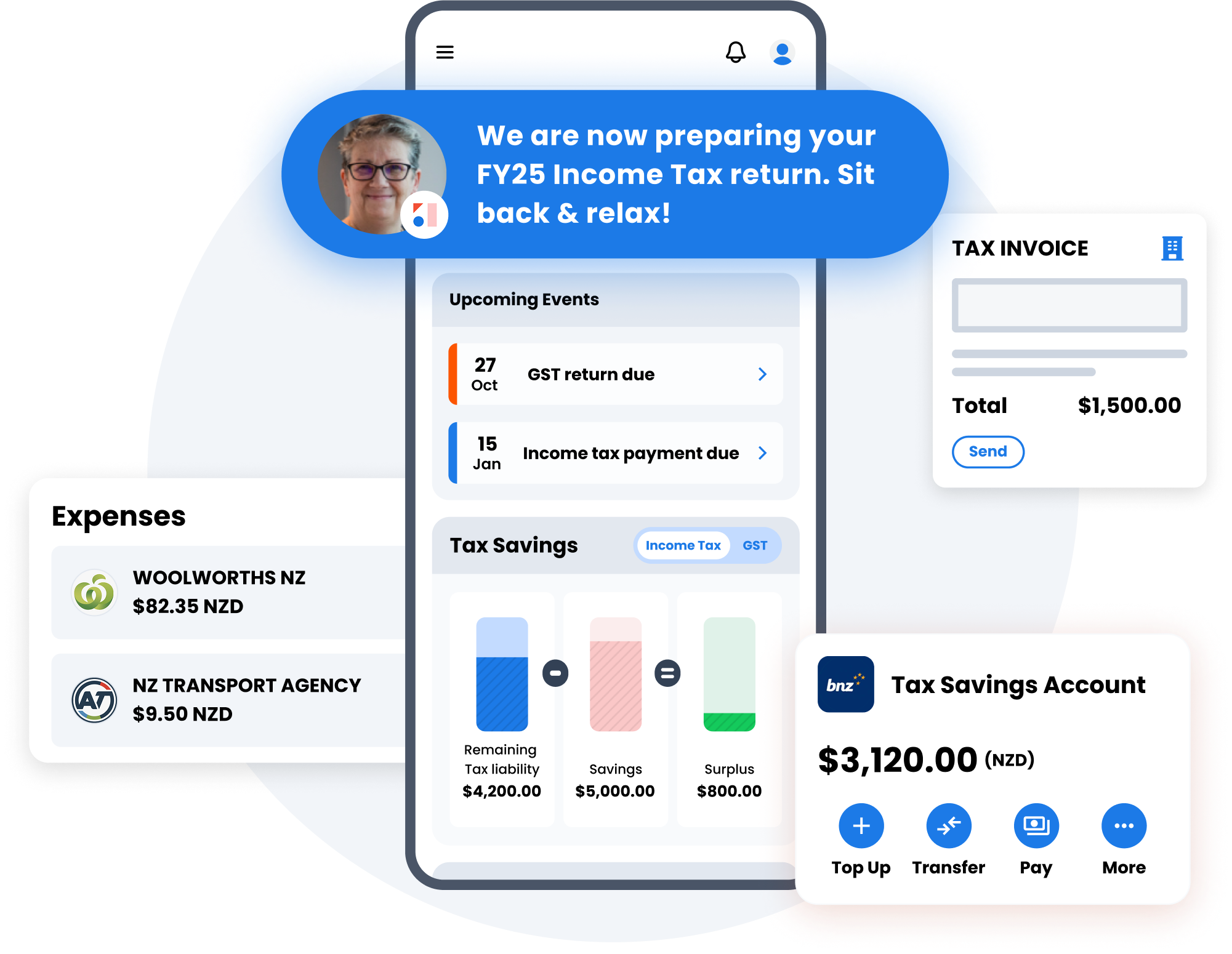

Take the Stress Out of

Tax Time

Real-time tax management software

backed by expert NZ Accountants

Easily manage your money, and make tax management stress-free.

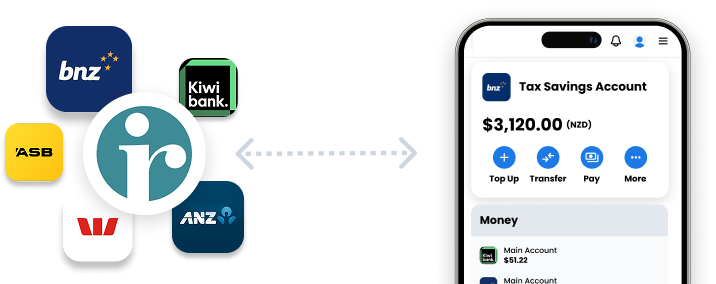

Simpler than other accounting software platforms and with enough levers to keep you in charge. Afirmo’s Scale Up service is your all-in-one cloud solution letting you easily manage your money.

Our monthly or annual plans include an expert NZ accountant who files your tax returns for you, with no add-ons or hidden fees.

How It Works

Instant access – FREE for 30 days

Sign up to explore all the cool features we have to offer and decide if we’re a right fit for you. Pick from 4 plans, each with varying degrees of tax support from our tax experts.

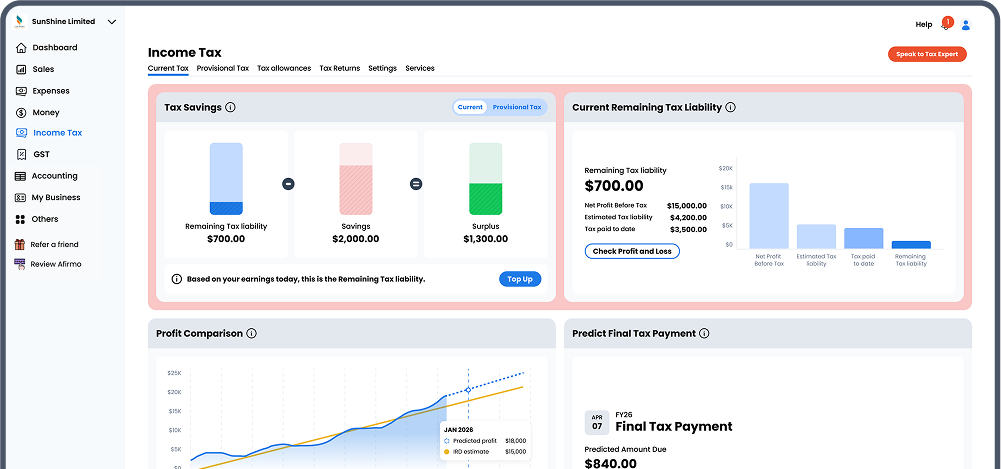

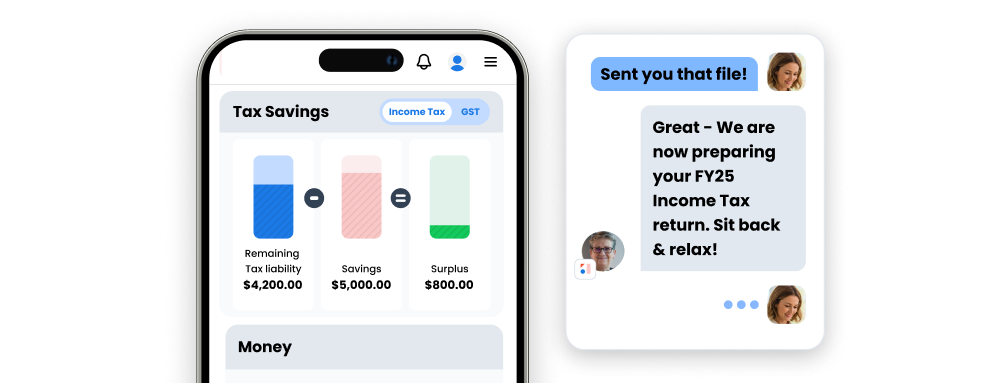

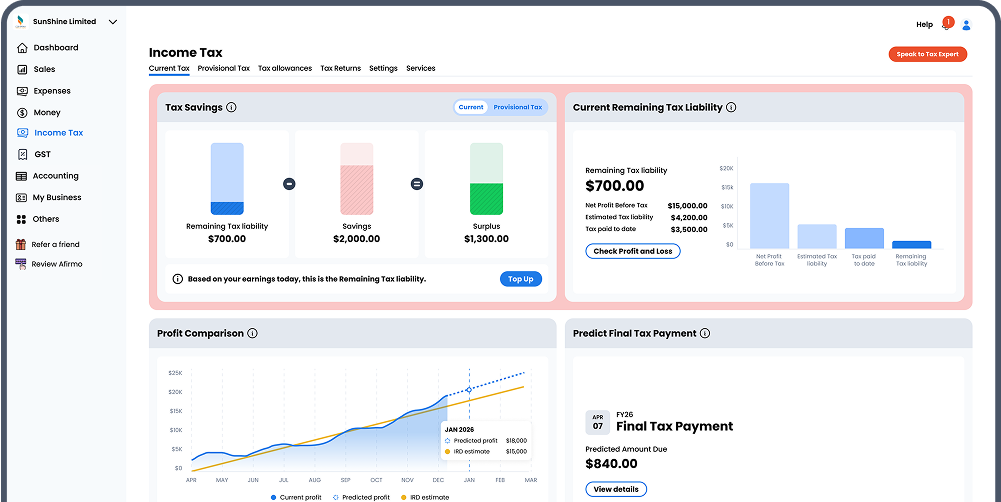

Time to feel empowered

You’ll see real-time graphs and calculations every time you login, and we’ll give you a heads up for upcoming tax deadlines, with instructions on what to do.

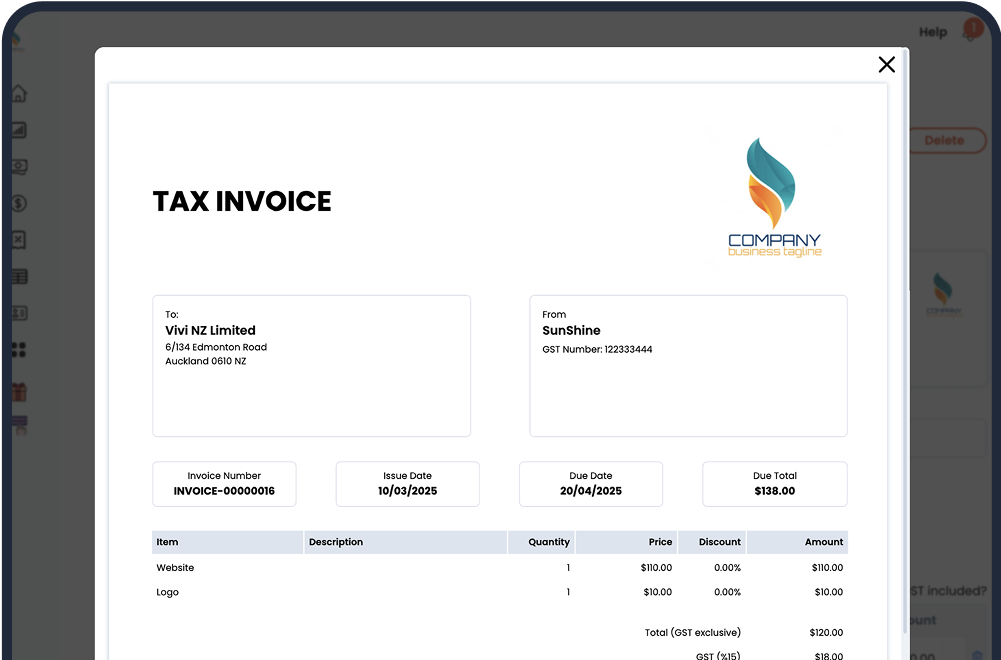

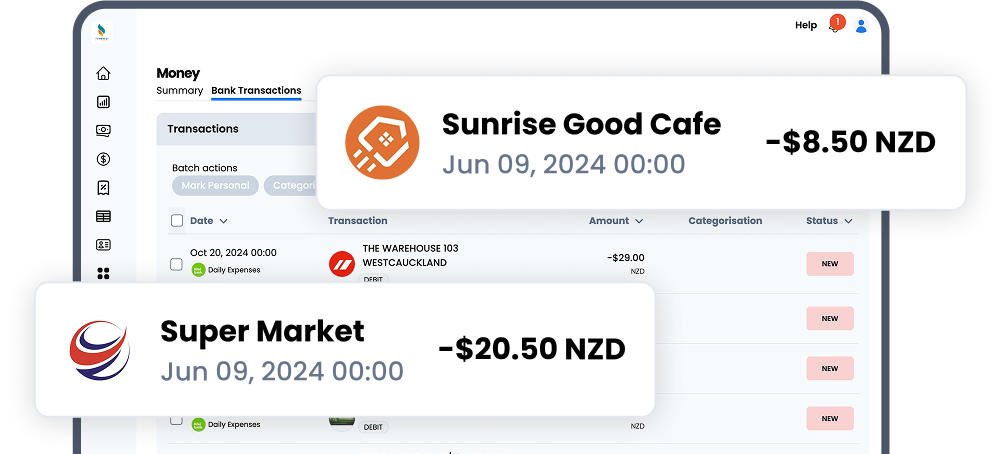

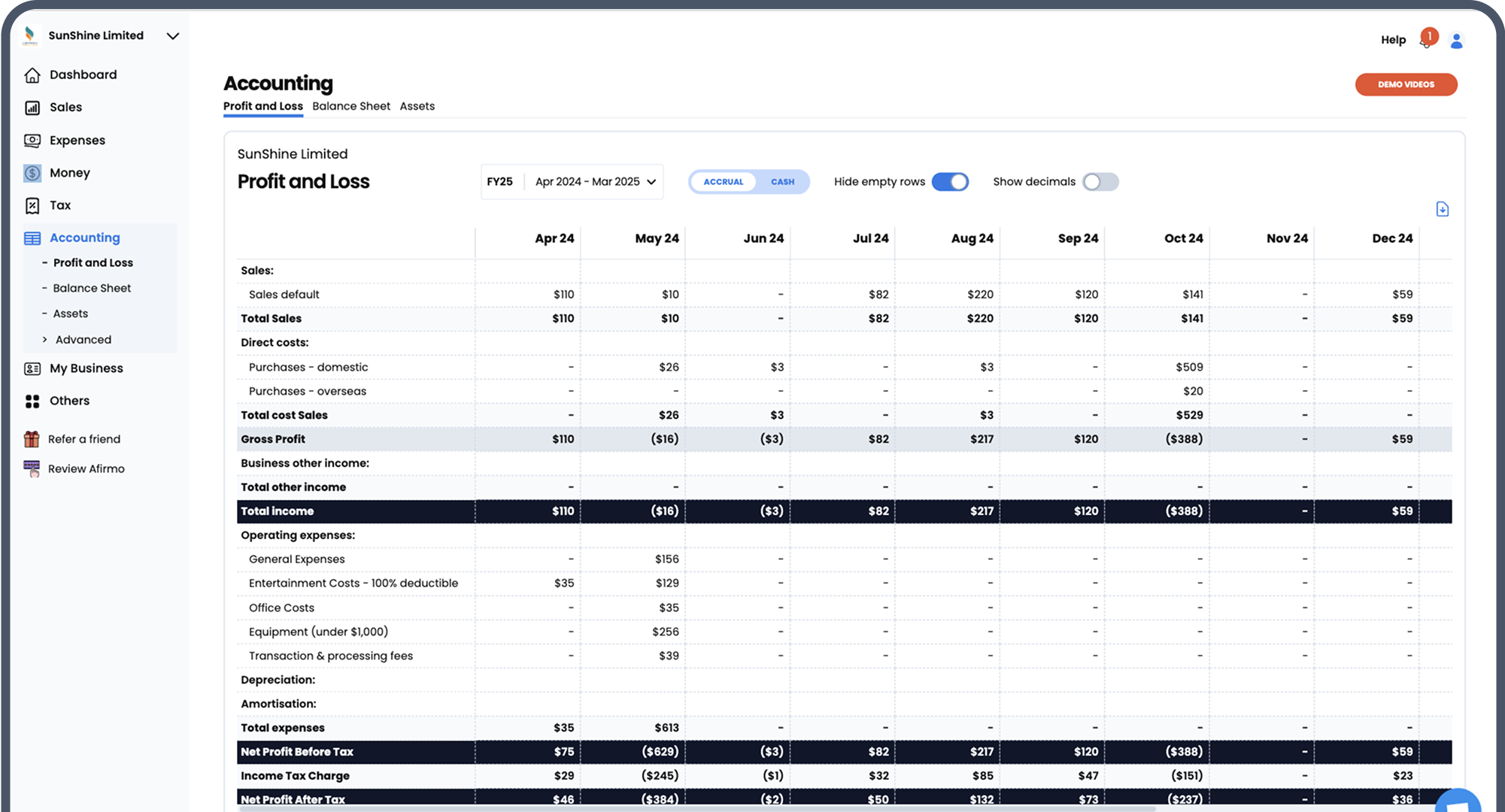

Know your numbers – or let us know them for you

Not a hands-on person? No problem, check out our bookkeeping service! We can handle your admin for you, so all you need to worry about is your tax savings, and snaping pictures of your expense claims.

Your accountant at your fingertips

It’s like having an accountant, but without the wait time, or the price tag! You’ll automatically get extensions on your income tax returns and provisional tax when you appoint us as your tax agent.

Frequently Asked Questions

A word from real customers

See who’s using Afirmo

⭐⭐⭐⭐⭐

Trusted by 7,500+ Users

Supercharge

$95/Month

$88 on Annual Plan

Supercharge

$1,140 $1,045/Year

Save $95

Best for Small Companies that:

- Need Afirmo to prepare and file up to six GST returns per year

- Need a year-end Business Income Tax return

- Need tax and accounts support

- Need year-end accounts prepared.

Supercharge PRO

$150/Month

$138 on Annual Plan

Supercharge PRO

$1,800 $1,650/Year

Save $150

Best for Growing Companies that:

- Need Afirmo to prepare and file up to 12 GST returns per year

- Need a priority year-end Business Income Tax return

- Need a director or shareholder personal tax return included

- Need one hour per month of bookkeeping support

- Fees-Free IRD tax payment date deferment

- Need year-end accounts prepared