Provisional tax is a way of pre-paying income tax in stages. It’s designed to help you avoid getting caught with a huge unexpected tax bill after completing your end-of-year accounts. This guide provides a handy introduction to the main ins and outs of provisional tax for sole traders, freelancers and self-employed contractors in New Zealand.

Do I have to pay provisional tax?

If your end-of-year tax bill (residual income tax) was more than $5,000, then you must pay provisional tax during the following year. That means ‘pre-paying’ the following year’s residual income tax in instalments.

The provisional tax threshold used to be $2,500, but was increased to $5,000 due to Covid-19. This was mainly done to let small taxpayers keep their tax payments for longer to help manage their cash flow.

Provisional tax often applies to untaxed income from:

- Self-employment

- Contracting

- Rent

- A partnership

- Overseas earnings

Sometimes you may also have to pay provisional tax on untaxed income you receive that third parties, such as banks and employers, have to report to Inland Revenue. Known as reportable income, this might happen if a wrong PAYE code was used, a payment to you was not taxed or incorrectly taxed, or you sell a residential property within its bright line period.

What is residual income tax?

Residual income tax (RIT) is the total income tax you have to pay for the year minus any PAYE you pay or tax credits you’re entitled to. This doesn’t include Working for Families tax credits.

What are the provisional tax payment dates?

Your provisional tax due dates will depend on whether you are registered for GST and which payment option you choose. So let’s start with the options.

Standard option for provisional tax

This method adds 5% to your previous year’s residual income tax each year. It then breaks the new tax total into three equal instalments, or two if you file a GST return every six months.

The standard option is the default if you don’t choose one of the others. It can be a good choice if you expect your income to grow.

Standard option due dates, starting with the first instalment for the financial year are:

- 28 August

- 15 January

- 7 May

Estimation option for provisional tax

As its name suggests, this option lets you estimate what your taxable income will be for the year ahead. You then work out the tax on that income and subtract any PAYE tax you’ll pay or eligible tax credits you’ll receive. The result is your estimate of the residual income tax you’ll have to pay over the year. You can then divide it into equal instalments, as you would with the standard option above.

The estimation option may be best if you’re sure your income will decrease over the coming year. You can even provide a zero estimate if you’re not expecting any residual income tax to pay.

Estimation option due dates, starting with the first instalment for the financial year are:

- 28 August

- 15 January

- 7 May

Ratio option for provisional tax

To use this option you must be registered for GST and meet the qualifying criteria below. If you choose this method, your provisional tax payments are made every two months at the same time as your GST returns.

Inland Revenue provides you with a percentage ratio based on your previous year’s residual income tax and GST-taxable supplies (sales) figures. To work out each provisional tax payment you simply multiply your GST-taxable supplies for the previous two months by the percentage Inland Revenue gave you.

This option might be best if you have variable or seasonal income. It can help your cash flow by letting you base your provisional tax payments on your actual sales.

To choose and continue using the ratio option you must:

- File GST returns monthly or two-monthly

- Have been registered for GST and in business for all of the previous tax year and some of the one before that

- Have a residual income tax of more than $5,000, but no more than $150,000 for the previous tax year

- Not be a partnership

- Have a ratio percentage from Inland Revenue that’s no more than 100%

Ratio option due dates, starting with the first instalment for the financial year, are:

- 28 June

- 28 August

- 28 October

- 15 January

- 28 February

- 7 May

Accounting income method (AIM) for provisional tax

This option means you only pay provisional tax when you make a profit. If your business makes a loss you can request a full or partial refund straight away, so you don’t have to wait until the end of the year. It’s the only provisional tax option that lets you do this.

The AIM method is available for annual turnovers of less than $5 million. It requires AIM-capable accounting software. You also have to keep your accounts up to date as you go.

Aim-capable software providers include:

- Xero

- Tax Gnome

- Reckon APS

- MYOB

AIM due dates are usually the same as your GST filing dates, or every two months if you’re not registered for GST.

You may still have an end-of-year extra payment, but there will be no use of money interest charge. AIM-capable software learns as it goes, getting better at estimating your provisional tax payments, so end-of-year adjustments become less and less.

The AIM method typically suits:

- New or growing businesses

- Irregular, seasonal or hard-to-predict income

You have to opt into AIM each year or Inland Revenue will switch you to the standard method.

Can I pay provisional tax in my first year?

The short answer is no you can’t, unless you choose the AIM method. But when you’re starting a business it’s important to plan ahead for when provisional tax will begin.

You may have realised that your first year’s tax return for the year ending 31 March must be filed by 7 July (unless you or your tax agent get an extension) and will be due for payment on 7 February of the following year or 7 April if you use a tax agent. This means you’ll have a double up with first year tax and your provisional tax ‘advance’ payments.

Here’s a diagram of likely payment dates during your second financial year if you’re using the standard or estimation options, which spread provisional tax over three payments.

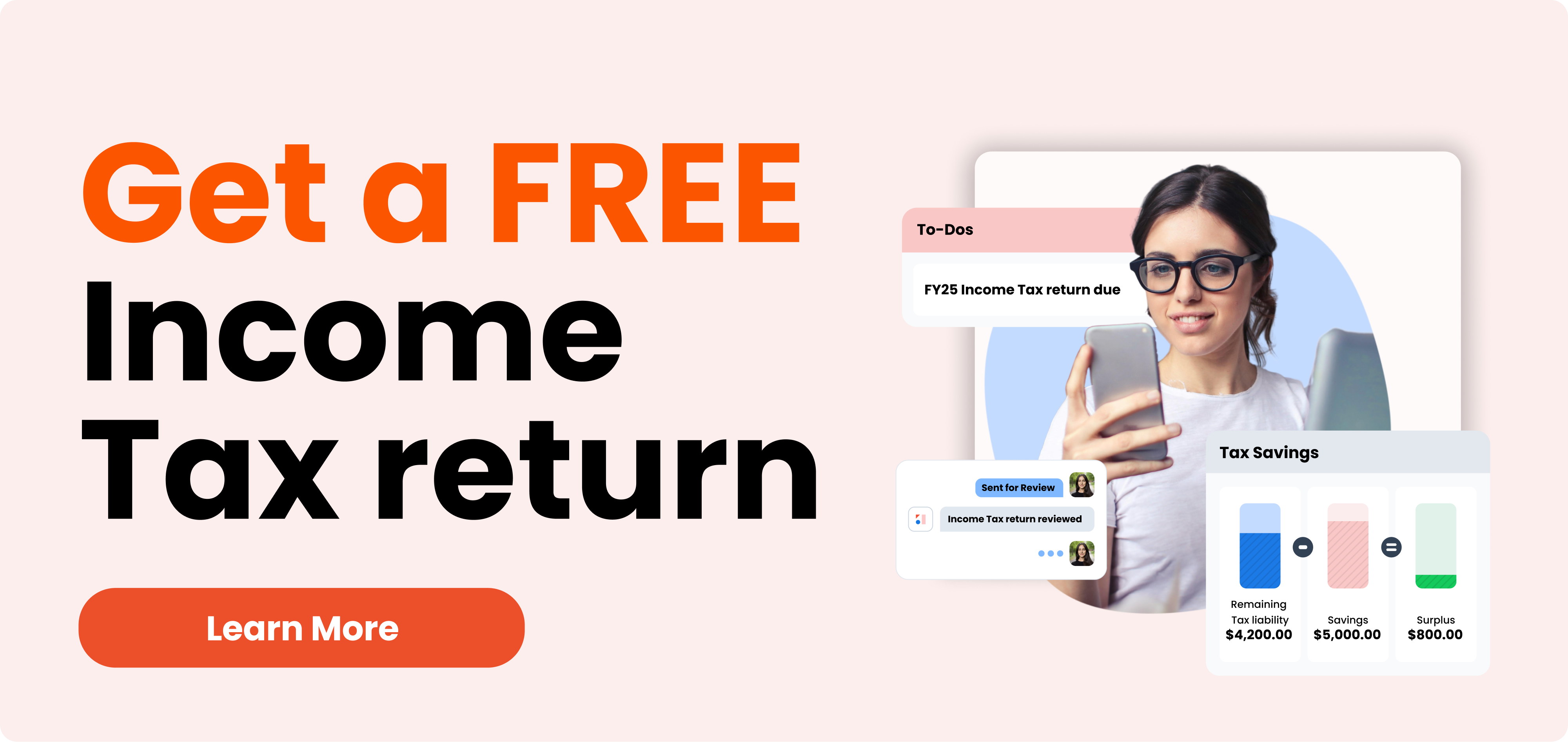

Learn More