How Afirmo Works:

Information is shared between Afirmo tools to save you time and optimise your experience.

Afirmo tools are personalised to your business, based on your business needs, and the information you provide Afirmo.

For example, your Business Industry Classification (BIC) is free with Afirmo and when you use it in Afirmo’s other tools, it determines what insurance you need, how much ACC levies you need to pay.

Our Tools

All key actions and upcoming events are made available at a glance on your personalised Afirmo dashboard.

Set Up Tools …

Scale up Tools …

Click on the “i” for more information on how each tool will benefit you and your business

Set Up Tools

Set Up Tools

Business Set Up Tool

Afirmo’s Business Set Up Tools provide an easy-to-follow series of steps to Set Up a new business for all business types, whether you want to Set Up a …

Sole trader – the cheapest and easiest business structure to Set Up and maintain and usually suited to contractors and freelancers. This suits single owner businesses only. Read more here

Company – this is a more complex business structure to Set Up and maintain but has the benefit of offering limited liability to the owner should the business fail. It is suitable for businesses with one or more owners. Read more here

Partnership – this structure is suitable for multiple owner businesses that do not need to limit the liability of the owners. Read more here

Need help choosing the right business structure for you?

Decide when you Set Up your business using Afirmo’s Business Selection Tool.

Your Customer Dashboard will keep you up to date on your key actions and upcoming events.

During your business Set Up process, Afirmo will take care of all the important stuff.

Hey, be bold, be seen

To get busy with customers and sales step through Afirmo’s Marketing Tool.

Afirmo’s Marketing Tool includes…

Set Up Tools

Business Profile

Your Business Profile is where you store all your key business information like your IRD number, ACC account number, NZBN number, Business Industry Classification Code (BIC).

Afirmo uses this information to tailor services and recommend tools to you. Afirmo also uses the information you input, across Afirmo’s other tools available to you, integrating it so you reduced duplication across the tools.

It’s FREE to set up an account and store all your important information in one place. Throw the old paper records away and store your data safely in the cloud.

Set Up Tools

Tax Registrations

Do you need to register for GST? Do you know the rules when you are mandated to register by the IRD? Did you know that in some cases registering before it is mandatory can save you money?

In the Business Set Up Tool, you can apply for various tax registrations.

IRD Number Application – get an IRD number for your business and start trading today

GST Registration – Get registered for GST by following Afirmo’s simple online registration process

NZBN Registration – Get your unique NZBN with Afirmo. Share it with customer and suppliers and let them see your identity information

ACC Cover Plus Account – avoid that surprise ACC levy invoice after you have been trading for 12 months. Create an account upfront and take control of your obligations

Professional looking sales invoices and quotes are key to getting paid on time. They also need to contain certain information to be tax compliant. Afirmo’s Sales Invoicing Tool ticks all these boxes and more. Afirmo also has some great analytical tools to help you stay on top of billing and sales.

Create sales invoices

You can raise your sales invoices, to send to your customers, by using Afirmo’s template invoices, to ensure you are compliant…

…and you can add your terms and conditions for future invoices.

Create a sales quote

With Afirmo you can raise your sales quotes, to send to your customers to get that sale.

Once your customers accept your quotes, you can convert the quote to an invoice saving you time.

Keep an eye on your key sales data

When you use the Sales Invoicing Tool you get access to FREE analytics so you can keep on top of who owes you money and how your sales are tracking.

Manage customer records

Maintaining up-to-date customer records is key to efficient sales invoicing. When creating an invoice simply retrieve your stored customer account information and avoid manual keying. Use the Customer Management Tool to keep your customer records current at all times.

Manage products and services

Maintaining up-to-date product information ensures you prepare sales quotes and invoices with the right product line items and consistently priced.

Use the Product Management Tool to keep your product and service records current at all times.

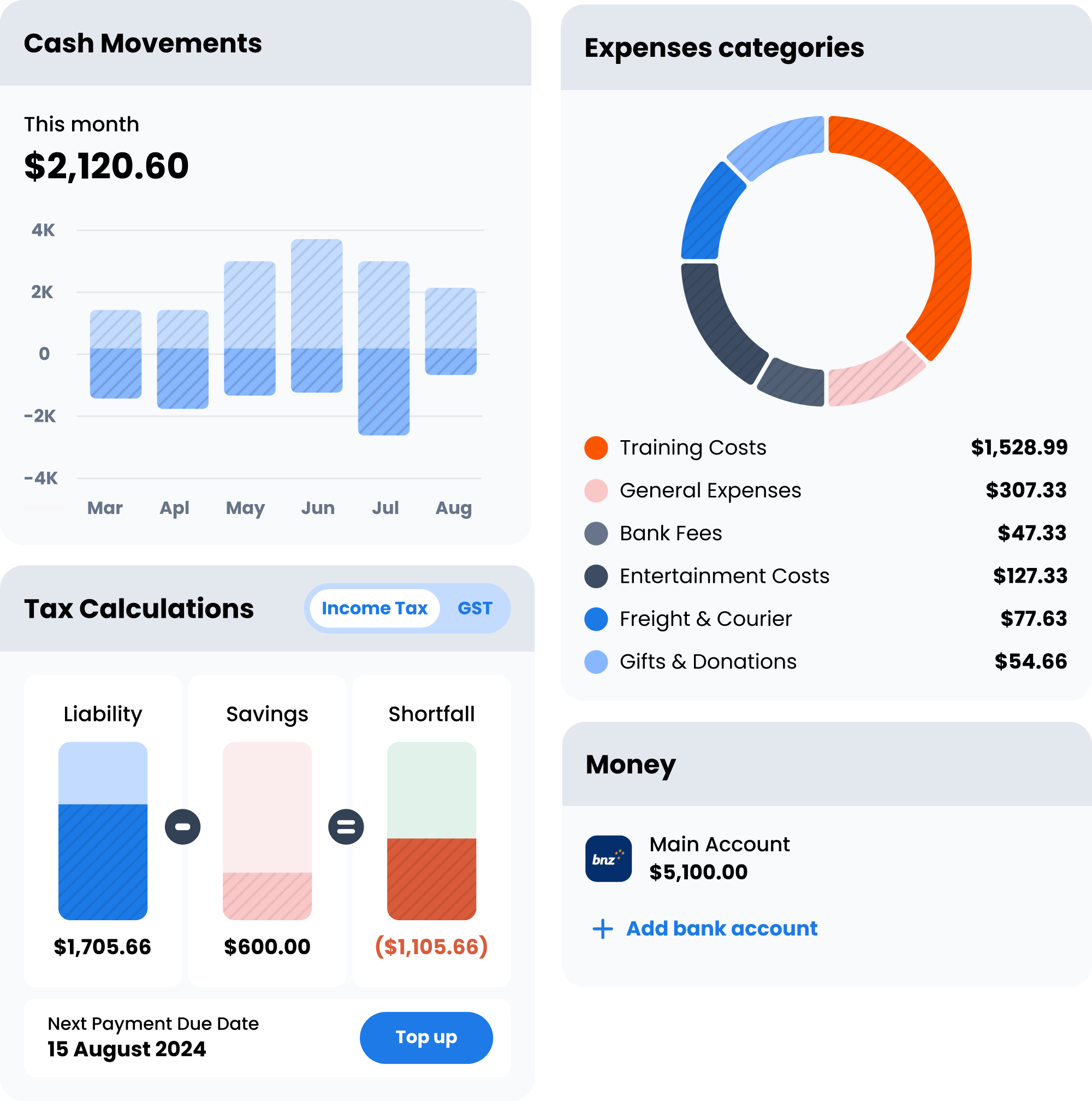

With the Money Tool, securely link your bank account(s) to get a complete picture of your business performance, together with FREE business insights.

Use the insights for loan applications, tax liability calculations, or let Afirmo alert you when you there is an action you might need to consider.

The money tool has many cool features and benefits such as …

Your business command centre is the Afirmo Dashboard summarising everything you need to know at a glance – upcoming events, key tasks, and a place to navigate from around the other tools.

As you use the other Afirmo Tools, your dashboard keeps track of things, so you do not need to.

Your Afirmo Dashboard will…

Keep track of your Afirmo generated task list so you know what to do next

Keep up to date on upcoming events and track key dates including tax due dates

Show your key renewal dates for your business critical services – like your insurance and domain name registration, so you will never lose that domain name or insurance cover.

Connect you to Afirmo’s Support Team either via the live chat, or if you prefer to, by raising a support request from Afirmo’s NZ based team.

The Tax Tool is a complete solution designed for Sole Traders, Partnerships and Limited Liability Companies. The tool works like this:

You securely link your bank account(s) to Afirmo via an Akahu powered integration (see notes on “how Afirmo links your bank accounts”)

Use Afirmo’s Money Tool to categorise your bank transactions

- The relevant parts of the Money Tool transactions are imported into the Tax Tool. Afirmo uses this information to calculate your tax liability

Afirmo calculates your income tax, GST (if any), ACC levies and student loan repayments (if any) and tells you when to pay these to the IRD

At the appropriate intervals, Afirmo prepares GST and income tax returns based on the calculated tax information. Each time you log on, you can see how this is progressing – the tax calculations update based on your information

You maintain a tax profile within the app so Afirmo tax accountants know your complete tax position. This also helps with the app’s tax calculations

You use Afirmo’s deductions calculator to optimise your tax liability

Scale up Tools

Insurance Tool

Make sure you’re covered

Afirmo has partnered with leading insurance brokers and Tier One insurance underwriters (the large companies that actually insure you) to bring a suite of insurance products to the Insurance Tool. The Insurance Tool is integrated with the other Tools to bring you some unique benefits.

Afirmo Tools are all integrated, meaning for you…

When you complete your Afirmo Business Profile, you can choose your BIC (Business Industry Classification). Afirmo will then use your BIC to identify what insurance products may be best for your business.

If you use Afirmo’s Money Tool and categorise a transaction to an asset, Afirmo will alert you so that you can consider arranging asset insurance for that new purchase.

If you have business interruption insurance at a set income level and the Money or Tax Tool can see you have grown past that level, Afirmo alerts you to review your cover.

Scale up Tools

Document Vault

Don’t lose track anymore of any paperwork. There is always paperwork associated with Setting Up and running a business and Afirmo will automatically store any important documentation generated by Afirmo Tools in your Document Vault.

You can also upload any documents into the Document Vault generated outside of Afirmo, so you have peace of mind that all your important paperwork is in one place, safe and sound.

Safer to store it in an encrypted cloud storage app, that in the bottom drawer and easy to find with Afirmo’s search option.

Local Customer Support Team

Afirmo’s New Zealand based Customer Support Team is on the ground, ready to help you, available during business hours.

Come visit Afirmo’s extensive collection of Knowledge Base articles to quick-fix any issues you have.

Be assured with Afirmo, there are experts to support you.

Learning Hub

You can read about small business related topics at. your leisure via Afirmo’s extensive free Learning Hub.

Afirmo Calculators

Afirmo’s got you covered with getting the right answers using the…

GST Calculator – if you fancy an easy to use tool to help you add or subtract GST to your sales calculations then look no further

Self-Employment Calculator – Get an estimate of your ACC levies, Student Loan repayments, Kiwisaver contributions and Income Tax liability using this calculator

PAYE Calculator – Get an estimate of your Pay As Your Earn tax liability along with Student Loan and Kiwisaver contributions based on your taxable income amount

Markup and Margin Calculator – get confused between markup and margin? You are not alone! This calculator will get you back on track