The message is clear: address tax affairs promptly to avoid legal repercussions.

In a stern warning in April 2024, Inland Revenue has confirmed a hard crack down is coming this year construction sector businesses together with a recommendation to sort their tax situations out.

At a Glance

Inland Revenue confirms they will be applying pressure on construction sector businesses to get tax compliant and meet tax obligations, with Inland Revenue’s audit team on high alert.

Tax Evasion in the Construction Sector

According to Inland Revenue, tax evasion is particularly prevalent in the construction sector, with significant under-declaration of income, often through cash transactions.

With rising material and labour costs, many tradespeople are turning to cash jobs to make it through the recession.

To weather the economic storm, businesses must address cash flow challenges, exploring alternative marketing tactics to get work, and prioritise tax preparedness as crucial strategies for survival.

Inland Revenue’s Richard Philp says tax compliance is key, confirming those who fulfil their obligations will receive support, while those who don’t will face consequences. He says if people do the right thing coming forward, Inland Revenue will help them. If people do not come forward, Inland Revenue will start follow-up action.

This highlights the importance of construction sector businesses managing tax effectively to avoid Inland Revenue repercussions.

The construction industry has a long history of cash-handling, and prior to the current economic state. While there has been Inland Revenue leniency in the past, things are about to change.

What you need to know

While non-tax compliance is not a good situation to be in, it is resolvable. Tax Agencies of Inland Revenue – such as Afirmo – are available to support construction industry business owners get their books in order.

In the coming months, Inland Revenue will contact 40,000 construction sector businesses with outstanding debts or overdue Income Tax returns. Initially Inland Revenue will be offering support to resolve the issues these 40,000 businesses have. Compliance officers will also conduct site visits and investigations as necessary.

Philip says construction industry businesses should not underestimate the importance of seeking assistance and not ignoring tax obligations to avoid severe consequences, including legal action.

How to get sorted – fast

To fast track getting taxes sorted before business owners are approached by Inland Revenue, these construction sector business owners can contact tax agency companies such as Afirmo. “Afirmo is an agent to Inland Revenue and supports business owners with compliance and getting in the good books with Inland Revenue”, says Afirmo CEO, Robert Rolls.

Rolls says, “Don’t get caught out by Inland Revenue. Stay ahead of your tax obligations with Afirmo’s assistance and avoid Inland Revenue auditors getting in touch. Our tax accountants will help you manage your compliance, and the Afirmo software is tailored to make tax management hassle-free for you and get you tax compliant. And affordably for you so that you can get that just-filed feeling – relief!”.

How Afirmo will help

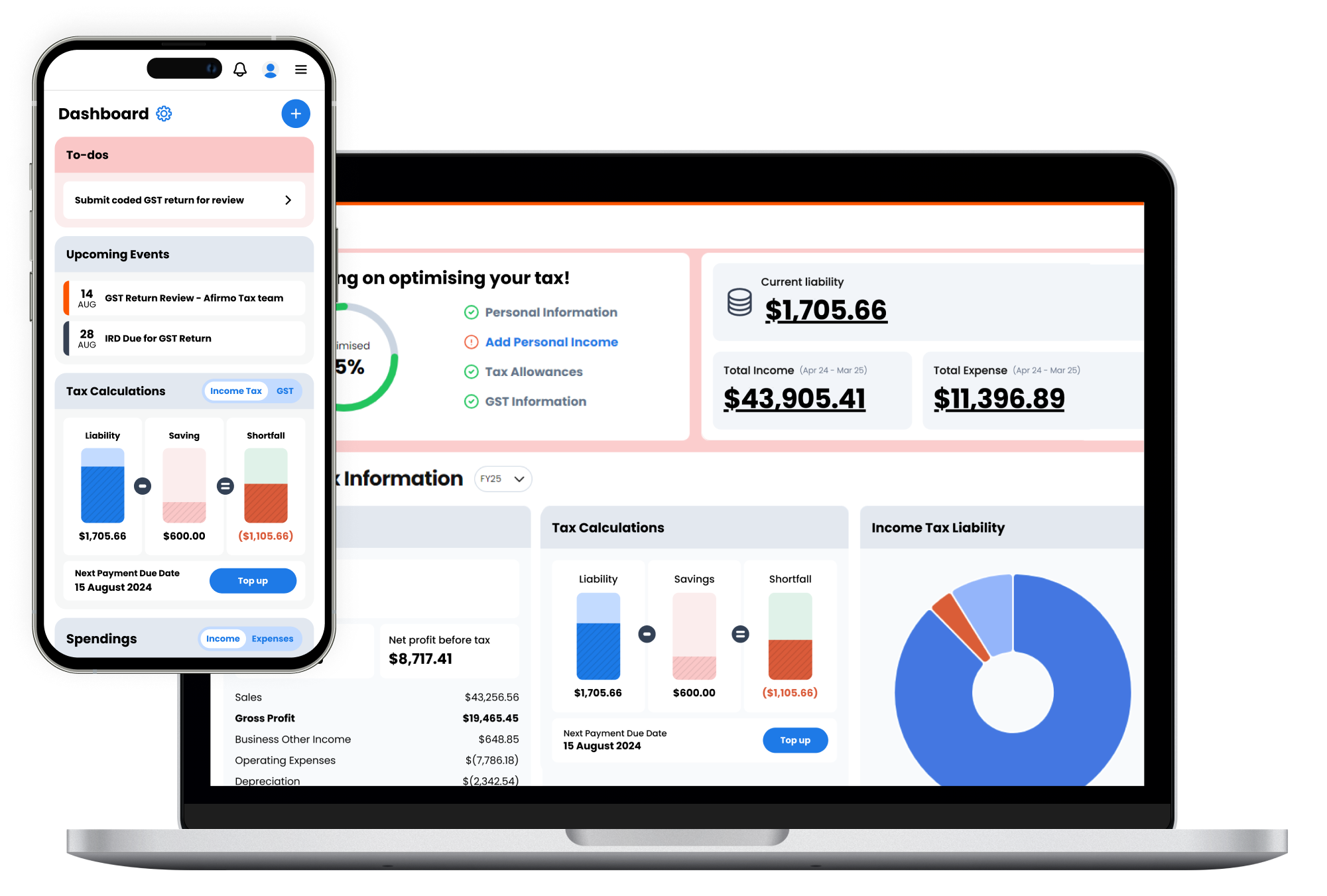

Afirmo is an online tax and accounting management software designed especially for New Zealand small businesses and Tradies. The software enables business owners to send invoices, track and code expenses, and monitor cashflow, and allocate funds for upcoming tax obligations.

Real-time tax calculations

Afirmo’s calculations and dashboards allow business owners to set aside the right amount for GST, Income Tax and Provisional Tax thought out the financial year, ensuring there are no surprises when tax season rolls around.

The money stays in the business owner’s accounts, meaning they have access to it during cashflow lulls.

Accountants are included

Afirmo’s tax accountant specialists provide advice and submit GST and Income Tax returns for customers on selected Afirmo plans, at an affordable price. These specialists will support non-compliant businesses get on top of compliance and confidentially and affordably.

Afirmo’s automated reminders ensure business owners know when they need to have the system updated.

Business owners who join Afirmo’s Tax Agency also enjoy the benefit of extended deadlines for Income Tax returns.

| Cash Job vs Tax Compliant Job | Cash Job | Tax Compliant |

|---|---|---|

| Illegal | ✅ | ❌ |

| Warranty on work | ❌ | ✅ |

| Insurance | ❌ | ✅ |

| Income protection | ❌ | ✅ |

| Extra cash in your pocket | ✅ (In the short term) | ❌ |

| Inland revenue penalty | ✅ | ❌ |

If you’re concerned about a potential audit from Inland Revenue, sign up today with Afirmo and start your 30 day trial and get your books in order.