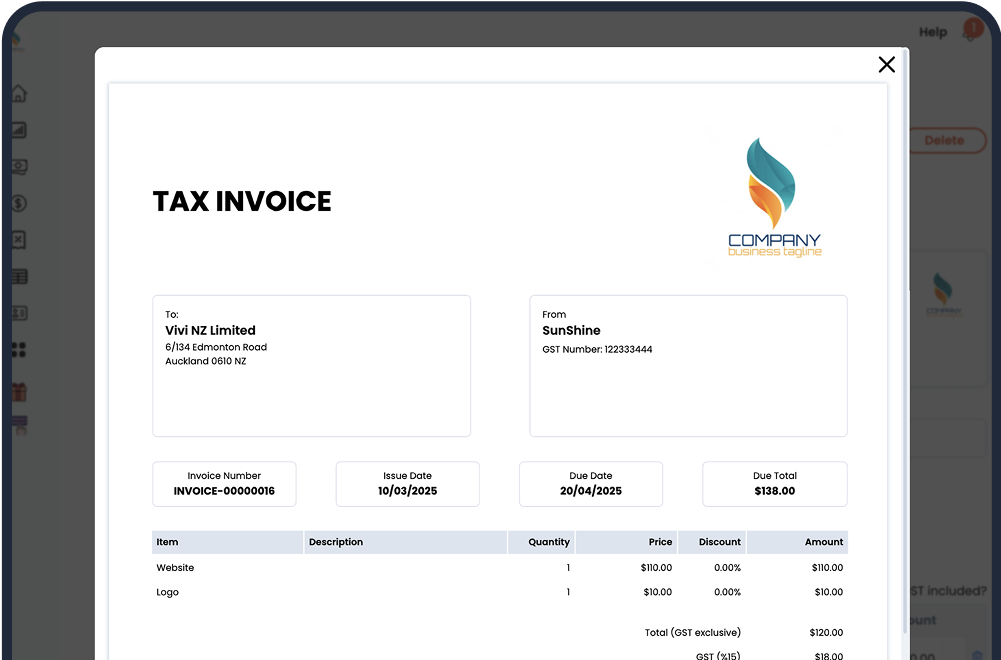

Use Afirmo Invoicing or Your Own

Use Afirmo Invoicing or Your Own

Create and track unlimited quotes and invoices with complete flexibility – use Afirmo’s sales invoices or your own software.

Customise them with your logo and products, and easily manage receipts and outstanding payments.

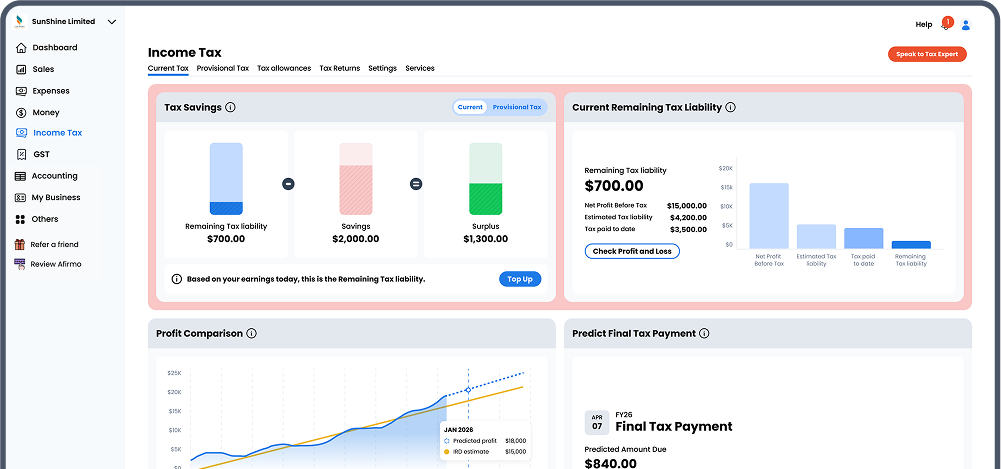

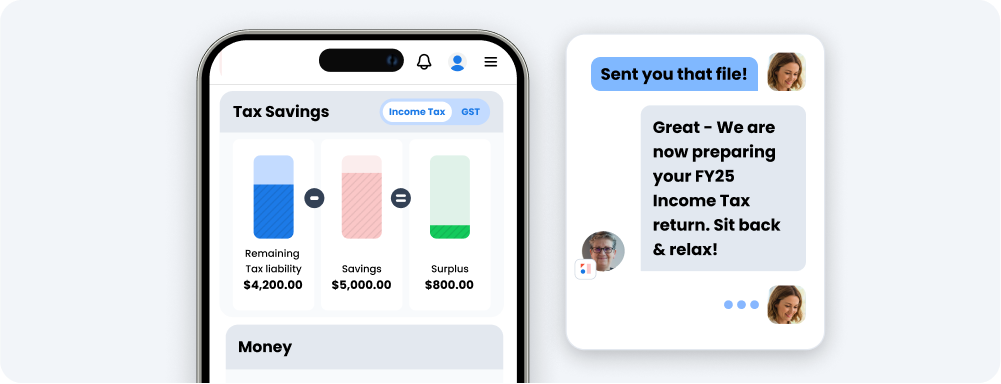

See your Income Tax & GST liabilities in real time

See your Income Tax & GST liabilities in real time

See your Income Tax and GST liabilities calculated 24/7 & set your tax deduction allowances. Always know what tax you need to set aside.

Save funds in your linked bank accounts to always stay ahead & use the Afirmo tax allowance calculator to maximise your tax deductions and reduce your tax bill.

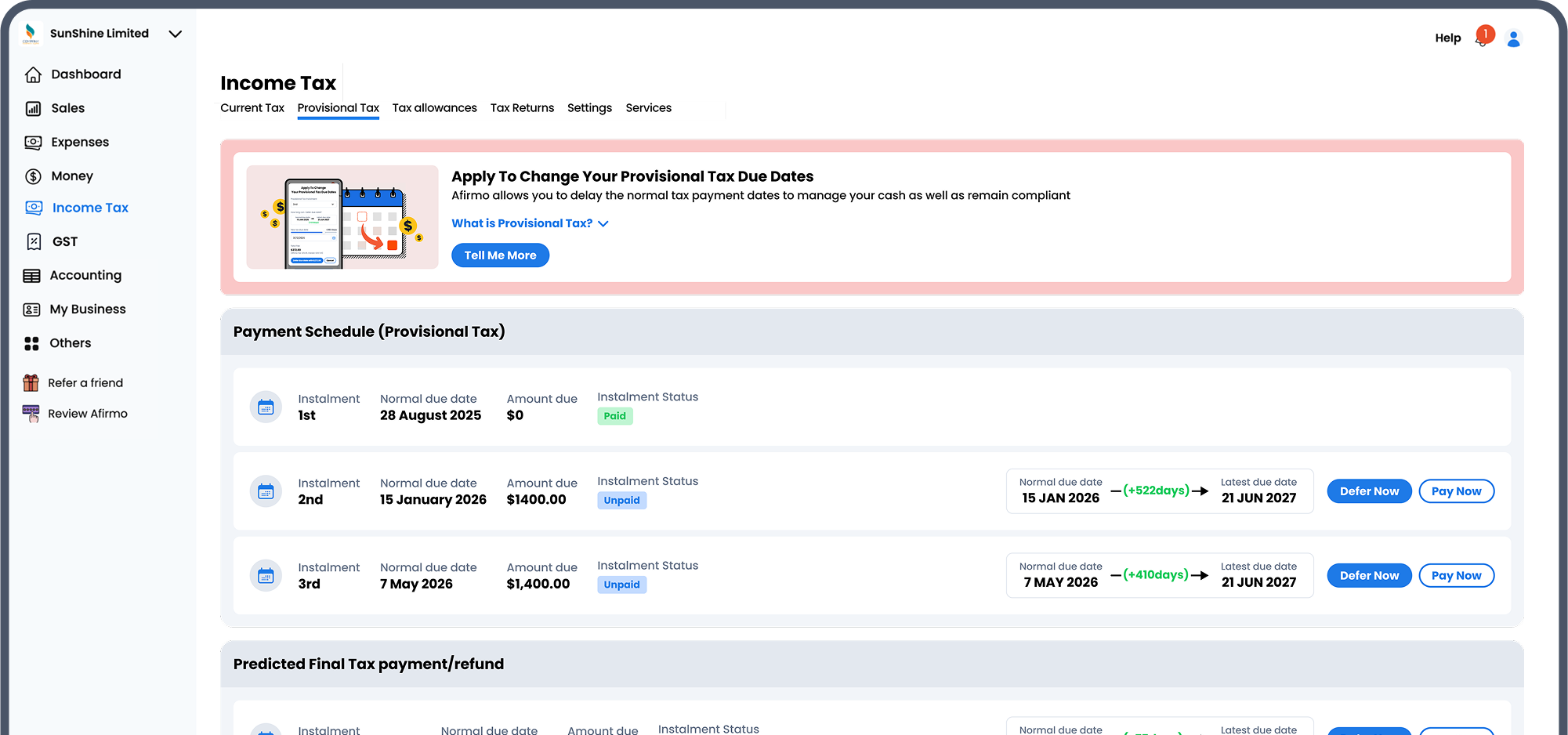

Easy Tax Deferment

Easy Tax Deferment

Choose when you pay tax by using the unique Afirmo tax deferring service to formally delay when you need to pay your income tax bills.

We will manage it with Inland Revenue so you retain a first-class compliance history.

Fully-managed Tax Returns

Fully-managed Tax Returns

Afirmo accountants review and submit your GST and Income Tax returns for you!

Supercharge

$95/Month

$88 on Annual Plan

Supercharge

$1,140 $1,045/Year

Save $95

Best for Small Companies that:

- Need Afirmo to prepare and file up to six GST returns per year

- Need a year-end Business Income Tax return

- Need tax and accounts support

- Need year-end accounts prepared.

Supercharge PRO

$150/Month

$138 on Annual Plan

Supercharge PRO

$1,800 $1,650/Year

Save $150

Best for Growing Companies that:

- Need Afirmo to prepare and file up to 12 GST returns per year

- Need a priority year-end Business Income Tax return

- Need a director or shareholder personal tax return included

- Need one hour per month of bookkeeping support

- Fees-Free IRD tax payment date deferment

- Need year-end accounts prepared

Cost Savings Calculator

How much will I save?

FAQs

A word from real customers

See who’s using Afirmo

⭐⭐⭐⭐⭐

Trusted by 7,500+ Users

Terms and Conditions

*By purchasing an annual Rocket, Supercharge or Supercharge Pro plan on or before 30 April 2025, you will receive free migration services, as well as one (1) complimentary FY25 Business Income Tax return filing. After successful payment, customers must complete the required Tax Agency form no later than 31 May 2025 to qualify for this complimentary service.